Mo Form 948 2010-2026

What is the Missouri Form 948?

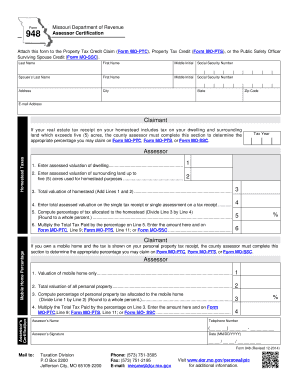

The Missouri Form 948, also known as the 948 form, is a tax form used primarily for claiming homestead property tax exemptions in the state of Missouri. This form is designed for homeowners who wish to reduce their property tax burden by applying for a homestead exemption. The exemption is available to qualified individuals, including senior citizens, disabled persons, and veterans, allowing them to receive a reduction in the assessed value of their property for tax purposes.

How to Use the Missouri Form 948

Using the Missouri Form 948 involves several straightforward steps. First, ensure that you meet the eligibility criteria for the homestead exemption. Next, download the form from the appropriate state website or obtain a physical copy from your local tax office. Fill out the required information accurately, including details about your property and your eligibility status. Once completed, submit the form to your local assessor's office by the specified deadline to ensure your exemption is processed for the upcoming tax year.

Steps to Complete the Missouri Form 948

Completing the Missouri Form 948 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including proof of residency and any documentation supporting your eligibility.

- Download or request the Missouri Form 948 from your local tax office.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your local assessor's office by the deadline.

Legal Use of the Missouri Form 948

The Missouri Form 948 is legally binding when filled out and submitted according to state regulations. To ensure the form's legality, it must be completed in compliance with the Missouri tax laws governing homestead exemptions. This includes providing accurate information and necessary documentation. Once submitted, the form is reviewed by the local assessor's office, which will determine eligibility based on the information provided.

Key Elements of the Missouri Form 948

Several key elements are essential when filling out the Missouri Form 948:

- Property Information: Include details about the property for which the exemption is being claimed, such as the address and parcel number.

- Applicant Information: Provide personal information about the applicant, including name, address, and contact details.

- Eligibility Criteria: Indicate the basis for claiming the exemption, such as age, disability status, or veteran status.

- Signature: The form must be signed by the applicant to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form 948 are crucial to ensure that applications are processed in time for tax assessments. Typically, the form must be submitted by a specific date each year, often by July first, to be considered for the current tax year. It is important to check with the local tax authority for the exact deadlines and any changes that may occur annually.

Quick guide on how to complete mo form 948

Handle Mo Form 948 smoothly on any device

Digital document management has gained traction among businesses and individuals. It offers a fine eco-friendly substitute to traditional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without hold-ups. Manage Mo Form 948 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused activity today.

How to modify and eSign Mo Form 948 with ease

- Obtain Mo Form 948 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Edit and eSign Mo Form 948 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo form 948

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form 948 and how can airSlate SignNow assist with it?

The Missouri Form 948 is a crucial document used for various administrative purposes in the state. With airSlate SignNow, you can easily eSign and manage your Missouri Form 948 online, ensuring efficiency and compliance. Our platform streamlines the document signing process, making it faster and more reliable.

-

How much does it cost to use airSlate SignNow for my Missouri Form 948?

airSlate SignNow offers flexible pricing plans to suit your needs, whether you're an individual or a business. For handling documents like the Missouri Form 948, our pricing is competitive and designed to save you money on printing and filing costs. Visit our pricing page to find the best option for you.

-

What features does airSlate SignNow offer for managing the Missouri Form 948?

airSlate SignNow includes features such as customizable templates, document tracking, and advanced security for your Missouri Form 948. Our platform also allows for in-person signing and mobile access, making it versatile for any situation. These features ensure that managing your documents is efficient and secure.

-

Can I integrate airSlate SignNow with other applications for my Missouri Form 948?

Yes, airSlate SignNow supports integrations with popular applications like Google Drive, Dropbox, and Salesforce. This allows you to seamlessly manage your Missouri Form 948 alongside other business tools you may already be using. Effortless integration enhances your workflow and document management.

-

Is the signing process for the Missouri Form 948 secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security with encryption and authentication methods to protect your Missouri Form 948. We ensure that your documents are safe during the signing process, providing you peace of mind. Your privacy is our top concern, allowing you to focus on what matters most.

-

How can airSlate SignNow benefit my business when dealing with the Missouri Form 948?

Using airSlate SignNow for your Missouri Form 948 can signNowly improve efficiency and reduce turnaround time. Our platform simplifies document management, allowing your team to focus on core activities rather than administrative tasks. The time saved can lead to increased productivity and better service delivery.

-

What is the user experience like when eSigning the Missouri Form 948 with airSlate SignNow?

The user experience on airSlate SignNow when eSigning your Missouri Form 948 is straightforward and intuitive. Users can easily navigate through the signing process, ensuring a swift completion without complications. Our platform is designed with the user in mind, making it accessible for everyone, regardless of tech-savviness.

Get more for Mo Form 948

Find out other Mo Form 948

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure