North Carolina Income Tax Form

Understanding North Carolina Income Tax

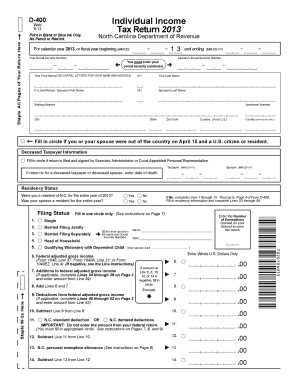

The North Carolina income tax is a tax imposed on the income of individuals and businesses within the state. This tax is calculated based on the taxpayer's taxable income, which includes wages, salaries, and other forms of income. The state employs a flat tax rate, meaning that all taxpayers pay the same percentage of their income, regardless of their income level. Understanding the specifics of this tax is essential for compliance and effective financial planning.

Steps to Complete the North Carolina Income Tax

Completing the North Carolina income tax forms involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, determine your filing status, as this will affect your tax rate and deductions. After that, fill out the appropriate forms, such as the D-400 for individual income tax. Ensure that you accurately report all income and claim any deductions or credits you may qualify for. Finally, review your completed forms for accuracy before submitting them to the North Carolina Department of Revenue.

Required Documents for Filing

When preparing to file your North Carolina income tax, it is important to have the following documents ready:

- W-2 forms from all employers

- 1099 forms for any freelance or contract work

- Records of other income, such as rental income or dividends

- Documentation for deductions, including mortgage interest statements and medical expenses

- Any previous year tax returns for reference

Having these documents organized will streamline the filing process and help ensure that you do not miss any important information.

Filing Deadlines for North Carolina Income Tax

Filing deadlines for the North Carolina income tax typically align with federal tax deadlines. Individual taxpayers must file their returns by April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these dates to avoid penalties and interest on unpaid taxes.

Legal Use of North Carolina Income Tax Forms

The legal use of North Carolina income tax forms is governed by state tax laws. To ensure compliance, taxpayers must use the forms as intended and provide accurate information. E-signatures are accepted on these forms, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a reliable digital platform can help ensure that your e-signatures are secure and legally binding.

Form Submission Methods

Taxpayers in North Carolina have several options for submitting their income tax forms. These methods include:

- Online submission through the North Carolina Department of Revenue's e-file system

- Mailing paper forms to the designated address

- In-person submissions at local tax offices

Choosing the right method can depend on personal preference and the complexity of the tax situation.

Examples of Using North Carolina Income Tax Forms

North Carolina income tax forms can be used in various scenarios, including:

- Filing as a single taxpayer with standard deductions

- Claiming credits for education expenses

- Reporting income from self-employment

Understanding how to properly use these forms in different contexts can help taxpayers maximize their refunds and ensure compliance with state tax laws.

Quick guide on how to complete north carolina income tax

Complete North Carolina Income Tax with ease on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage North Carolina Income Tax on any device via airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to edit and electronically sign North Carolina Income Tax effortlessly

- Locate North Carolina Income Tax and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Don’t worry about lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in a few clicks from your preferred device. Modify and electronically sign North Carolina Income Tax and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north carolina income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are printable tax forms and how can airSlate SignNow help?

Printable tax forms are documents used for filing taxes, which can be filled out and printed for submission. airSlate SignNow makes it easy to create, edit, and eSign these forms, ensuring that you have a seamless process for your tax-related needs.

-

Are there any costs associated with using airSlate SignNow for printable tax forms?

Yes, airSlate SignNow offers various pricing plans based on your business needs. Our cost-effective solutions provide access to features designed to streamline the creation and management of printable tax forms, ensuring value for your investment.

-

Can I use airSlate SignNow to fill out IRS printable tax forms?

Absolutely! With airSlate SignNow, you can easily fill out IRS printable tax forms online and then download or print them for submission. This simplifies the process, allowing you to handle your tax forms efficiently.

-

What features does airSlate SignNow provide for managing printable tax forms?

airSlate SignNow offers features such as eSigning, document templates, and integration with various applications that enhance your experience with printable tax forms. These features ensure you can create and manage your documents effortlessly.

-

Is it easy to integrate airSlate SignNow with my existing software for printable tax forms?

Yes, airSlate SignNow is designed to integrate seamlessly with your existing software. Whether you use accounting software or cloud storage, our platform accommodates connections for managing your printable tax forms.

-

How secure is my data when using airSlate SignNow for printable tax forms?

Data security is a top priority at airSlate SignNow. We implement industry-standard encryption and security measures to protect your sensitive information while you create or manage printable tax forms.

-

Can I send printable tax forms for eSigning to others?

Yes, you can easily send printable tax forms to others for eSigning through airSlate SignNow. Our user-friendly platform allows you to specify recipients and track the signing process, making it simple to finalize your documents.

Get more for North Carolina Income Tax

Find out other North Carolina Income Tax

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile