Pttax340 Lake County Il Form

What is the Pttax340 Lake County Il Form

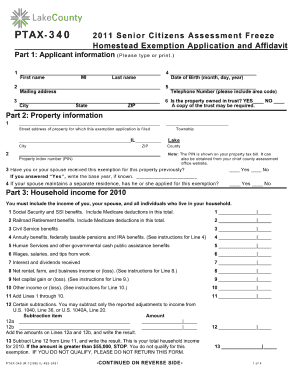

The Pttax340 Lake County Il form is an essential document used for property tax assessment in Lake County, Illinois. This form is primarily utilized by property owners to report changes in property ownership, value, or use. It helps local authorities determine the appropriate tax rates and ensures that property assessments are accurate and up to date. Understanding the purpose of this form is crucial for property owners to maintain compliance with local tax regulations.

Steps to complete the Pttax340 Lake County Il Form

Completing the Pttax340 Lake County Il form involves several straightforward steps. First, gather all necessary information regarding your property, including its current value, any recent improvements, and ownership details. Next, accurately fill out each section of the form, ensuring that all information is correct and complete. After filling out the form, review it for any errors or omissions. Finally, submit the completed form to the appropriate local tax authority by the specified deadline, either online or via mail.

Legal use of the Pttax340 Lake County Il Form

The legal use of the Pttax340 Lake County Il form is governed by state and local tax laws. It is essential for property owners to understand that submitting this form accurately and on time is a legal obligation. Failure to comply with these requirements can result in penalties or incorrect property tax assessments. The form must be signed and dated to validate its submission, and it is recommended to keep a copy for personal records.

Required Documents

When completing the Pttax340 Lake County Il form, certain documents may be required to support your submission. These may include:

- Proof of property ownership, such as a deed or title.

- Recent property tax bills or assessment notices.

- Documentation of any improvements made to the property.

- Identification information, such as a driver's license or Social Security number.

Having these documents ready can streamline the completion process and ensure that your submission is accurate.

Form Submission Methods

The Pttax340 Lake County Il form can be submitted through various methods to accommodate different preferences. Property owners can choose to submit the form online through the Lake County tax authority's website, which often provides a user-friendly interface for electronic submissions. Alternatively, the form can be mailed to the appropriate office or delivered in person. Each method has its own advantages, such as immediate confirmation for online submissions or the ability to discuss any questions in person.

Eligibility Criteria

Eligibility to use the Pttax340 Lake County Il form typically includes property owners who have experienced changes in ownership, property value, or use. This may apply to individuals, businesses, or organizations that own real estate within Lake County. It is important for applicants to ensure that they meet the criteria outlined by local tax authorities to avoid complications during the assessment process.

Quick guide on how to complete pttax340 lake county il form

Effortlessly Prepare Pttax340 Lake County Il Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents quickly without any hurdles. Manage Pttax340 Lake County Il Form on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Edit and eSign Pttax340 Lake County Il Form with Ease

- Locate Pttax340 Lake County Il Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to preserve your changes.

- Select how you prefer to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require reprinting new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choice. Edit and eSign Pttax340 Lake County Il Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pttax340 lake county il form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the lake county illinois ptax 340 form?

The lake county illinois ptax 340 form is a property tax exemption application used by residents in Lake County, Illinois. This form allows homeowners to apply for various property tax exemptions provided by the state, potentially reducing their overall tax burden. Completing this form correctly is essential to ensure that you receive any applicable discounts.

-

How can I obtain the lake county illinois ptax 340 form?

You can obtain the lake county illinois ptax 340 form from the official Lake County government website or by visiting the local assessment office. Additionally, airSlate SignNow offers an easy digital solution to access and fill out this form online, allowing you to start the application process quickly and conveniently.

-

Is there a fee associated with filing the lake county illinois ptax 340 form?

There are typically no fees directly associated with filing the lake county illinois ptax 340 form itself, but it’s important to check for any potential processing fees depending on your submission method. Using airSlate SignNow can make the submission process seamless at no extra cost, saving you time and effort.

-

What benefits do I get from using the lake county illinois ptax 340 form?

Utilizing the lake county illinois ptax 340 form can lead to signNow savings on property taxes through various exemptions. This form helps you qualify for tax benefits granted to specific categories such as seniors or disabled persons. By ensuring your eligibility and filing on time, you can maximize your potential savings.

-

Can I submit the lake county illinois ptax 340 form online?

Yes, you can submit the lake county illinois ptax 340 form online using platforms like airSlate SignNow. This service facilitates electronic submission, enabling you to complete and sign your documents securely, thus streamlining the overall process for your convenience.

-

How does airSlate SignNow enhance the process of completing the lake county illinois ptax 340 form?

airSlate SignNow simplifies the process of completing the lake county illinois ptax 340 form with its user-friendly interface and electronic signing capabilities. The platform allows you to fill out your form at your own pace, ensuring accuracy while providing tools to securely save and share your document effortlessly.

-

What integrations does airSlate SignNow offer for managing the lake county illinois ptax 340 form?

airSlate SignNow offers various integrations with systems such as Google Drive, Dropbox, and CRM software, enhancing document management for the lake county illinois ptax 340 form. These integrations allow you to easily organize, access, and store your files, improving your workflow efficiency and productivity.

Get more for Pttax340 Lake County Il Form

Find out other Pttax340 Lake County Il Form

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement