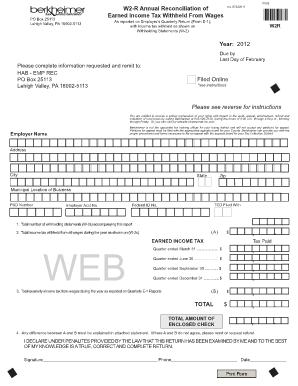

W2 R Annual Reconciliation Keystone Form

What is the W2 R Annual Reconciliation Keystone

The W2 R Annual Reconciliation Keystone is a vital document used by employers to report and reconcile employee earnings and tax withholdings for the year. This form consolidates information from individual W-2 forms, ensuring that the total wages and taxes reported match the amounts submitted to the IRS. It plays a crucial role in maintaining accurate payroll records and fulfilling tax obligations. Understanding the purpose and structure of this form is essential for compliance and accurate reporting.

How to use the W2 R Annual Reconciliation Keystone

Using the W2 R Annual Reconciliation Keystone involves several key steps. First, gather all individual W-2 forms issued to employees throughout the year. Ensure that each form is complete and accurate. Next, input the data from these forms into the W2 R Annual Reconciliation Keystone, ensuring that totals for wages and tax withholdings match the figures reported to the IRS. Finally, submit the completed form to the appropriate tax authorities as required. This process helps to ensure that all employee earnings are correctly reported and that the organization remains compliant with tax regulations.

Steps to complete the W2 R Annual Reconciliation Keystone

Completing the W2 R Annual Reconciliation Keystone involves a systematic approach:

- Collect all W-2 forms issued during the year.

- Verify the accuracy of each W-2 form, checking for correct names, Social Security numbers, and amounts.

- Summarize total wages and tax withholdings from all W-2 forms.

- Fill in the W2 R Annual Reconciliation Keystone with the summarized data.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the specified deadline.

Legal use of the W2 R Annual Reconciliation Keystone

The legal use of the W2 R Annual Reconciliation Keystone is governed by IRS regulations. This form must be completed accurately to ensure compliance with federal tax laws. Incorrect or incomplete submissions can lead to penalties or audits. Employers are required to maintain records of all submitted forms for a specified period, as these documents may be requested during audits or reviews. Understanding the legal implications of this form is essential for businesses to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the W2 R Annual Reconciliation Keystone are critical for compliance. Typically, employers must submit this form by January 31 of the following year. It is essential to be aware of any changes to deadlines, as the IRS may adjust dates based on specific circumstances or regulations. Staying informed about these deadlines helps ensure timely submissions and avoids penalties associated with late filings.

Required Documents

To complete the W2 R Annual Reconciliation Keystone, several documents are necessary:

- All W-2 forms issued to employees for the reporting year.

- Employer Identification Number (EIN) for accurate identification.

- Payroll records that detail employee earnings and tax withholdings.

- Any relevant state or local tax forms that may apply.

Quick guide on how to complete w2 r annual reconciliation keystone

Effortlessly Prepare W2 R Annual Reconciliation Keystone on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly and without delays. Manage W2 R Annual Reconciliation Keystone on any device using airSlate SignNow's Android or iOS applications and optimize any document-related process today.

How to Edit and eSign W2 R Annual Reconciliation Keystone with Ease

- Obtain W2 R Annual Reconciliation Keystone and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose your delivery method for the form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign W2 R Annual Reconciliation Keystone and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w2 r annual reconciliation keystone

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Keystone annual reconciliation?

Keystone annual reconciliation is a financial process that aligns and verifies the accuracy of records at the end of the year. It ensures that all financial transactions are accounted for properly, providing a clear picture of a business's performance. Utilizing tools like airSlate SignNow can streamline this process by simplifying document management and electronic signatures.

-

How can airSlate SignNow assist with Keystone annual reconciliation?

AirSlate SignNow offers an efficient solution for handling documents related to Keystone annual reconciliation. With its easy-to-use platform, users can quickly send, sign, and manage essential financial documents, helping to reduce errors and save time. This ensures a smoother reconciliation process at year-end.

-

What features does airSlate SignNow provide for document management during Keystone annual reconciliation?

AirSlate SignNow includes features such as customizable templates, secure document sharing, and comprehensive tracking for every signing event. These functionalities support businesses in maintaining organized records throughout the year, which is crucial for effective Keystone annual reconciliation.

-

Is there a pricing plan suitable for small businesses needing Keystone annual reconciliation solutions?

Yes, airSlate SignNow offers a variety of pricing plans, including options specifically designed for small businesses. These plans are cost-effective and provide essential features for managing documents efficiently, making them ideal for businesses that need to perform Keystone annual reconciliation without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for Keystone annual reconciliation?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software to enhance your Keystone annual reconciliation process. These integrations enable automatic document sharing and signing, ensuring that all your financial records are up-to-date and easily accessible.

-

What are the benefits of using airSlate SignNow for Keystone annual reconciliation?

Using airSlate SignNow for Keystone annual reconciliation offers numerous benefits, including improved efficiency, reduced manual errors, and enhanced collaboration. The platform allows team members to access documents from anywhere, facilitating a smoother and quicker reconciliation process.

-

How secure is airSlate SignNow for sensitive documents related to Keystone annual reconciliation?

AirSlate SignNow prioritizes security, utilizing advanced encryption and compliance features to protect sensitive documents. This ensures that all information shared during the Keystone annual reconciliation process is safeguarded against unauthorized access, giving users peace of mind.

Get more for W2 R Annual Reconciliation Keystone

- The grantor an individual form

- Unmarried of the of county of state of form

- Exploration agreement with option for joint venture secgov form

- Control number il sdeed 6 form

- Quit claim deed form prepare a property deed onlinelegalzoom

- In 00llc 1 form

- Unmarried hereinafter referred to as grantor conveys and quitclaims to form

- Married hereinafter referred to as form

Find out other W2 R Annual Reconciliation Keystone

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document