Iowa Sales Tax Exemption Certificate Energy Used in Processing or 2014

What is the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

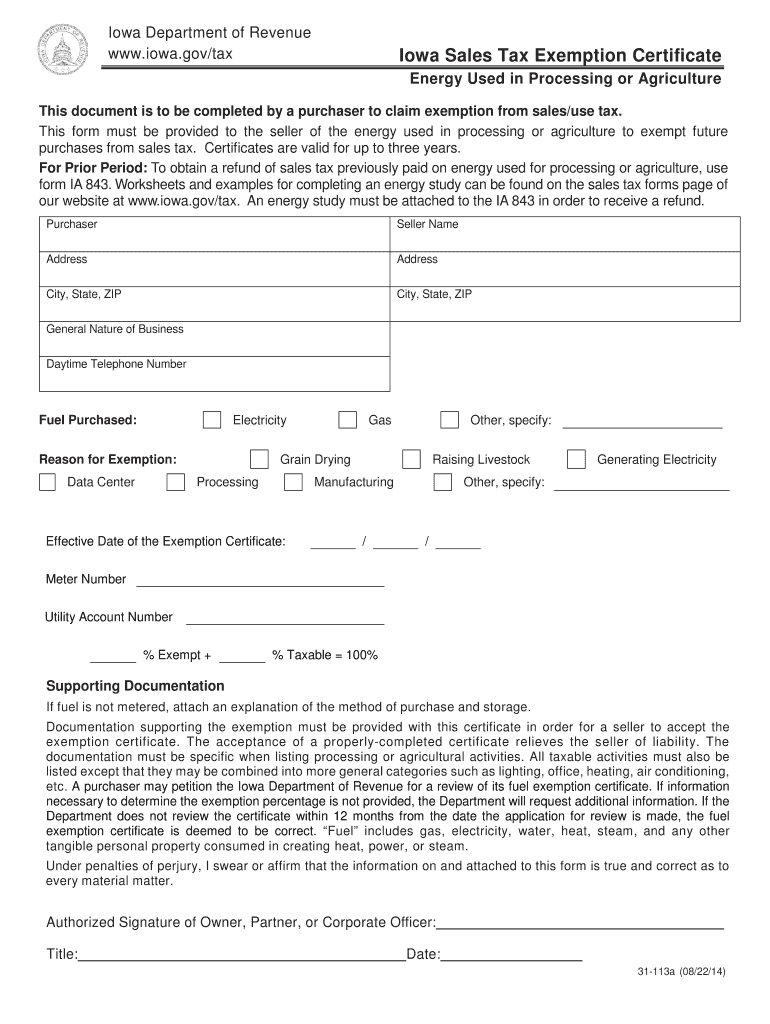

The Iowa Sales Tax Exemption Certificate Energy Used In Processing Or is a specific form designed for businesses that utilize energy in their manufacturing or processing operations. This certificate allows eligible businesses to purchase energy without paying sales tax, thereby reducing operational costs. The exemption applies to energy sources such as electricity, gas, and other fuels when they are directly used in the manufacturing process. Understanding this certificate is crucial for businesses looking to optimize their tax obligations and ensure compliance with state regulations.

How to use the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

To effectively use the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, businesses must complete the form accurately and present it to their energy supplier. The form should include the purchaser's name, address, and the nature of the business, along with a declaration that the energy will be used in processing. It is essential to retain a copy of the certificate for your records, as it may be required for audits or verification by the Iowa Department of Revenue.

Steps to complete the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

Completing the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or involves several key steps:

- Gather necessary business information, including the business name and address.

- Identify the specific energy sources that qualify for the exemption.

- Fill out the certificate with accurate details, ensuring all required fields are completed.

- Sign and date the certificate to validate it.

- Provide the completed certificate to your energy supplier at the time of purchase.

Eligibility Criteria

To qualify for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, businesses must meet certain eligibility criteria. Typically, the business must be engaged in manufacturing or processing activities. The energy must be used directly in these operations, and the business must be registered with the Iowa Department of Revenue. Additionally, the business should not have any outstanding tax liabilities that could affect its eligibility for the exemption.

Legal use of the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

The legal use of the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or is governed by state tax laws. Businesses must use the certificate strictly for qualifying energy purchases related to manufacturing or processing. Misuse of the certificate, such as using it for non-qualifying purchases, can lead to penalties, including back taxes and fines. It is important for businesses to stay informed about the legal requirements and maintain accurate records to ensure compliance.

Examples of using the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

Examples of using the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or include:

- A manufacturing plant that uses electricity to power machinery involved in production.

- A food processing facility that requires natural gas for cooking and processing food items.

- A textile manufacturer that utilizes steam generated from natural gas to process fabrics.

In each case, the energy used directly contributes to the manufacturing process, making the purchase eligible for tax exemption under Iowa law.

Quick guide on how to complete iowa sales tax exemption certificate energy used in processing or

Your assistance manual on how to prepare your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

If you’re curious about how to finalize and submit your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, here are some brief guidelines on how to simplify tax processing.

To begin, you just need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an extremely user-friendly and powerful document platform that enables you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to amend responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Complete the following steps to finalize your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or in a few moments:

- Set up your account and start working on PDFs instantly.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or in our editor.

- Fill out the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting paper forms can lead to more errors and delays in refunds. Before e-filing your taxes, ensure you review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa sales tax exemption certificate energy used in processing or

FAQs

-

How do you think Mexico can stop the US from charging Mexico for the wall using tariffs on goods manufactured in Mexico for sale in the US, and/or for taxing money sent out of the US to Mexico?

Mexico can't stop America from doing that. They also can't stop America from charging tariffs and taxing Americans to pay for Trump's hair treatments. Mexico has no control over America's tariff and taxation policy, that's run by the US government, and is ultimately only accountable to the American people.What Mexico can, and absolutely will do, is retaliate by imposing tariffs on American goods, effectively kicking off a trade war which will hurt both countries. American farmers, ranchers, manufacturers, etc., who sell things to Mexico will lose business, and some will go out of business. American consumers will pay more for everything from gas to grapes, and American manufacturers who buy materials and components from Mexico (and there are many), will find their expenses going up. Some will have lay offs or go out of business.As for the taxation, if Trump can convince a Republican congress to raise taxes, Mexico has no say in it. I mean, to 100% certainty it will increase the market for illegal smuggling of money and other financial interests across international borders. Some of the more tech-savvy organizations might use BitCoin, or some other digital currency. America will likely try to crack down on this, occasionally confiscate an envelope of money to wave around on the news as a sign they're doing their job, but the additional federal money gained from this program will probably be less than the additional money we have to spend on border enforcement just chasing the dark money. But that's ultimately a US thing. Sure, it would be hypocritical of a Republican congress to raise federal taxes, but hypocrisy has never stopped them before. And it would have massive political backlash from every American with friends or relatives in Mexico who wants to send them money for any reason. But this administration has basically written of the support of everyone with Mexican ties in the entire US, so that's probably not such a big thing.So, if destruction of trade and onerous taxes on the poorest of our workers is what Trump wants to build his wall on, all Pena can do is try to tie his country closer with other, more reasonable global powers.

Create this form in 5 minutes!

How to create an eSignature for the iowa sales tax exemption certificate energy used in processing or

How to make an electronic signature for your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or online

How to generate an eSignature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or in Google Chrome

How to make an eSignature for putting it on the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or in Gmail

How to create an eSignature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or from your smartphone

How to generate an electronic signature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or on iOS

How to generate an electronic signature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or on Android OS

People also ask

-

What is the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

The Iowa Sales Tax Exemption Certificate Energy Used In Processing Or is a specific document that allows businesses to purchase energy used in processing without paying sales tax. This exemption is crucial for industries that rely heavily on energy consumption for production. To qualify, businesses must properly complete and submit this certificate when making their purchases.

-

How can the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or benefit my business?

By using the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, your business can signNowly reduce operational costs associated with energy expenses. This exemption promotes better cash flow and allows reinvestment into growth opportunities. Ensuring you are registered and compliant with this exemption can lead to considerable savings.

-

What types of energy are covered by the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

The Iowa Sales Tax Exemption Certificate Energy Used In Processing Or typically covers electricity, natural gas, and other forms of energy that are directly used in processing activities. However, it's essential to check specific guidelines as there may be limitations depending on the equipment and processes used. Proper documentation is necessary to ensure compliance.

-

How do I apply for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

To apply for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, you must fill out the appropriate forms provided by the Iowa Department of Revenue. It's important to include all necessary information about your business and the processes utilizing energy to ensure your application is approved. Consulting with a tax professional can streamline this process.

-

Can airSlate SignNow help in generating the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

Yes, airSlate SignNow can facilitate the creation and management of the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or through its efficient document management features. With our platform, you can easily fill out, eSign, and store this certificate securely. This enhances your workflow and ensures that all necessary documentation is readily accessible.

-

Is there a cost associated with using airSlate SignNow for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

Using airSlate SignNow involves a subscription cost, which varies based on the features and scale you choose for your business. However, the cost is often outweighed by the savings gained from efficiently managing important documents like the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or. Our service is designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow offer to assist with the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

airSlate SignNow offers a variety of features, including document templates, eSigning capabilities, and extensive integrations to streamline your workflow for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or. Additionally, our platform ensures secure storage and easy access to all your important documents, enhancing productivity and compliance.

Get more for Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

- Toghotthele scholarship application form

- Naemt educational programs participant form

- Declaration regarding final arrangements 008 lap legal document library form

- Commercial vehicle motor home condition report form

- Department of labour electrical contractor registration form 644599671

- Request for formal written price ekurhuleni

- 20170711application form for employment

- Kgatso form

Find out other Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe