Form Ear 14

What is the Form Ear 14

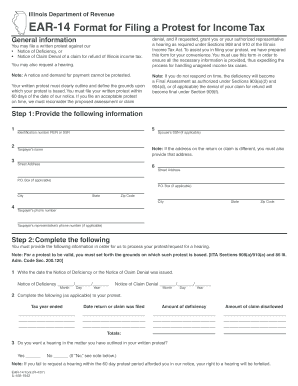

The Form Ear 14 is a specific document used by the Illinois Department of Revenue. It is primarily utilized for reporting and documenting certain tax-related information. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding the purpose of the Form Ear 14 is crucial for accurate reporting and fulfilling legal obligations.

How to use the Form Ear 14

Using the Form Ear 14 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documentation that pertains to the specific tax period. Next, fill out the form with accurate details, including personal identification information and any relevant financial data. Once completed, review the form for accuracy before submission to avoid delays or penalties. It is important to adhere to the specific instructions provided for the form to ensure proper processing.

Steps to complete the Form Ear 14

Completing the Form Ear 14 requires attention to detail. Follow these steps:

- Obtain the latest version of the Form Ear 14 from the Illinois Department of Revenue.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the necessary financial details as required by the form.

- Review all entries for accuracy and completeness.

- Sign and date the form where indicated.

Form Submission Methods (Online / Mail / In-Person)

The Form Ear 14 can be submitted through various methods, depending on your preference and convenience. Options include:

- Online Submission: Many users prefer to submit the form electronically through the Illinois Department of Revenue's online portal.

- Mail: If you choose to mail the form, ensure it is sent to the correct mailing address specified on the form.

- In-Person: You may also deliver the form in person at designated locations, ensuring immediate receipt and processing.

Legal use of the Form Ear 14

The legal use of the Form Ear 14 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the specified deadlines. Compliance with these regulations is essential to avoid penalties and ensure that your tax obligations are met. Utilizing the form correctly helps maintain transparency with the Illinois Department of Revenue and supports lawful financial practices.

State-specific rules for the Form Ear 14

Each state may have unique rules regarding the use of tax forms, including the Form Ear 14. In Illinois, it is important to familiarize yourself with the specific guidelines set forth by the Illinois Department of Revenue. These rules may include filing deadlines, required information, and any additional documentation that must accompany the form. Adhering to these state-specific regulations is crucial for successful submission and compliance.

Quick guide on how to complete form ear 14

Complete Form Ear 14 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents swiftly without delays. Handle Form Ear 14 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Form Ear 14 without any hassle

- Find Form Ear 14 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authenticity as a conventional wet ink signature.

- Review all details thoroughly and click the Done button to save your changes.

- Choose your preferred method for sending your form: by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Form Ear 14 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ear 14

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where do you mail ear 14 forms?

You can mail ear 14 forms to the appropriate address indicated in the form's instructions. It's important to check the specific mailing address for your situation, as it may vary depending on the type of form and your location. Ensure that you send the forms via a reliable mailing service to avoid delays.

-

What features does airSlate SignNow offer for eSigning ear 14 forms?

airSlate SignNow provides a seamless eSigning solution that allows users to sign ear 14 forms electronically. This feature eliminates the need for physical mailing, making the process faster and more efficient. With customizable templates and user-friendly tools, you can easily manage and track your documents.

-

Is there a cost associated with using airSlate SignNow for eSigning ear 14 forms?

Yes, airSlate SignNow offers various pricing plans based on your business needs. There are options for individuals, small teams, and larger organizations, ensuring flexibility and affordability. The cost may vary depending on the features you choose for managing documents like ear 14 forms.

-

How does airSlate SignNow integrate with other tools for managing ear 14 forms?

airSlate SignNow provides integration with numerous third-party applications, enhancing the efficiency of managing ear 14 forms. You can connect it with CRMs, document storage services, and productivity tools, allowing for smoother workflows. This integration helps in streamlining your signing process.

-

What are the benefits of using airSlate SignNow compared to traditional methods for ear 14 forms?

The primary benefits of using airSlate SignNow for ear 14 forms include time savings and enhanced security. Unlike traditional mailing methods, eSigning allows for quicker turnaround and tracking of documents. Additionally, it reduces the risk of lost paperwork and ensures compliance with legal standards.

-

Can I access airSlate SignNow on mobile devices for signing ear 14 forms?

Yes, airSlate SignNow is mobile-friendly and can be accessed on various devices, including smartphones and tablets. This flexibility allows you to sign ear 14 forms anytime and anywhere. The mobile app is designed for ease of use, making document management convenient.

-

What customer support options are available if I have questions about mailing ear 14 forms?

airSlate SignNow offers robust customer support through various channels, including live chat, email, and phone support. If you have questions about where to mail ear 14 forms or any other issues, their support team is ready to assist you. Comprehensive resources are also available in their help center.

Get more for Form Ear 14

- Ged transcripts ga form

- O cial transcript request western kentucky university form

- Transcript request pdffiller on line pdf form filler

- Crosby tugs application fill online printable fillable blank form

- Cattle raisers texas and southwestern cattle raisers form

- 2020 di mens basketball official printable bracket 2020 ncaa march madness first four mens division 1 basketball printable form

- Note this form is used by a residential property manager or landlord when the landlord is terminating a month tomonth rental

- Wiva student ampamp parent handbook wisconsin virtual academy form

Find out other Form Ear 14

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document