Form W 4v

What is the Form W-4V?

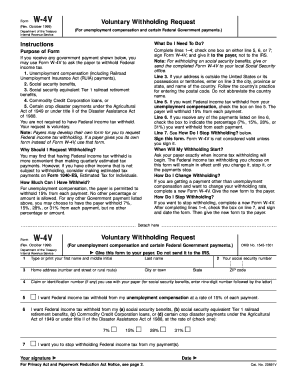

The Form W-4V, also known as the Voluntary Withholding Request, is a tax form used by individuals to request voluntary federal income tax withholding from certain types of payments. This form is typically utilized by recipients of Social Security benefits, pensions, annuities, and other payments who wish to have federal taxes withheld from their income. By completing the W-4V, individuals can specify the percentage of their payment that they would like withheld for federal income tax purposes.

How to Use the Form W-4V

Using the Form W-4V involves a straightforward process. First, individuals should obtain the form, which can be downloaded from the IRS website or requested from the payer. After filling out the required information, including personal details and the desired withholding percentage, the completed form should be submitted to the payer or the relevant agency. It is important to keep a copy of the form for personal records. The payer will then use this information to withhold the specified amount from future payments.

Steps to Complete the Form W-4V

Completing the Form W-4V requires careful attention to detail. Here are the steps to follow:

- Download the Form W-4V from the IRS website or obtain it from your payer.

- Fill in your name, address, and Social Security number in the designated fields.

- Select the percentage of withholding you prefer, which can be ten percent, or another amount if specified by the payer.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the payer or agency responsible for issuing your payments.

Legal Use of the Form W-4V

The legal use of the Form W-4V is governed by IRS regulations that allow individuals to request federal income tax withholding voluntarily. This form is particularly relevant for those receiving payments that are not subject to automatic withholding. By submitting the W-4V, individuals ensure that they comply with tax obligations and help avoid underpayment penalties during tax filing season.

Examples of Using the Form W-4V

There are several scenarios where the Form W-4V may be applicable:

- An individual receiving Social Security benefits may choose to have federal taxes withheld to avoid a large tax bill at the end of the year.

- A retiree receiving pension payments can use the W-4V to manage their tax liability more effectively.

- Individuals receiving unemployment benefits may opt for withholding to help cover their tax obligations.

Form Submission Methods

The completed Form W-4V can be submitted in various ways, depending on the payer's requirements. Common submission methods include:

- Mailing the form directly to the payer's address.

- Submitting the form electronically if the payer offers an online submission option.

- Delivering the form in person, if applicable.

Quick guide on how to complete form w 4v 1666078

Complete Form W 4v effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form W 4v on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Form W 4v with ease

- Obtain Form W 4v and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form W 4v to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4v 1666078

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w 4v form?

The w 4v form is a specific IRS form used by employees to request that federal income tax withholding be calculated based on a nonresident status or a specific exemption. Using airSlate SignNow, you can easily send and eSign the w 4v form, ensuring accuracy and compliance.

-

How can airSlate SignNow help with the w 4v form process?

airSlate SignNow streamlines the entire w 4v form process by allowing users to complete, sign, and send documents electronically. This eliminates the hassle of printing and scanning, making it ideal for busy professionals aiming for efficiency.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored for different business needs, starting from a basic plan to comprehensive solutions. These plans often include features to manage the w 4v form and other important documents, providing a cost-effective solution for all users.

-

Are there any benefits to using airSlate SignNow for w 4v forms?

Using airSlate SignNow for w 4v forms offers numerous benefits, including enhanced security, document tracking, and built-in compliance features. These advantages help ensure your w 4v forms are processed efficiently and securely, reducing the risk of errors.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with a variety of platforms such as Google Drive, Salesforce, and Zapier. This means you can easily manage your w 4v forms alongside your other business processes without the need for extensive changes to your current workflow.

-

Is it easy to send a w 4v form with airSlate SignNow?

Yes, sending a w 4v form with airSlate SignNow is straightforward. The platform features a user-friendly interface that allows you to upload, customize, and send your w 4v form with just a few clicks.

-

Can I track the status of my w 4v forms in airSlate SignNow?

Absolutely! airSlate SignNow offers tracking capabilities that allow you to monitor the status of your sent w 4v forms. You'll receive notifications when the document is opened, viewed, or signed, ensuring you stay updated throughout the process.

Get more for Form W 4v

Find out other Form W 4v

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free