Printable Federal Tax Form 5329

What is the Printable Federal Tax Form 5329

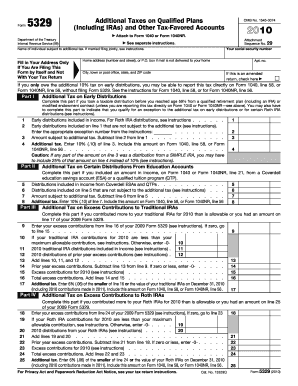

The IRS Form 5329 is a federal tax form used to report additional taxes on qualified retirement plans, including Individual Retirement Accounts (IRAs). This form is essential for taxpayers who have taken early distributions from their retirement accounts or who have excess contributions. It helps ensure compliance with tax regulations regarding retirement savings. The form also allows individuals to claim exceptions to the additional taxes, making it a critical component of the tax filing process for those with retirement accounts.

How to use the Printable Federal Tax Form 5329

Using IRS Form 5329 involves several steps to ensure accurate reporting of additional taxes. First, download the form in PDF format from the IRS website or a trusted source. Next, fill in your personal information, including your name, address, and Social Security number. Then, indicate the type of retirement account involved and the reason for the additional tax. Be sure to calculate any taxes owed accurately. Finally, review the form for completeness before submitting it with your federal tax return.

Steps to complete the Printable Federal Tax Form 5329

Completing Form 5329 requires careful attention to detail. Follow these steps:

- Download the form from a reliable source.

- Enter your personal information in the designated fields.

- Identify the type of retirement account and the specific tax situation.

- Calculate the additional tax owed based on the instructions provided.

- Check for any exceptions that may apply to your situation.

- Sign and date the form before submission.

How to obtain the Printable Federal Tax Form 5329

Obtaining IRS Form 5329 is straightforward. You can access the form directly from the IRS website, where it is available for download in PDF format. Alternatively, you may find the form through tax preparation software or by requesting it from a tax professional. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 5329 typically align with the general tax return deadlines. For most taxpayers, the due date for submitting your federal tax return, along with Form 5329, is April 15 of each year. If you require additional time, you may file for an extension, but it is essential to pay any taxes owed by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failing to file Form 5329 when required can result in significant penalties. The IRS imposes an additional tax of ten percent on early distributions from retirement accounts if the appropriate exceptions are not claimed. Moreover, not reporting excess contributions can lead to a six percent penalty on the excess amount for each year it remains in the account. Timely and accurate filing is crucial to avoid these financial repercussions.

Quick guide on how to complete printable federal tax form 5329

Complete Printable Federal Tax Form 5329 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Printable Federal Tax Form 5329 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Printable Federal Tax Form 5329 without hassle

- Obtain Printable Federal Tax Form 5329 and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Select your preferred method to share your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Printable Federal Tax Form 5329 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable federal tax form 5329

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5329 and why is it important?

Form 5329 is used to report additional taxes on qualified plans and IRAs. It’s essential for individuals who wish to rectify any tax issues related to retirement accounts, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with filling out form 5329?

airSlate SignNow offers user-friendly document management and eSigning features that streamline the process of completing form 5329. You can easily fill in, sign, and share the form securely, minimizing errors and saving time.

-

Is there a cost associated with using airSlate SignNow for form 5329?

Yes, airSlate SignNow has various pricing plans that cater to different business needs. The cost-effective solution allows businesses of all sizes to manage form 5329 and other documents efficiently.

-

What features does airSlate SignNow offer for form 5329 users?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage. These tools specifically facilitate the easy preparation and processing of form 5329.

-

Can I integrate airSlate SignNow with other applications while handling form 5329?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to work fluidly with other tools while managing form 5329. This integration enhances productivity and streamlines your document workflows.

-

Is electronic signing of form 5329 legally recognized?

Yes, electronic signing via airSlate SignNow is legally recognized and compliant with U.S. laws. This means that your signed form 5329 will hold up in court and be accepted by the IRS, providing peace of mind.

-

How secure is airSlate SignNow for submitting form 5329?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and strict compliance with data protection regulations to ensure that your form 5329 and personal information are secure.

Get more for Printable Federal Tax Form 5329

Find out other Printable Federal Tax Form 5329

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed