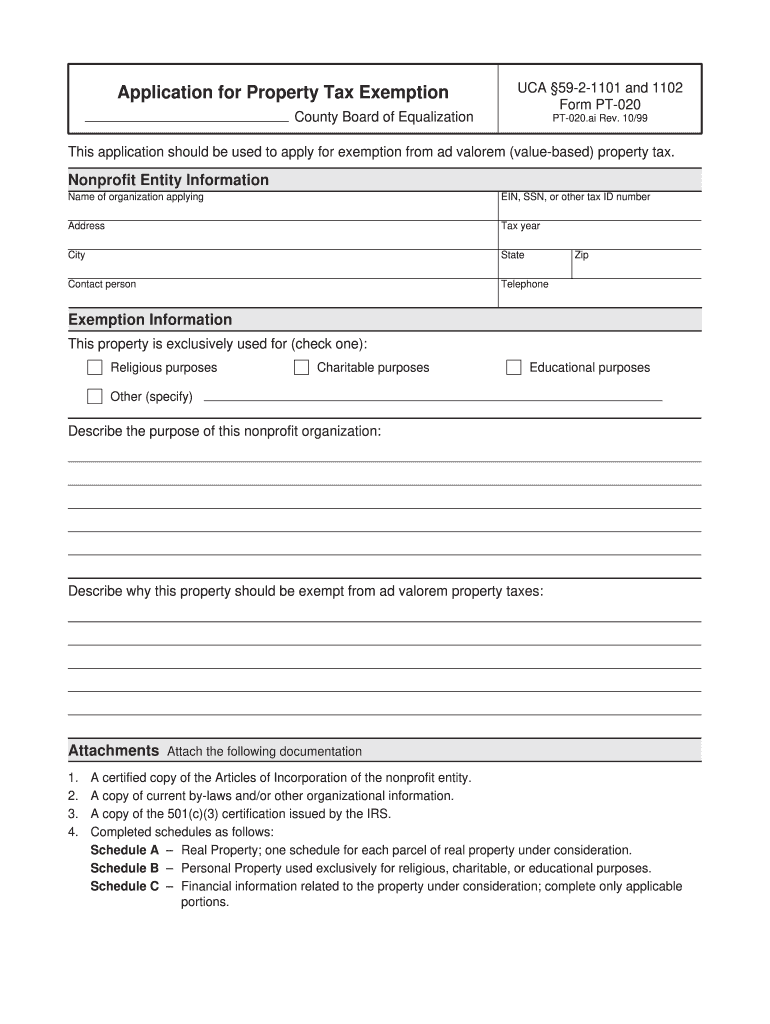

Application for Property Tax Exemption County Board of Equalization UCA 59 2 1101 and 1102 Form PT 020 PT 020 Propertytax Utah 1999-2026

Understanding the Utah Property Tax Exemption Application

The Utah form property exemption, also known as the Application for Property Tax Exemption, is designed for individuals seeking to reduce their property tax liability. This form is essential for those who qualify under specific criteria, such as primary residential exemptions or personal property exemptions. Understanding the purpose of this form is crucial for ensuring compliance with state regulations and maximizing potential tax benefits.

Steps to Complete the Property Tax Exemption Application

Completing the Utah form property exemption involves several key steps:

- Gather necessary documentation, including proof of residency and ownership.

- Carefully fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or missing information before submission.

- Submit the completed form to the appropriate county office by the specified deadline.

Eligibility Criteria for Property Tax Exemption

To qualify for the Utah property tax exemption, applicants must meet specific eligibility criteria. These may include:

- Ownership of the property for which the exemption is sought.

- Use of the property as a primary residence.

- Meeting income limits or other financial criteria set by the state.

It is important to review these criteria carefully to ensure that your application is valid and stands a good chance of approval.

Required Documents for Submission

When applying for the property tax exemption in Utah, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of property ownership, such as a deed or title.

- Financial documents that demonstrate eligibility, such as tax returns or income statements.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The Utah form property exemption can be submitted through various methods, including:

- Online submission via the state’s tax website.

- Mailing the completed form to the appropriate county office.

- In-person submission at designated county offices.

Each method has its own advantages, so choose the one that best fits your needs and circumstances.

Approval Time for Property Tax Exemption Applications

After submitting the Utah form property exemption, applicants can expect a varying approval time depending on the county's processing speed. Generally, it may take several weeks to a few months to receive a decision. It is advisable to follow up with the county office if you have not received any communication regarding your application status.

Quick guide on how to complete application for property tax exemption county board of equalization uca 59 2 1101 and 1102 form pt 020 pt 020 propertytax utah

Your assistance manual on preparing your Application For Property Tax Exemption County Board Of Equalization UCA 59 2 1101 And 1102 Form PT 020 PT 020 Propertytax Utah

If you are interested in learning how to finalize and submit your Application For Property Tax Exemption County Board Of Equalization UCA 59 2 1101 And 1102 Form PT 020 PT 020 Propertytax Utah, below are a few brief directions on how to make tax submission considerably simpler.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an intuitive and robust document solution that enables you to modify, draft, and finalize your tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and electronic signatures, and you can return to alter any responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to complete your Application For Property Tax Exemption County Board Of Equalization UCA 59 2 1101 And 1102 Form PT 020 PT 020 Propertytax Utah in just a few minutes:

- Create your account and begin handling PDFs in moments.

- Utilize our catalog to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Application For Property Tax Exemption County Board Of Equalization UCA 59 2 1101 And 1102 Form PT 020 PT 020 Propertytax Utah in our editor.

- Fill in the essential fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding electronic signature (if necessary).

- Examine your document and correct any discrepancies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return mistakes and delay reimbursements. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for property tax exemption county board of equalization uca 59 2 1101 and 1102 form pt 020 pt 020 propertytax utah

How to make an electronic signature for your Application For Property Tax Exemption County Board Of Equalization Uca 59 2 1101 And 1102 Form Pt 020 Pt 020 Propertytax Utah in the online mode

How to make an eSignature for the Application For Property Tax Exemption County Board Of Equalization Uca 59 2 1101 And 1102 Form Pt 020 Pt 020 Propertytax Utah in Chrome

How to generate an electronic signature for signing the Application For Property Tax Exemption County Board Of Equalization Uca 59 2 1101 And 1102 Form Pt 020 Pt 020 Propertytax Utah in Gmail

How to generate an eSignature for the Application For Property Tax Exemption County Board Of Equalization Uca 59 2 1101 And 1102 Form Pt 020 Pt 020 Propertytax Utah from your smart phone

How to generate an eSignature for the Application For Property Tax Exemption County Board Of Equalization Uca 59 2 1101 And 1102 Form Pt 020 Pt 020 Propertytax Utah on iOS devices

How to make an electronic signature for the Application For Property Tax Exemption County Board Of Equalization Uca 59 2 1101 And 1102 Form Pt 020 Pt 020 Propertytax Utah on Android

People also ask

-

What is the Utah form property exemption?

The Utah form property exemption is a legal process that allows eligible property owners to exempt their primary residence from certain property taxes. This exemption can signNowly reduce tax liabilities for homeowners, making it an essential resource for those looking to manage their finances effectively. Understanding the requirements and application process for the Utah form property exemption is crucial for potential claimants.

-

How can airSlate SignNow help with the Utah form property exemption application?

AirSlate SignNow offers a streamlined solution for completing and submitting applications for the Utah form property exemption. With our intuitive eSigning features, users can easily fill out, sign, and send documents securely from any device. This eliminates the hassle of paperwork and ensures that your application is processed quickly.

-

What are the costs associated with obtaining a Utah form property exemption?

The costs to obtain a Utah form property exemption may vary based on local tax regulations, but generally there are no fees for the application itself. However, it's advisable to review local guidelines for any applicable fees or documentation costs. Utilizing airSlate SignNow can further reduce costs by providing a cost-effective solution for managing your forms.

-

Are there specific eligibility criteria for the Utah form property exemption?

Yes, there are specific eligibility criteria for the Utah form property exemption, which typically include age, income levels, and ownership status of the property. Homeowners must generally occupy the property as their primary residence to qualify. For detailed requirements, it's recommended to check with local tax authorities or consult the airSlate SignNow resources.

-

What features does airSlate SignNow provide for the Utah form property exemption process?

AirSlate SignNow provides several features that facilitate the Utah form property exemption process. Key features include customizable templates, eSignature capabilities, and real-time tracking of document status. These tools not only save time but also enhance the accuracy and efficiency of the application process.

-

Can I integrate airSlate SignNow with other tools for managing the Utah form property exemption?

Yes, airSlate SignNow offers integrations with various applications that enhance the management of the Utah form property exemption. You can connect it with tools like Salesforce, Google Drive, and Dropbox to streamline your document workflow. This integration ensures a seamless experience when handling your property exemption documentation.

-

What are the benefits of using airSlate SignNow for my Utah form property exemption?

Using airSlate SignNow for your Utah form property exemption offers numerous benefits, including saving time and reducing paper waste. The eSigning process is secure and legally binding, ensuring that your application is not just quick but also compliant with laws. Plus, our user-friendly interface makes it easy for anyone to navigate.

Get more for Application For Property Tax Exemption County Board Of Equalization UCA 59 2 1101 And 1102 Form PT 020 PT 020 Propertytax Utah

Find out other Application For Property Tax Exemption County Board Of Equalization UCA 59 2 1101 And 1102 Form PT 020 PT 020 Propertytax Utah

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later