Iowa Sales Tax Exemption Certificate Energy Used in Processing or 2015

What is the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

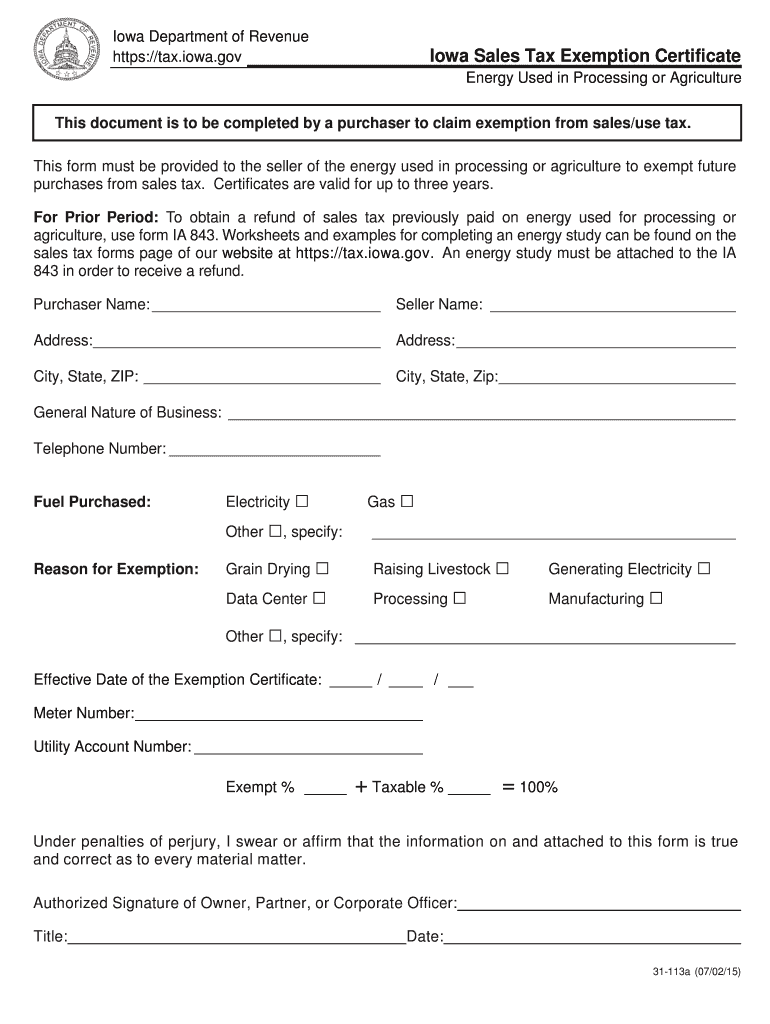

The Iowa Sales Tax Exemption Certificate Energy Used In Processing Or is a specific form that allows businesses in Iowa to claim an exemption from sales tax on energy used in manufacturing or processing. This certificate is essential for companies that utilize energy resources in their production processes, enabling them to reduce operational costs by avoiding sales tax on eligible energy purchases. Understanding this certificate is crucial for compliance with state tax regulations and for maximizing potential savings.

How to use the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

To use the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, businesses must first complete the form accurately, ensuring all required information is provided. Once filled out, the certificate should be presented to suppliers when making purchases of energy that qualifies for the exemption. It is important to retain copies of the certificate and any related documentation for record-keeping purposes, as these may be needed for future audits or compliance checks.

Steps to complete the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

Completing the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or involves several key steps:

- Download the form from the Iowa Department of Revenue website or obtain it from a supplier.

- Fill in the business name, address, and tax identification number accurately.

- Specify the type of energy being purchased and how it will be used in the manufacturing or processing operation.

- Sign and date the certificate to validate it.

- Provide the completed certificate to the energy supplier at the time of purchase.

Eligibility Criteria

Eligibility for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or is generally limited to businesses engaged in manufacturing or processing activities. To qualify, a business must demonstrate that the energy purchased is directly used in the production process. This includes electricity, gas, or other forms of energy required for manufacturing operations. It is advisable for businesses to review specific state guidelines to ensure compliance with eligibility requirements.

Required Documents

When applying for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, businesses typically need to provide several documents, including:

- A completed Iowa Sales Tax Exemption Certificate form.

- Proof of business registration and tax identification number.

- Documentation that outlines the nature of the manufacturing or processing activities.

- Invoices or receipts for energy purchases, if applicable.

Legal use of the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

The legal use of the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or requires strict adherence to state tax laws. Businesses must ensure that the energy purchased is solely used for qualifying manufacturing or processing activities. Misuse of the certificate can lead to penalties, including back taxes and fines. Therefore, it is important to maintain accurate records and provide truthful information when completing the form.

Quick guide on how to complete iowa sales tax exemption certificate energy used in processing or 6964540

Your assistance manual on how to prepare your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

If you’re eager to learn how to complete and submit your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or, here are some straightforward guidelines to simplify tax declaration.

To start, you need to establish your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures while making necessary amendments. Optimize your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or in a matter of minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our catalog to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or in our editor.

- Complete the required fillable fields with your details (textual data, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to an increase in return errors and delay refunds. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa sales tax exemption certificate energy used in processing or 6964540

Create this form in 5 minutes!

How to create an eSignature for the iowa sales tax exemption certificate energy used in processing or 6964540

How to create an eSignature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or 6964540 online

How to generate an eSignature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or 6964540 in Google Chrome

How to generate an electronic signature for putting it on the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or 6964540 in Gmail

How to generate an eSignature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or 6964540 right from your mobile device

How to make an eSignature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or 6964540 on iOS

How to create an electronic signature for the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or 6964540 on Android devices

People also ask

-

What is the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

The Iowa Sales Tax Exemption Certificate Energy Used In Processing Or is a document that allows businesses to claim exemption from sales tax on energy used specifically in manufacturing or processing operations. This certificate streamlines compliance and can lead to signNow cost savings for eligible businesses. By utilizing this certificate, companies can reinvest these savings into growth opportunities.

-

How can airSlate SignNow help with the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

airSlate SignNow simplifies the process of creating, signing, and managing your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or. Our platform provides easy templates and eSignature capabilities that save time and ensure compliance. This allows businesses to focus on their operations rather than paperwork.

-

Are there any fees associated with using airSlate SignNow for the certificate?

While airSlate SignNow offers various pricing plans, creating and managing your Iowa Sales Tax Exemption Certificate Energy Used In Processing Or comes with affordable rates that cater to businesses of all sizes. The potential savings from tax exemptions often outweigh the nominal fees. Check our pricing page for detailed options to find the best fit for your needs.

-

What features does airSlate SignNow offer for managing tax exemption certificates?

airSlate SignNow provides features including customizable templates, secure eSignatures, document tracking, and cloud storage, all tailored for important documents like the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or. These features enhance efficiency and ensure that your records are organized and easily accessible. The platform also supports integration with other business tools for seamless workflow management.

-

Can I integrate airSlate SignNow with my existing accounting software for better tax management?

Yes, airSlate SignNow offers integrations with popular accounting software to streamline the management of the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or. This enables businesses to maintain accurate financial records and ensures compliance effortlessly. By automating documentation workflows, you save valuable time and reduce the risk of errors.

-

What benefits can businesses gain from using the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or?

Using the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or allows businesses to avoid unnecessary sales tax expenses on energy costs, enhancing overall profitability. By using this certificate, companies can allocate savings towards other operational needs or investments. Moreover, it promotes better cash flow management.

-

Is there support available for completing the Iowa Sales Tax Exemption Certificate?

Absolutely! airSlate SignNow provides customer support to assist users in completing the Iowa Sales Tax Exemption Certificate Energy Used In Processing Or accurately. Our resources include detailed guides and responsive support staff who can answer specific queries, ensuring that you navigate the process smoothly.

Get more for Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

- Sf 5515 form

- Child custody affidavit pdf form

- Sacramento spca community service timesheet form

- Denis dental insurance form

- Unit trusts application for a withdrawal repurch form

- Parentsinc orgwhat is a parenting planwhat is a parenting planparents inc form

- Hospital admission form 15778099

- Applicationatmospheric and oceanic sciences form

Find out other Iowa Sales Tax Exemption Certificate Energy Used In Processing Or

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed