Ftb 3701 Form

What is the FTB 3701

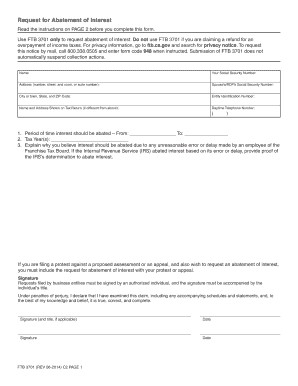

The FTB 3701 form, also known as the California Nonresident or Part-Year Resident Income Tax Return, is a crucial document for individuals who earn income in California but do not reside there full-time. This form allows nonresidents and part-year residents to report their California-source income and calculate their tax liability accurately. It is essential for ensuring compliance with California tax laws, as it helps determine the appropriate amount of tax owed based on the income earned within the state.

How to use the FTB 3701

Using the FTB 3701 form involves several steps to ensure accurate reporting of income. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements related to your California earnings. Next, complete the form by accurately reporting your income, deductions, and credits. Ensure that you follow the instructions carefully, as errors can lead to delays or penalties. Once completed, you can submit the form either electronically or by mail, depending on your preference and eligibility.

Steps to complete the FTB 3701

Completing the FTB 3701 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income earned in California, along with any deductions you may qualify for.

- Calculate your tax liability based on the provided instructions.

- Review your completed form for accuracy before submission.

Legal use of the FTB 3701

The legal use of the FTB 3701 form is governed by California tax regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to legal consequences. The form must be filed by the designated deadline to avoid penalties. Additionally, utilizing a reliable eSignature platform, like airSlate SignNow, can enhance the security and legality of the document submission process, ensuring compliance with relevant electronic signature laws.

Key elements of the FTB 3701

Several key elements are vital to understanding the FTB 3701 form. These include:

- Income Reporting: Accurate reporting of all California-source income.

- Deductions: Identification of eligible deductions that can reduce taxable income.

- Filing Status: Selection of the appropriate filing status based on residency and income.

- Signature: A valid signature or eSignature is required to authenticate the form.

Form Submission Methods

The FTB 3701 form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Eligible taxpayers can file electronically through the California Franchise Tax Board's website.

- Mail: Completed forms can be sent via postal mail to the designated address provided in the instructions.

- In-Person: Some individuals may choose to submit their forms in person at designated tax offices, if available.

Quick guide on how to complete ftb 3701

Effortlessly prepare Ftb 3701 on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Ftb 3701 on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly modify and electronically sign Ftb 3701

- Find Ftb 3701 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specially designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, be it through email, SMS, or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors necessitating new printed copies. airSlate SignNow caters to all your document management needs in a few clicks from any device you choose. Edit and electronically sign Ftb 3701 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 3701

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 3701 form and why do I need it?

The ftb 3701 form is specifically used for California taxpayers to report financial transaction information. Completing the ftb 3701 form accurately is crucial for compliance and can impact your tax returns positively. Using airSlate SignNow can streamline this process, allowing you to eSign and submit the form efficiently.

-

How can airSlate SignNow help me with the ftb 3701 form?

With airSlate SignNow, you can easily fill out and eSign the ftb 3701 form in a digital format, saving you time and resources. Our platform provides templates and guidance to ensure all required information is included, making your filing experience seamless. Additionally, you can track the status of your submissions directly through our user-friendly interface.

-

Is there a cost associated with using airSlate SignNow for the ftb 3701 form?

AirSlate SignNow offers competitive pricing tailored to businesses of all sizes, which includes features for completing the ftb 3701 form. There are various subscription plans that cater to different needs, ensuring you find a cost-effective solution. We also provide a free trial, allowing you to explore our tools before committing.

-

Are there specific features in airSlate SignNow that support the ftb 3701 form preparation?

Yes, airSlate SignNow features tools that enhance the preparation of the ftb 3701 form, including document templates and eSignature capabilities. Our software facilitates collaboration, allowing multiple stakeholders to review and eSign the document efficiently. This ensures your forms are completed correctly and submitted on time.

-

Can I integrate airSlate SignNow with other applications while working on the ftb 3701 form?

Absolutely! AirSlate SignNow offers integrations with various applications, such as Google Drive, Dropbox, and CRM systems. This allows you to import data related to the ftb 3701 form easily, ensuring all information is consistent across platforms and reducing the likelihood of errors.

-

How secure is my information when using airSlate SignNow for the ftb 3701 form?

Security is a priority at airSlate SignNow. When you're working on the ftb 3701 form, your data is protected with advanced encryption and secure storage protocols. We implement industry-standard security measures to ensure that your sensitive information remains confidential throughout the eSigning process.

-

What benefits can I expect from using airSlate SignNow for the ftb 3701 form?

Using airSlate SignNow for the ftb 3701 form offers numerous benefits, including increased efficiency and reduced paper waste. The eSigning process eliminates the need to print physical documents, streamlining the overall administration of your tax affairs. Users often report signNow time savings, allowing them to focus on other important tasks.

Get more for Ftb 3701

- Right to information department of child safety youth and

- Prior learning assessment application form camosun college

- Grievance form opseu newsite opseu

- Printable rent receipt online form

- Canada revenue agency formsrc59 2008

- Isp 1300 form 2010

- Test summary sheet skate canada central ontario form

- Inkomstdeklaration 2 pdf form

Find out other Ftb 3701

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe