For Resale at Retail Form

What is the For Resale At Retail

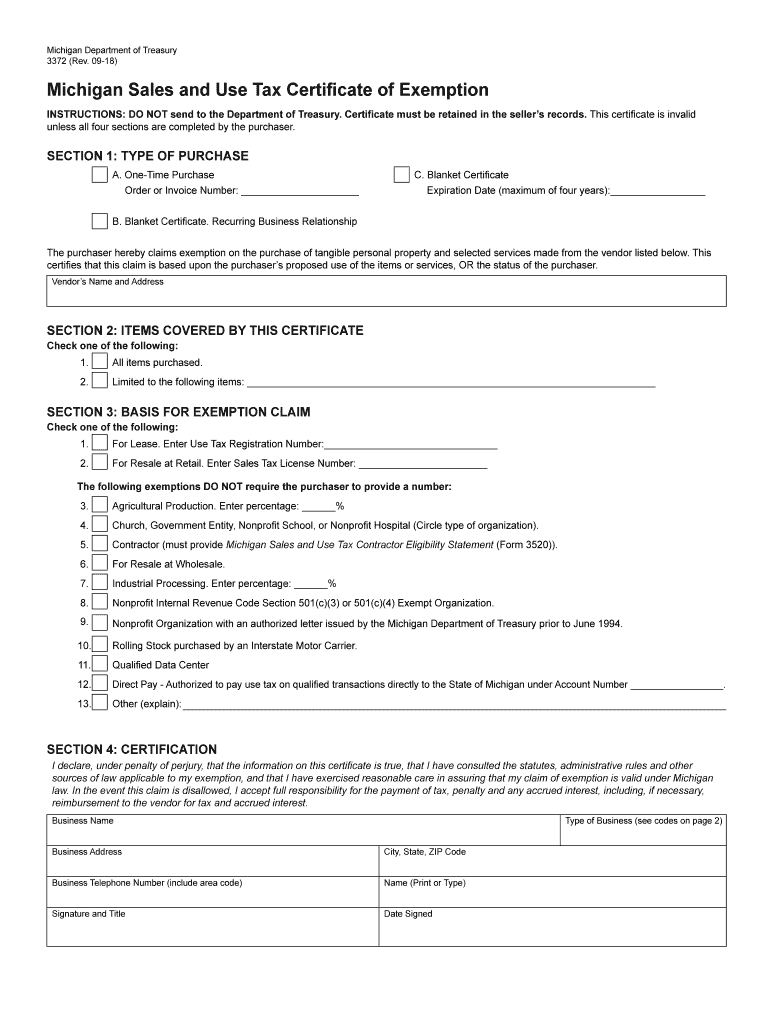

The For Resale At Retail form is a crucial document used in Michigan for businesses that purchase goods intended for resale. This form allows retailers to buy items without paying sales tax at the point of purchase, as they will collect sales tax from their customers when the goods are sold. Understanding this form is essential for compliance with Michigan tax regulations and for ensuring that businesses can operate efficiently without incurring unnecessary tax liabilities.

How to use the For Resale At Retail

To use the For Resale At Retail form, a business must complete it accurately and present it to suppliers when making purchases. The form serves as a certificate that the buyer is purchasing items for resale, exempting them from sales tax. It is important to ensure that the form is filled out completely, including the seller's name, address, and the nature of the business, to avoid any issues with compliance. Retaining a copy of the completed form is also advisable for record-keeping purposes.

Steps to complete the For Resale At Retail

Completing the For Resale At Retail form involves several key steps:

- Obtain the form from the Michigan Department of Treasury or a reliable source.

- Fill in your business name, address, and sales tax identification number.

- Specify the type of goods being purchased for resale.

- Sign and date the form to validate it.

- Present the completed form to your supplier at the time of purchase.

Legal use of the For Resale At Retail

The legal use of the For Resale At Retail form in Michigan is governed by state tax laws. Businesses must ensure that they are genuinely purchasing items for resale to qualify for the tax exemption. Misuse of the form, such as using it for personal purchases or items not intended for resale, can lead to penalties and back taxes. It is essential to maintain accurate records and documentation to support the use of this form in case of an audit.

Eligibility Criteria

To be eligible to use the For Resale At Retail form, a business must hold a valid sales tax license issued by the Michigan Department of Treasury. This license demonstrates that the business is registered to collect sales tax from customers. Additionally, the items purchased must be intended solely for resale purposes. Businesses that do not meet these criteria may not qualify for the tax exemption and should consult with a tax professional for guidance.

Required Documents

When using the For Resale At Retail form, businesses should have the following documents ready:

- A valid Michigan sales tax license.

- Identification information for the business, such as the Employer Identification Number (EIN).

- Documentation of the types of goods being purchased for resale.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the For Resale At Retail form can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential audits by the Michigan Department of Treasury. It is crucial for businesses to ensure that they are using the form correctly and maintaining accurate records to avoid these consequences.

Quick guide on how to complete for resale at retail

Complete For Resale At Retail effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage For Resale At Retail on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centered activity today.

How to modify and eSign For Resale At Retail easily

- Find For Resale At Retail and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign For Resale At Retail and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for resale at retail

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sales tax in Michigan?

Sales tax in Michigan is a tax imposed on the sale of goods and services. The current statewide sales tax rate is 6%, which applies to most transactions. Understanding how sales tax in Michigan works is essential for businesses to ensure compliance and accurate documentation.

-

How can airSlate SignNow help with sales tax documentation in Michigan?

airSlate SignNow provides a seamless way to send and eSign important sales tax documents in Michigan. By using our platform, you can streamline the approval process and ensure that all tax-related documents are signed and stored securely, making it easier to keep track of your sales tax obligations.

-

Are there any features in airSlate SignNow specifically designed for sales tax management in Michigan?

Yes, airSlate SignNow offers features like customizable templates that cater specifically to sales tax documentation in Michigan. These templates can be tailored to fit the unique requirements of your business, ensuring that you comply with state sales tax regulations without any hassle.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, starting from a basic plan for small businesses to advanced features for larger enterprises. Considering the importance of managing sales tax in Michigan, our plans include comprehensive features to help you effectively handle documentation, at competitive prices.

-

Does airSlate SignNow integrate with other accounting software for sales tax in Michigan?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software such as QuickBooks and Xero, allowing you to manage your sales tax in Michigan efficiently. This integration helps to sync your documents and keep sales tax calculations accurate across all platforms.

-

Can airSlate SignNow assist in tracking sales tax rates specific to Michigan?

While airSlate SignNow doesn’t provide real-time tracking of sales tax rates, it allows you to create and store customized forms that reflect the current sales tax in Michigan. This ensures that your business remains compliant when filing tax returns and assists in accurate calculations for transactions.

-

Is airSlate SignNow secure for handling sensitive sales tax documents in Michigan?

Yes, airSlate SignNow prioritizes security and uses advanced encryption methods to protect sensitive sales tax documents in Michigan. You can eSign and store your documents safely, thereby ensuring that your business information remains confidential and secure.

Get more for For Resale At Retail

- Massachusetts health care proxy printable form

- New state resident package massachusetts form

- Revocation of health care proxy massachusetts form

- Commercial property sales package massachusetts form

- General partnership package massachusetts form

- Contract for deed package massachusetts form

- Power of attorney forms package massachusetts

- Massachusetts anatomical gift form

Find out other For Resale At Retail

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word