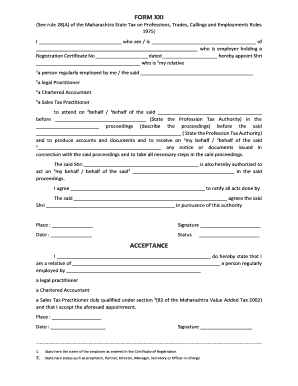

Form Xxi U R 28 a

What is the Form XXI U R 28 A

The Form XXI U R 28 A is a specific document used for professional tax purposes in certain states, particularly in Maharashtra. This form is essential for individuals and businesses to declare their income and calculate their professional tax liability. It serves as a formal declaration to the tax authorities, ensuring compliance with local tax regulations. Understanding the purpose and requirements of this form is crucial for anyone subject to professional tax obligations.

Steps to Complete the Form XXI U R 28 A

Completing the Form XXI U R 28 A involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and income statements. Next, accurately fill in the required fields, ensuring that all figures are correct. Pay special attention to the calculation of professional tax based on your income bracket. After completing the form, review it for any errors before submission. Finally, ensure that you sign the form electronically if submitting online, or provide a physical signature if mailing it.

Legal Use of the Form XXI U R 28 A

The legal use of the Form XXI U R 28 A is governed by state tax laws, which outline the obligations of taxpayers. This form must be filled out accurately to avoid penalties and ensure that the information provided is legally binding. Compliance with eSignature regulations is also vital, as electronic submissions must meet specific legal standards to be considered valid. Utilizing a reliable eSigning platform can help ensure that your submission adheres to these legal requirements.

Required Documents for the Form XXI U R 28 A

When preparing to fill out the Form XXI U R 28 A, certain documents are necessary to support your application. These typically include proof of identity, such as a driver's license or social security number, and documentation of income, such as pay stubs or tax returns. Additionally, any previous professional tax payment receipts may be required. Having these documents ready will streamline the completion process and help ensure that you provide all necessary information.

Form Submission Methods

The Form XXI U R 28 A can be submitted through various methods, catering to different preferences and needs. Individuals may choose to submit the form online via an authorized e-filing platform, which often provides a more efficient process. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its own guidelines, so it is important to follow the specific instructions provided for the chosen submission method.

Examples of Using the Form XXI U R 28 A

Practical examples of using the Form XXI U R 28 A can help clarify its application. For instance, a self-employed individual may use this form to report their earnings and calculate their professional tax liability for the year. Similarly, a small business owner must complete this form to comply with local tax regulations and ensure that their employees' professional tax is accurately reported. These scenarios illustrate the importance of the form in various professional contexts.

Quick guide on how to complete form xxi u r 28 a

Effortlessly prepare Form Xxi U R 28 A on any device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Form Xxi U R 28 A on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based process today.

How to modify and electronically sign Form Xxi U R 28 A with ease

- Find Form Xxi U R 28 A and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or missing files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form Xxi U R 28 A and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form xxi u r 28 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form XXI profession tax?

The form XXI profession tax is a document required by certain jurisdictions to report and pay taxes related to specific professions. It ensures compliance with local tax regulations and helps professionals avoid penalties. Using airSlate SignNow, you can easily manage and eSign this form, streamlining your tax filing process.

-

How can airSlate SignNow help with the form XXI profession tax?

AirSlate SignNow simplifies the process of completing and submitting the form XXI profession tax by allowing users to fill out the form electronically. This reduces the risk of errors and ensures that all necessary information is accurately provided. With our eSigning feature, you can quickly sign and send your tax forms without hassle.

-

Is there a cost associated with using airSlate SignNow for the form XXI profession tax?

Yes, airSlate SignNow offers several pricing plans depending on your business needs. Each plan provides access to features that make handling the form XXI profession tax more efficient, including unlimited document signing and storage. You can choose a plan that suits your budget while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing tax forms?

AirSlate SignNow includes features like customizable templates, eSigning, and seamless document storage that are beneficial for managing tax forms like the form XXI profession tax. In addition, our platform allows for easy collaboration and sharing, ensuring that all stakeholders can access the necessary documents. These features can signNowly simplify your tax preparation efforts.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation, including the form XXI profession tax, provides a fast and secure method to manage important paperwork. Our user-friendly interface makes it easy for anyone to navigate and complete forms quickly. Plus, our electronic signing capabilities save time and enhance the overall efficiency of your tax filing.

-

Can airSlate SignNow integrate with other software for filing the form XXI profession tax?

Yes, airSlate SignNow offers integrations with various software tools that can support the filing of the form XXI profession tax. This allows you to streamline your workflow by connecting to accounting software, project management tools, and more. These integrations ensure that you have a seamless experience when handling your tax documents.

-

Is airSlate SignNow compliant with legal requirements for tax forms?

Absolutely! AirSlate SignNow is designed to meet legal compliance standards for electronic signatures and document handling. When it comes to filing the form XXI profession tax, you can have peace of mind knowing that our platform adheres to all necessary regulations and allows for secure document management.

Get more for Form Xxi U R 28 A

- Uscg overseasremote duty screening process med navy form

- Octc intake referral form ottawa childrens treatment centre octc

- Dramaturgy for little shop of horrors form

- Legionella environmental assessment form legionella environmental assessment form cdc

- Hsa trustee or custodian form

- Tobii pro glasses 2 software development kit and api form

- Pdf download graphic design the new basics second edition revised and expanded by ellen lupton jennifer cole phillips full form

- 2018 form 593 v payment voucher for real franchise tax

Find out other Form Xxi U R 28 A

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe