City of Boulder Sales Tax Form

What is the City Of Boulder Sales Tax Form

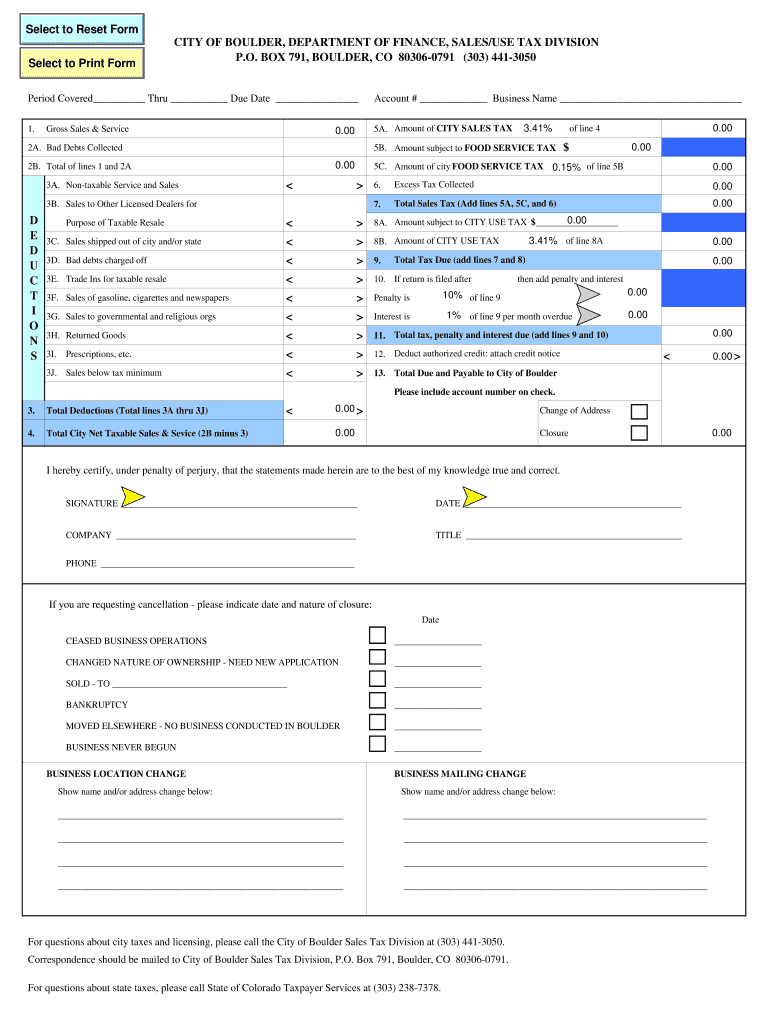

The City of Boulder Sales Tax Form is an official document used by businesses and individuals to report and pay sales tax collected within the city limits of Boulder, Colorado. This form is essential for ensuring compliance with local tax regulations and for accurate tax reporting. It typically includes sections for reporting total sales, taxable sales, and the amount of sales tax due. Understanding this form is crucial for anyone engaged in business activities in Boulder, as it helps maintain transparency and accountability in tax obligations.

How to use the City Of Boulder Sales Tax Form

Using the City of Boulder Sales Tax Form involves several key steps. First, gather all necessary sales records for the reporting period. Next, accurately fill in the form with details such as total sales, taxable sales, and the calculated sales tax. It is important to ensure that all figures are correct to avoid discrepancies. After completing the form, review it for accuracy before submission. The form can be submitted online, by mail, or in person, depending on the preferred method of filing.

Steps to complete the City Of Boulder Sales Tax Form

Completing the City of Boulder Sales Tax Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant sales documentation for the reporting period.

- Identify total sales and separate taxable sales from non-taxable sales.

- Calculate the sales tax based on the applicable Boulder sales tax rate.

- Fill in each section of the form with the appropriate information.

- Double-check all entries for accuracy and completeness.

- Choose a submission method: online, mail, or in-person.

Legal use of the City Of Boulder Sales Tax Form

The City of Boulder Sales Tax Form is legally binding and must be used in accordance with local tax laws. It is designed to meet the requirements set forth by the City of Boulder and the Colorado Department of Revenue. Using this form correctly ensures that businesses comply with tax obligations and avoid potential penalties. It is important to stay informed about any changes in sales tax regulations to ensure ongoing compliance.

Filing Deadlines / Important Dates

Filing deadlines for the City of Boulder Sales Tax Form are crucial for timely compliance. Typically, sales tax returns are due on a monthly or quarterly basis, depending on the volume of sales. Businesses should mark their calendars for these important dates to avoid late fees and penalties. It is advisable to check the City of Boulder’s official website for the most current deadlines and any changes that may occur throughout the year.

Form Submission Methods (Online / Mail / In-Person)

The City of Boulder Sales Tax Form can be submitted through various methods to accommodate different preferences. Online submission is often the most efficient option, allowing for quick processing and confirmation. Alternatively, the form can be mailed to the appropriate city office or submitted in person. Each method has its own advantages, and taxpayers should choose the one that best fits their needs while ensuring compliance with submission deadlines.

Quick guide on how to complete city of boulder sales tax forms

Your assistance manual on how to prepare your City Of Boulder Sales Tax Form

If you’re interested in learning how to generate and submit your City Of Boulder Sales Tax Form, here are some concise instructions on how to facilitate tax processing.

To start, you simply need to register your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to amend responses as necessary. Enhance your tax oversight with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your City Of Boulder Sales Tax Form in just a few minutes:

- Establish your account and start working on PDFs right away.

- Access our catalog to acquire any IRS tax form; explore various versions and schedules.

- Select Get form to launch your City Of Boulder Sales Tax Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to increased errors and delayed refunds. Additionally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

Create this form in 5 minutes!

How to create an eSignature for the city of boulder sales tax forms

How to create an electronic signature for the City Of Boulder Sales Tax Forms online

How to generate an electronic signature for the City Of Boulder Sales Tax Forms in Google Chrome

How to make an eSignature for signing the City Of Boulder Sales Tax Forms in Gmail

How to generate an electronic signature for the City Of Boulder Sales Tax Forms straight from your mobile device

How to make an electronic signature for the City Of Boulder Sales Tax Forms on iOS devices

How to make an electronic signature for the City Of Boulder Sales Tax Forms on Android OS

People also ask

-

What is the City Of Boulder Sales Tax Form and why do I need it?

The City Of Boulder Sales Tax Form is a document required for businesses operating within Boulder to report and pay their sales tax obligations. Completing this form accurately is essential to comply with local tax regulations and avoid penalties. Using airSlate SignNow, you can easily fill out and eSign this form, ensuring a seamless submission process.

-

How does airSlate SignNow help with the City Of Boulder Sales Tax Form?

AirSlate SignNow simplifies the process of completing the City Of Boulder Sales Tax Form by providing user-friendly templates and electronic signing features. You can quickly fill out the necessary information, sign the document, and send it directly to the appropriate department. This saves time and reduces the chance of errors compared to traditional methods.

-

Is there a cost associated with using airSlate SignNow for the City Of Boulder Sales Tax Form?

Yes, there are various pricing plans available for airSlate SignNow, which can accommodate different business sizes and needs. Our plans offer great value for businesses looking to streamline the process of completing the City Of Boulder Sales Tax Form and other important documents. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software to manage the City Of Boulder Sales Tax Form?

Absolutely! AirSlate SignNow offers integrations with popular software applications such as CRM systems and accounting tools. This allows you to manage the City Of Boulder Sales Tax Form alongside your other business processes, creating a more efficient workflow.

-

What features does airSlate SignNow provide for the City Of Boulder Sales Tax Form?

AirSlate SignNow provides a range of features to assist with the City Of Boulder Sales Tax Form, including customizable templates, electronic signature capabilities, and document tracking. These features ensure that you can complete and submit your form accurately and efficiently, with the ability to monitor its status.

-

Is airSlate SignNow secure for submitting the City Of Boulder Sales Tax Form?

Yes, airSlate SignNow prioritizes security and privacy, ensuring that your data is protected when submitting the City Of Boulder Sales Tax Form. We utilize advanced encryption and compliance measures to safeguard your information, giving you peace of mind while using our service.

-

How can I access the City Of Boulder Sales Tax Form on airSlate SignNow?

You can easily access the City Of Boulder Sales Tax Form through the airSlate SignNow platform by searching our template library. Once you find the form, you can fill it out, eSign it, and submit it electronically, all within a few clicks.

Get more for City Of Boulder Sales Tax Form

- Area transit commission form

- Cdph 502 application for ait program california department of form

- While caa sco strives to be available to service its members at all times there are situations when 3rd form

- Form 1002 a domestic violence temporary protection order dvtpo

- 031 o form

- For resale at retail form

- Betterment checking form

- Motion to quash form

Find out other City Of Boulder Sales Tax Form

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile