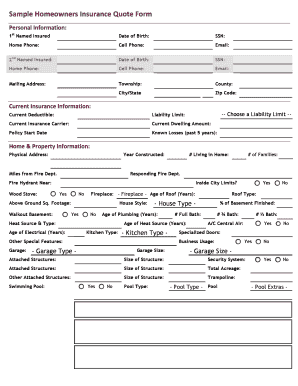

Quote for Homeowners Insurance Form

What is the quote for homeowners insurance?

The quote for homeowners insurance is an estimate provided by insurance companies that outlines the potential cost of insuring a home. This quote takes into account various factors, including the home's location, size, age, and the coverage options selected. It serves as a crucial tool for homeowners to understand the financial commitment involved in protecting their property against risks such as theft, fire, and natural disasters.

Steps to complete the quote for homeowners insurance

Completing a quote for homeowners insurance involves several key steps to ensure accuracy and comprehensiveness. Here is a structured approach:

- Gather necessary information: Collect details about your home, such as its address, square footage, and any special features like a swimming pool or security system.

- Assess coverage needs: Determine the level of coverage you require, including dwelling coverage, personal property protection, and liability coverage.

- Contact insurance providers: Reach out to multiple insurance companies to request quotes. This can often be done online for convenience.

- Compare quotes: Review the quotes you receive, paying attention to coverage limits, deductibles, and premiums.

- Finalize your choice: Select the policy that best meets your needs and budget, then proceed with the application process.

Key elements of the quote for homeowners insurance

A homeowners insurance quote typically includes several essential elements that help homeowners understand their coverage options. These elements are:

- Premium: The amount you will pay for your insurance policy, usually billed annually or monthly.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in for a claim.

- Coverage limits: The maximum amount your insurance company will pay for damages or losses under your policy.

- Exclusions: Specific situations or damages that are not covered by the policy, which homeowners should be aware of.

- Discounts: Potential savings based on factors such as bundling policies, having a security system, or being claims-free.

How to obtain the quote for homeowners insurance

Obtaining a quote for homeowners insurance can be done through various methods, making it accessible for homeowners. Here are the primary ways to get a quote:

- Online quote tools: Many insurance companies offer online tools that allow homeowners to input their information and receive instant quotes.

- Insurance agents: Working with an insurance agent can provide personalized assistance and help navigate different policy options.

- Phone inquiries: Homeowners can call insurance companies directly to discuss their needs and receive quotes over the phone.

Legal use of the quote for homeowners insurance

The legal use of a homeowners insurance quote is essential for ensuring that the coverage is valid and enforceable. To maintain legal integrity, homeowners should:

- Ensure compliance: Verify that the quote adheres to state regulations and insurance laws.

- Document everything: Keep records of all communications and documents related to the quote and policy.

- Understand terms: Familiarize yourself with the terms and conditions outlined in the quote to avoid misunderstandings later.

Examples of using the quote for homeowners insurance

Understanding practical applications of a homeowners insurance quote can help homeowners make informed decisions. Here are a few examples:

- Comparing policies: A homeowner may receive multiple quotes to compare coverage options and costs before selecting a policy.

- Adjusting coverage: After receiving a quote, a homeowner might decide to adjust their coverage limits or deductibles based on their financial situation.

- Negotiating terms: Homeowners can use quotes from different providers to negotiate better terms or discounts with their preferred insurance company.

Quick guide on how to complete quote for homeowners insurance

Prepare Quote For Homeowners Insurance effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly with no delays. Manage Quote For Homeowners Insurance on any device using airSlate SignNow's Android or iOS apps and enhance any document-centered workflow today.

The simplest way to alter and eSign Quote For Homeowners Insurance without hassle

- Find Quote For Homeowners Insurance and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you prefer to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries over lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Quote For Homeowners Insurance and guarantee exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quote for homeowners insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homeowners insurance template?

A homeowners insurance template is a customizable document that outlines the key elements of a homeowners insurance policy. It helps policyholders understand coverage options, limits, and exclusions. Using a homeowners insurance template simplifies the process of creating and managing insurance agreements for your property.

-

How can I create a homeowners insurance template with airSlate SignNow?

You can easily create a homeowners insurance template using airSlate SignNow's intuitive document editor. Simply upload your existing insurance agreement or use our pre-built template options. Once customized, you can save your template for quick access in future transactions.

-

Is airSlate SignNow cost-effective for creating homeowners insurance templates?

Yes, airSlate SignNow offers a cost-effective solution for creating homeowners insurance templates without compromising on features. Our pricing plans cater to various business needs, ensuring you have access to all essential tools while staying within budget. You can manage multiple templates effortlessly at a competitive price.

-

What features does airSlate SignNow offer for homeowners insurance templates?

airSlate SignNow provides features like eSigning, document tracking, and collaboration tools specifically designed for homeowners insurance templates. You can add fields for signatures, dates, and other necessary information. Additionally, you can integrate with other applications to enhance your document management process.

-

Are there any benefits to using a homeowners insurance template?

Utilizing a homeowners insurance template streamlines the insurance documentation process, saving you time and minimizing errors. It also ensures consistency in your agreements, which can improve clarity with clients. The use of a standardized template can enhance professionalism and trust in your services.

-

Can I integrate airSlate SignNow with other software for managing homeowners insurance templates?

Yes, airSlate SignNow offers integration capabilities with various software applications, making it easy to manage your homeowners insurance templates alongside your other business tools. You can connect with platforms like CRM systems or accounting software to centralize your data and improve workflow efficiency.

-

What types of businesses can benefit from using a homeowners insurance template?

A wide range of businesses can benefit from using a homeowners insurance template, including real estate agencies, property management companies, and insurance brokers. These organizations require efficient document management solutions for handling insurance agreements. By using a standardized template, they can improve efficiency and enhance customer service.

Get more for Quote For Homeowners Insurance

Find out other Quote For Homeowners Insurance

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template