Tax Transparency Certificate Form

What is the Tax Transparency Certificate

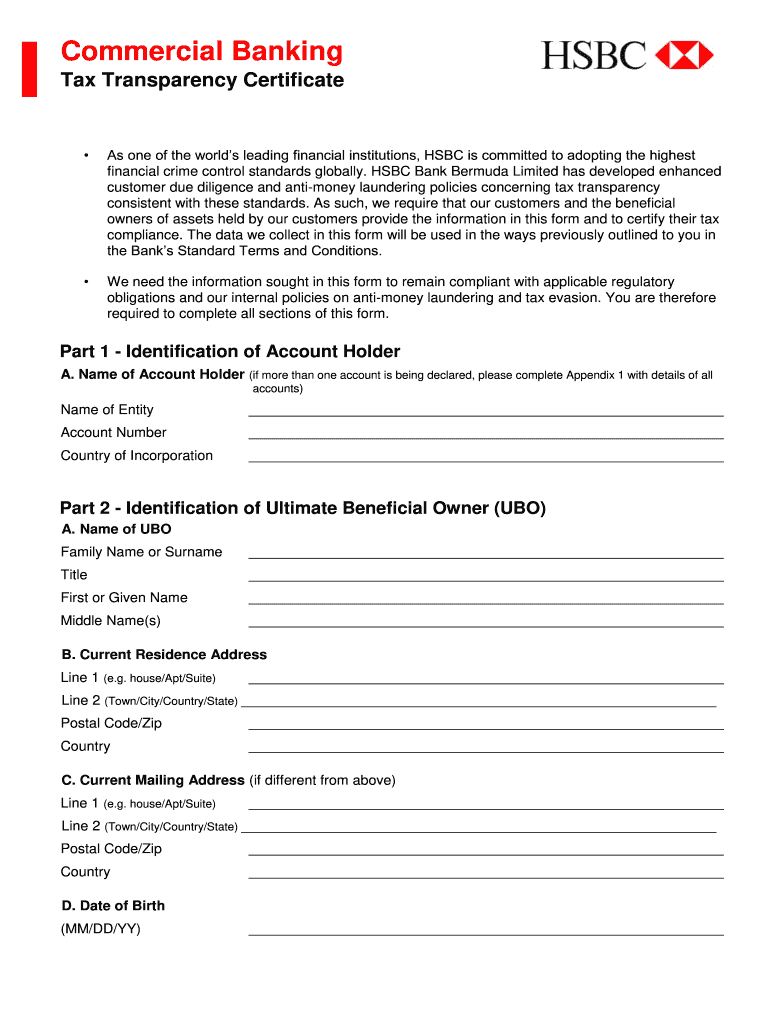

The tax transparency certificate is an official document issued by financial institutions, such as HSBC, to provide verification of a taxpayer's status and compliance with tax regulations. This certificate is essential for individuals and businesses that need to demonstrate their tax obligations and transparency to regulatory bodies or other financial institutions. It typically includes information about the taxpayer's identification, tax residency, and any relevant tax identification numbers.

How to Obtain the Tax Transparency Certificate

To obtain a tax transparency certificate from HSBC, you generally need to follow these steps:

- Contact your local HSBC branch or visit their official website.

- Provide necessary personal information, including your tax identification number and proof of identity.

- Complete any required forms or applications as directed by the bank.

- Submit your request, either online or in person, depending on the options available.

Once your request is processed, the bank will issue the tax transparency certificate, which you can then use for various tax-related purposes.

Steps to Complete the Tax Transparency Certificate

Completing the tax transparency certificate involves several key steps:

- Gather all necessary documentation, including your tax identification number and any previous tax returns.

- Fill out the certificate form accurately, ensuring all personal and financial details are correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form to HSBC, either electronically or in person, as per their guidelines.

It is important to keep a copy of the submitted certificate for your records.

Legal Use of the Tax Transparency Certificate

The tax transparency certificate is legally binding and can be used in various situations, including:

- Proving tax residency to foreign financial institutions.

- Facilitating cross-border transactions and investments.

- Complying with local and international tax regulations.

Ensuring that the certificate is filled out correctly and submitted in accordance with legal requirements is crucial for its validity.

Key Elements of the Tax Transparency Certificate

Key elements typically included in a tax transparency certificate are:

- Taxpayer's full name and address.

- Tax identification number.

- Tax residency status.

- Details of any applicable tax treaties.

These elements help establish the taxpayer's compliance with tax laws and facilitate the verification process by third parties.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of tax transparency certificates. Taxpayers should ensure that the information reported on the certificate aligns with IRS requirements to avoid any discrepancies. It is advisable to consult IRS publications or a tax professional for detailed guidance on how the certificate fits into your overall tax obligations.

Quick guide on how to complete tax transparency certificate

Complete Tax Transparency Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly and without hold-ups. Manage Tax Transparency Certificate on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to alter and electronically sign Tax Transparency Certificate without difficulty

- Locate Tax Transparency Certificate and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Transparency Certificate and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax transparency certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSBC tax transparency certificate?

An HSBC tax transparency certificate is a document that confirms the tax residency status of account holders. It is essential for individuals and businesses looking to comply with various international tax regulations. This certificate helps ensure that customers are transparent about their tax obligations and can facilitate smoother international transactions.

-

How can airSlate SignNow help in obtaining an HSBC tax transparency certificate?

airSlate SignNow streamlines the process of requesting and managing documents, including an HSBC tax transparency certificate. With our eSigning solutions, users can easily complete, sign, and send necessary documents electronically. This eliminates the need for cumbersome paperwork and provides a more efficient approach to securing important certificates.

-

What features of airSlate SignNow support document signing for tax transparency certificates?

AirSlate SignNow offers robust features such as customizable templates, advanced authentication, and real-time tracking for documents. These features make it easier to handle the signing process for important documents like the HSBC tax transparency certificate. Users can ensure that everything is organized and compliant with regulations.

-

Is there a cost associated with obtaining an HSBC tax transparency certificate via airSlate SignNow?

While airSlate SignNow itself charges for its services, obtaining an HSBC tax transparency certificate may involve additional fees set by HSBC. However, using airSlate SignNow's cost-effective platform can signNowly reduce administrative costs associated with printing and mailing documents.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation provides benefits such as speed, efficiency, and enhanced security. Customers can quickly send, receive, and sign documents, including the HSBC tax transparency certificate, without the delays of traditional methods. This leads to faster processing times and greater peace of mind.

-

Can airSlate SignNow integrate with other tools to assist with tax documentation?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, including accounting and tax software. This integration can further simplify the process of managing tasks related to the HSBC tax transparency certificate and other critical documents. Users benefit from a cohesive workflow that enhances productivity.

-

What types of users can benefit from the HSBC tax transparency certificate?

Individuals, businesses, and organizations engaged in international finance can benefit from obtaining an HSBC tax transparency certificate. This document is crucial for ensuring compliance with international tax laws and regulations, making it essential for anyone dealing with global transactions. airSlate SignNow can assist these users in managing the documentation efficiently.

Get more for Tax Transparency Certificate

- Monthly report of federal civilian employment opm form

- Sale of government property bid and award national energy form

- 14208 amendment of invitation for bidsacquisitiongov form

- Instructions gsa form

- Holding agency number form

- Gsa control number gsa use only form

- Form 5423 bill of sale for scrap metal operatorsvehicles ten years or older without title

- Ad sales form silver lake public schools silverlakemustangs

Find out other Tax Transparency Certificate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors