Offset Form

What is the Offset Form

The offset form is a specific document used primarily in financial and tax contexts to adjust or offset certain liabilities or tax obligations. This form allows individuals or businesses to report overpayments or to claim credits that can reduce their overall tax burden. Understanding the purpose and function of the offset form is essential for ensuring compliance with tax regulations and for optimizing financial responsibilities.

How to Use the Offset Form

To effectively use the offset form, begin by gathering all necessary financial information related to your tax situation. This includes previous tax returns, documentation of overpayments, and any relevant credits. Once you have this information, fill out the form accurately, ensuring that all figures are correct and that you provide any required supporting documentation. After completing the form, you can submit it according to the instructions provided, whether electronically or via mail.

Steps to Complete the Offset Form

Completing the offset form involves several key steps:

- Gather necessary documentation, including previous tax returns and proof of payments.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Attach any required supporting documents.

- Submit the form according to the specified method, either online or by mail.

Legal Use of the Offset Form

The legal use of the offset form is governed by various tax laws and regulations. It is crucial to ensure that the form is filled out in accordance with the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state tax authorities. Proper use of the offset form can help avoid penalties and ensure that any claims for credits or adjustments are recognized legally.

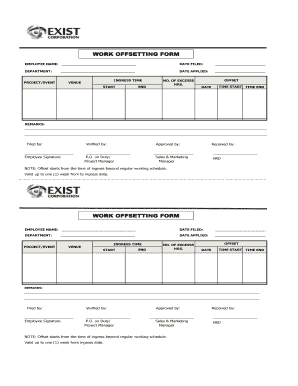

Key Elements of the Offset Form

Key elements of the offset form include:

- Identification information for the taxpayer or business.

- Details regarding the tax year in question.

- Information on overpayments or credits being claimed.

- Signature and date to certify the accuracy of the information provided.

Examples of Using the Offset Form

Examples of when to use the offset form include situations where a taxpayer has overpaid their taxes in previous years and wishes to apply that overpayment to the current year's tax liability. Another example is when a business has incurred credits due to losses or other adjustments that can offset future tax obligations. These scenarios illustrate the form's utility in managing tax responsibilities effectively.

Quick guide on how to complete offset form

Complete Offset Form effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the proper form and securely store it online. airSlate SignNow provides all the necessary tools to develop, adjust, and electronically sign your documents promptly without hold-ups. Manage Offset Form on any platform using airSlate SignNow Android or iOS apps and streamline any document-related process today.

How to modify and eSign Offset Form effortlessly

- Obtain Offset Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or hide sensitive information using tools specifically made available by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal standing as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Transform and eSign Offset Form and ensure outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the offset form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an offset form template?

An offset form template is a customizable document that allows users to create structured forms for data collection and signatures. With airSlate SignNow, you can easily design an offset form template tailored to your business needs, streamlining the signing process.

-

How can I create an offset form template using airSlate SignNow?

Creating an offset form template in airSlate SignNow is straightforward. Simply log in to your account, choose the template option, and start building your form with pre-defined fields and signature placements, making it easy to gather information and approvals.

-

Are there any costs associated with using an offset form template?

airSlate SignNow offers various pricing plans that include access to offset form templates at no additional cost. You can choose a plan that fits your budget and requirements, ensuring you have access to all necessary features for your business.

-

What features does the offset form template include?

The offset form template comes with a range of features such as customizable fields, electronic signature options, and automated workflows. These features facilitate seamless document management, helping you save time and enhance productivity.

-

How does the offset form template benefit my business?

Utilizing an offset form template streamlines the document signing process, reducing turnaround time and improving efficiency. With airSlate SignNow, you can enhance customer satisfaction and maintain compliance with an organized approach to document handling.

-

Can I integrate my offset form template with other software?

Yes, airSlate SignNow allows integrations with various third-party applications such as CRM systems and productivity tools. This integration capability maximizes the use of your offset form template, enabling smooth data transfer across platforms.

-

Is the offset form template secure for use in my business?

Absolutely, airSlate SignNow prioritizes security by offering encrypted storage and secure access controls for your offset form template. You can be confident that your sensitive information is protected while managing your documents online.

Get more for Offset Form

- Ia form 2015

- Ia form 2017

- Iowa 8453 ind 2013 2019 form

- Iowa sales tax exemption certificate energy used in processing or form

- Energy used in processing of agriculture form

- Iowa sales tax exemption certificate energy used in processing or 6964540 form

- Iowa form contractor 2013

- Iowa form contractor 2016 2019

Find out other Offset Form

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure