The Debt Snowball Worksheet Answer Key Form

What is the debt snowball worksheet answer key

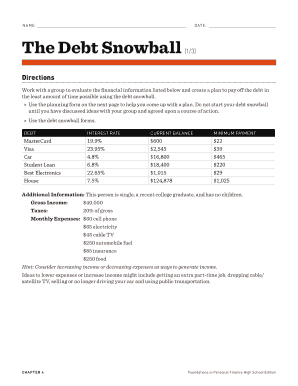

The debt snowball worksheet answer key serves as a guide for individuals using the debt snowball method to manage and eliminate their debts. This method involves listing debts from smallest to largest and focusing on paying off the smallest debt first while making minimum payments on larger debts. The answer key provides solutions and insights for completing the worksheet accurately, helping users track their progress and stay motivated throughout the debt repayment process.

How to use the debt snowball worksheet answer key

To effectively use the debt snowball worksheet answer key, begin by gathering all relevant financial information, including the total amount owed on each debt, minimum monthly payments, and interest rates. Fill out the debt snowball worksheet by listing these debts in order from smallest to largest. Refer to the answer key to verify your calculations and ensure that you are following the correct steps. This will help you stay organized and focused on your goal of becoming debt-free.

Steps to complete the debt snowball worksheet answer key

Completing the debt snowball worksheet involves several key steps:

- List all debts, including credit cards, loans, and any other outstanding balances.

- Organize the debts from smallest to largest based on the total amount owed.

- Determine the minimum payment for each debt and ensure it is included in your budget.

- Focus on paying off the smallest debt first while maintaining minimum payments on larger debts.

- Use the answer key to check your calculations and verify that you are following the correct repayment strategy.

Legal use of the debt snowball worksheet answer key

The debt snowball worksheet answer key is legally valid when used appropriately in the context of personal finance management. Users must ensure that the information provided is accurate and reflective of their actual debts. While the worksheet itself does not require legal validation, maintaining accurate records of payments and communications with creditors is essential for legal purposes, especially if disputes arise.

Key elements of the debt snowball worksheet answer key

Key elements of the debt snowball worksheet answer key include:

- A comprehensive list of all debts categorized by amount.

- Minimum payment amounts for each debt.

- Strategies for prioritizing payments based on the debt snowball method.

- Progress tracking to visualize debt reduction over time.

- Motivational reminders to encourage persistence in the repayment journey.

Examples of using the debt snowball worksheet answer key

Examples of using the debt snowball worksheet answer key can illustrate how individuals can apply this method to their financial situations. For instance, a person with three debts totaling two thousand dollars, five thousand dollars, and eight thousand dollars can focus on the two thousand dollar debt first. By allocating extra funds toward this debt while making minimum payments on the others, they can achieve a sense of accomplishment and motivation as they pay off each debt in succession.

Quick guide on how to complete the debt snowball worksheet answer key

Effortlessly Prepare The Debt Snowball Worksheet Answer Key on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Manage The Debt Snowball Worksheet Answer Key across any platform with the airSlate SignNow apps for Android or iOS, and enhance your document-driven processes today.

How to Edit and eSign The Debt Snowball Worksheet Answer Key with Ease

- Obtain The Debt Snowball Worksheet Answer Key and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight key sections of your documents or obscure sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign The Debt Snowball Worksheet Answer Key while ensuring excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the debt snowball worksheet answer key

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the debt snowball answer key?

The debt snowball answer key is a financial strategy that helps individuals pay off their debts by targeting the smallest debts first. This method not only simplifies debt repayment but also boosts motivation through quick wins. By focusing on the debt snowball answer key, you can achieve financial freedom systematically.

-

How can airSlate SignNow assist with the debt snowball answer key?

airSlate SignNow can facilitate the implementation of the debt snowball answer key by providing easy-to-use eSigning solutions for necessary financial documents. Whether it's loan agreements or budget plans, SignNow streamlines the process, ensuring that both signing and sharing happen in a secure, efficient way.

-

What features make airSlate SignNow suitable for managing the debt snowball answer key?

The key features of airSlate SignNow that support the debt snowball answer key include customizable templates, workflow automation, and secure document storage. These features simplify document preparation and enhance tracking of payment schedules, thereby enhancing your debt management process.

-

Is there a cost associated with using airSlate SignNow to manage the debt snowball answer key?

Yes, there are pricing plans for airSlate SignNow that cater to different business needs. Users can choose from various plans depending on their document management requirements while utilizing the debt snowball answer key effectively. Each plan is designed to provide value, ensuring that managing your debt is cost-effective.

-

Can I integrate airSlate SignNow with other tools to help with the debt snowball answer key?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to implement the debt snowball answer key. Whether you need to connect with financial software or CRM systems, these integrations allow you to maintain all your debt management processes in one place.

-

What are the benefits of using airSlate SignNow alongside the debt snowball answer key?

Using airSlate SignNow in conjunction with the debt snowball answer key allows for quicker document processing and streamlined communication with creditors. The efficiency gained can lead to better financial management and more focus on paying off debts. Plus, it simplifies the eSigning process for quicker resolutions.

-

How does airSlate SignNow ensure the security of documents related to the debt snowball answer key?

AirSlate SignNow uses advanced encryption and security protocols to protect all documents, including those related to the debt snowball answer key. Users can confidently eSign and share sensitive information knowing that their data is secure and compliant with industry standards.

Get more for The Debt Snowball Worksheet Answer Key

- Representativeagent commission invoice uc santa barbara form

- Florida residency for form

- Requestor instructions form

- Information technology management checklist

- Fabrication services agreement n0014111doc1 form

- Search results for tuition ampamp coststhe university of tulsa form

- Research faculty appointment action request form

- Visiting scholar plan brochure and forms northwesternedu

Find out other The Debt Snowball Worksheet Answer Key

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template