Form 1024 PDF

What is the Form 1024 Pdf

The Form 1024 is a document used by organizations seeking recognition of exemption from federal income tax under section 501(a) of the Internal Revenue Code. This form is specifically for entities that wish to be classified as tax-exempt organizations, such as charities, educational institutions, and religious organizations. Completing the Form 1024 pdf accurately is crucial for obtaining the desired tax-exempt status from the IRS.

How to use the Form 1024 Pdf

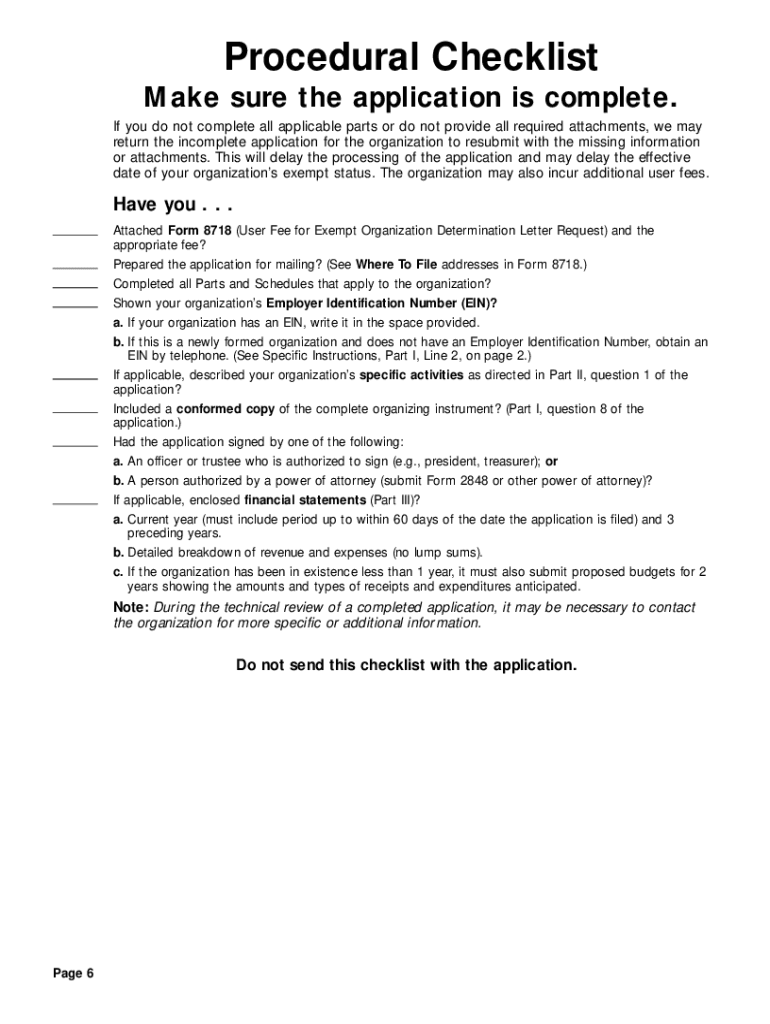

Using the Form 1024 pdf involves several steps to ensure proper completion and submission. First, download the form from the IRS website or a trusted source. Next, gather all necessary information about your organization, including its structure, purpose, and financial data. Carefully fill out each section of the form, ensuring that all required fields are completed. After filling out the form, review it for accuracy before submitting it to the IRS.

Steps to complete the Form 1024 Pdf

Completing the Form 1024 pdf requires attention to detail. Follow these steps:

- Download the latest version of the Form 1024 pdf.

- Provide your organization’s legal name and address.

- Indicate the type of organization and its purpose.

- Detail the activities and programs your organization will undertake.

- Include financial information, such as projected income and expenses.

- Sign and date the form, ensuring all information is accurate.

Legal use of the Form 1024 Pdf

The Form 1024 pdf must be used in accordance with IRS guidelines to ensure that the application for tax-exempt status is legally valid. This includes providing truthful information and adhering to the specific requirements outlined by the IRS. Misrepresentation or incomplete information can lead to delays or denial of the application. It is essential to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1024 pdf are critical for organizations seeking tax-exempt status. Generally, the form must be submitted within 27 months from the end of the month in which the organization was formed to receive retroactive tax-exempt status. If filed after this period, the organization may only receive tax-exempt status from the date of filing. It is important to keep track of these deadlines to ensure compliance with IRS regulations.

Required Documents

When submitting the Form 1024 pdf, several supporting documents are required to validate the application. These may include:

- Articles of incorporation or organization.

- Bylaws of the organization.

- Financial statements or budgets.

- Detailed descriptions of the organization's activities.

- Any additional documentation that supports the claim for tax-exempt status.

Form Submission Methods (Online / Mail / In-Person)

The Form 1024 pdf can be submitted to the IRS through various methods. Organizations may choose to file electronically using the IRS e-File system, which can expedite processing times. Alternatively, the form can be mailed to the appropriate IRS address based on the organization's location. In-person submissions are generally not available for this form. It is important to check the IRS guidelines for the most current submission methods and requirements.

Quick guide on how to complete form 1024 pdf

Complete Form 1024 Pdf effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without hold-ups. Manage Form 1024 Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form 1024 Pdf without hassle

- Obtain Form 1024 Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1024 Pdf and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1024 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1024 and how does airSlate SignNow help with it?

Form 1024 is an application used by nonprofit organizations to request tax-exempt status. airSlate SignNow simplifies the process of completing and eSigning form 1024, allowing users to manage their documents securely and efficiently online.

-

What features does airSlate SignNow offer for managing form 1024?

airSlate SignNow provides a range of features including templates, collaboration tools, and audit trails specifically designed for managing form 1024. Users can easily customize their forms, track changes, and ensure compliance throughout the signing process.

-

Is there a free trial available to test airSlate SignNow for form 1024?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore its functionalities for form 1024 without any commitment. This enables you to evaluate how the software can meet your nonprofit's eSignature needs effectively.

-

How can airSlate SignNow improve the submission process for form 1024?

By utilizing airSlate SignNow, users can digitize the entire submission process of form 1024, reducing paperwork and streamlining workflows. This results in quicker turnaround times, fewer errors, and a more organized filing system.

-

Are there any integrations available with airSlate SignNow for form 1024?

airSlate SignNow integrates seamlessly with various commonly used applications, enhancing the overall document management process for form 1024. This includes options like Google Drive, Dropbox, and various CRM systems, making it easier to access and manage documents.

-

What security measures does airSlate SignNow provide for form 1024?

airSlate SignNow implements robust security protocols to protect sensitive information on form 1024, including data encryption and secure cloud storage. Users can confidently send and receive documents knowing that their data is safeguarded against unauthorized access.

-

Can airSlate SignNow be used by multiple users simultaneously for form 1024?

Absolutely, airSlate SignNow supports collaborations, allowing multiple users to work on form 1024 simultaneously. This feature is especially beneficial for teams within nonprofit organizations that need to coordinate their efforts in submitting the application.

Get more for Form 1024 Pdf

- Appendix a 1 model open end or finance vehicle lease disclosures federalreserve form

- Declaration of domicile for multi parish charter school application isl edu form

- How do i schedule an inspectiontown of herndon va form

- Peter harrison lawyer in signal mountain tn form

- Ive been paying taxes on upkept and justia ask a lawyer form

- Application for mls listing input security level imls members form

- Listing input security level application form

- Tricare prime electronic funds transfer eft form

Find out other Form 1024 Pdf

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now