Dmna Form 86e 2014

What is the Dmna Form 86e

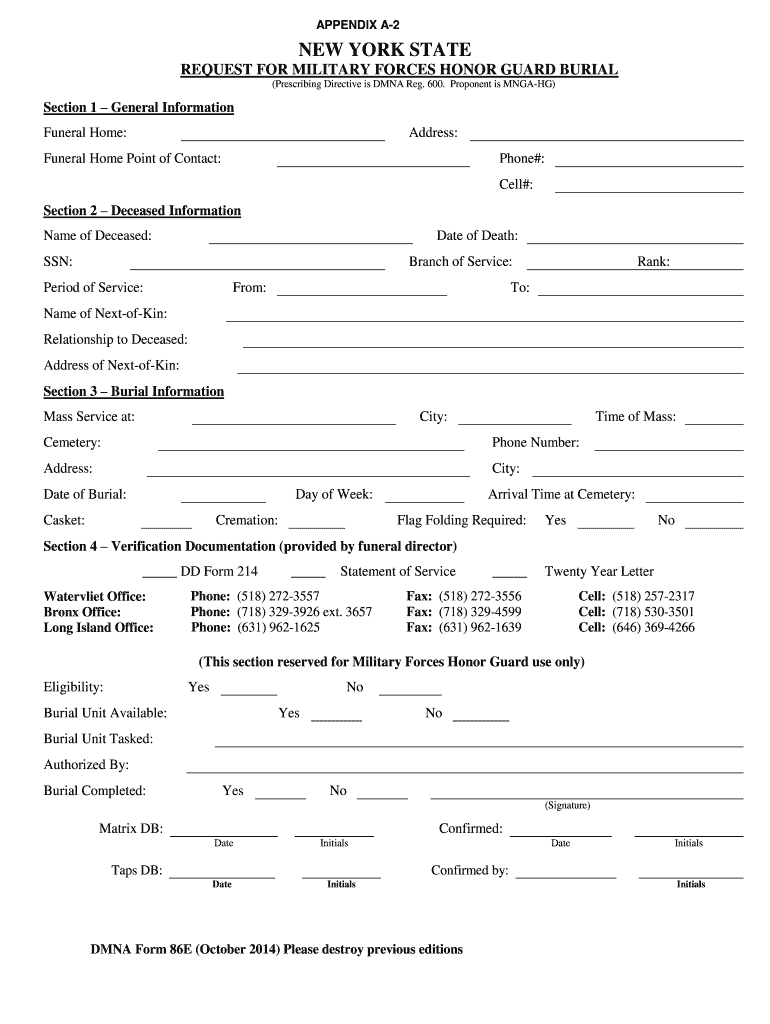

The Dmna Form 86e is a document utilized within the New York State Division of Military and Naval Affairs. This form is primarily designed for individuals seeking to apply for a variety of military-related benefits or services. It serves as a formal request for assistance or resources from the state’s military division, ensuring that applicants can access necessary support.

How to use the Dmna Form 86e

Using the Dmna Form 86e involves several straightforward steps. First, individuals must obtain the form, which can typically be found on the official New York State Division of Military and Naval Affairs website. Once the form is in hand, applicants should carefully read the instructions provided. Completing the form accurately is crucial, as it ensures that the request is processed efficiently. After filling out the required information, the form can be submitted according to the specified methods, which may include online submission or mailing it to the appropriate office.

Steps to complete the Dmna Form 86e

Completing the Dmna Form 86e requires attention to detail. Here are the essential steps:

- Download or obtain a physical copy of the Dmna Form 86e.

- Read the instructions carefully to understand the requirements.

- Fill in personal information, including name, address, and contact details.

- Provide any necessary supporting documentation as specified.

- Review the completed form for accuracy and completeness.

- Submit the form via the designated method, ensuring it reaches the appropriate office.

Legal use of the Dmna Form 86e

The legal use of the Dmna Form 86e is governed by state regulations. This form is recognized as a valid document when filled out correctly and submitted according to the guidelines set forth by the New York State Division of Military and Naval Affairs. It is essential for applicants to ensure compliance with all legal requirements to avoid any potential issues with their requests.

Key elements of the Dmna Form 86e

Key elements of the Dmna Form 86e include:

- Applicant Information: Full name, address, and contact details.

- Purpose of Request: A clear statement of the benefits or services being requested.

- Supporting Documentation: Any required documents that substantiate the request.

- Signature: A signature affirming the accuracy of the information provided.

Form Submission Methods

The Dmna Form 86e can be submitted through various methods, depending on the preferences of the applicant. Common submission methods include:

- Online Submission: If available, this method allows for a quick and efficient process.

- Mail: Applicants can print the completed form and send it to the appropriate address.

- In-Person Submission: Some individuals may prefer to deliver the form directly to a local office.

Quick guide on how to complete dmna new york state dmna ny

Effortlessly Prepare Dmna Form 86e on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Dmna Form 86e on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to Edit and eSign Dmna Form 86e with Ease

- Find Dmna Form 86e and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a standard handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Dmna Form 86e to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dmna new york state dmna ny

FAQs

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

How do I report Form 1042 S for New York State Tax on their website https://tax.ny.gov/?

Just give a call to the Personal Income Tax Information Center at 518-457-5181.They will ask you to report it as W-2 and attach scanned copy of your 1042-S. They will also make a note about that is how they asked you to report it.So, dont just report 1042-S as W-2. Give them a call first.

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Should a resident of New York register their business in Delaware? The business will operate in NY before rolling out to other states.

Delaware native here!“Register” is a misleading term. Do you mean form your business in Delaware? That is usually when Delaware comes up — forming an entity (whether an LLC, a partnership, or a C Corporation) is fast and cheap in Delaware, especially compared to New York.It doesn’t really matter where you do business or when you’re rolling out to other states. The two most important things to consider in formation:The difficulty and expense of formation (annual taxes and filings due), andThe laws of the state that will govern your entity.Your business only becomes “a company” or “a corporation” because it is duly recognized as such under the laws of a state. Those laws (and the mechanism for disputes that occur under those laws) are different in every state.I have never heard a single argument for why New York is preferable to Delaware in either of those cases, and when I lived in New York, I filed for our company’s formation in Delaware. I’m in Texas today but happily pay Delaware’s annual franchise tax of $300.This is different than “registering,” which you may need to do as a foreign entity doing business or employing people in one or more stats. This definition (usually tied to a term like “nexus”) varies by state and it depends on the activity you’re engaged in. You may have to collect sales tax. You may have to provide worker’s comp. You may have to withhold employee taxes. The key distinction here is that you register when you have to do so because some activity you’re engaged in triggers the requirement. But you choose where you form your entity and it really doesn’t have a lot to do with your location.

Create this form in 5 minutes!

How to create an eSignature for the dmna new york state dmna ny

How to create an eSignature for your Dmna New York State Dmna Ny in the online mode

How to generate an eSignature for the Dmna New York State Dmna Ny in Google Chrome

How to create an eSignature for putting it on the Dmna New York State Dmna Ny in Gmail

How to generate an electronic signature for the Dmna New York State Dmna Ny from your mobile device

How to create an eSignature for the Dmna New York State Dmna Ny on iOS devices

How to generate an electronic signature for the Dmna New York State Dmna Ny on Android devices

People also ask

-

What is the dmna form 86e?

The dmna form 86e is a specific document used by the New York State Division of Military and Naval Affairs for various administrative purposes. This form is essential for personnel management and ensures compliance with military regulations.

-

How can I fill out the dmna form 86e using airSlate SignNow?

Filling out the dmna form 86e with airSlate SignNow is straightforward. You can upload the document directly to the platform, use our intuitive editor to fill in the required fields, and then eSign to complete the process quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the dmna form 86e?

Yes, airSlate SignNow offers various pricing plans based on your business needs. Each plan includes features that simplify the management and eSigning of documents like the dmna form 86e, ensuring that you receive excellent value regardless of your choice.

-

What are the benefits of using airSlate SignNow for the dmna form 86e?

Using airSlate SignNow for the dmna form 86e provides numerous benefits, including increased efficiency, easy collaboration, and secure document management. It simplifies the signing process and allows for faster execution, which is essential in military and administrative contexts.

-

Can I integrate airSlate SignNow with other applications for handling the dmna form 86e?

Absolutely! airSlate SignNow offers seamless integrations with many popular applications, which allow you to manage the dmna form 86e and other documents efficiently. Integrations with tools like Google Drive and Dropbox enhance convenience and workflow.

-

Is it safe to use airSlate SignNow for the dmna form 86e?

Yes, airSlate SignNow prioritizes the security of your documents, including the dmna form 86e. The platform employs advanced encryption methods and complies with industry standards to ensure that your sensitive information is protected at all times.

-

What features does airSlate SignNow provide for managing the dmna form 86e?

airSlate SignNow provides a variety of features for managing the dmna form 86e, including customizable templates, automated workflows, and real-time tracking. These features help streamline the documentation process and enhance operational efficiency.

Get more for Dmna Form 86e

Find out other Dmna Form 86e

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT