941 Form Printable

What is the 941 Form Printable

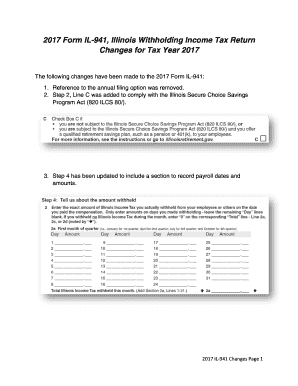

The IL 941 form is a crucial document used by employers in the United States to report income taxes withheld from employees' paychecks, along with the employer's share of Social Security and Medicare taxes. This form is typically submitted quarterly and is essential for maintaining compliance with federal tax regulations. The printable version of the IL 941 form allows businesses to complete and submit their tax information easily, ensuring accurate reporting and timely payment of taxes owed to the Internal Revenue Service (IRS).

How to use the 941 Form Printable

Using the IL 941 form printable involves several steps to ensure accurate completion. First, download the form from a reliable source. Next, gather the necessary financial information, including total wages paid, taxes withheld, and any adjustments. Fill out the form carefully, ensuring that all figures are accurate. Once completed, the form can be printed for submission. Employers can choose to file the form electronically or by mail, depending on their preference and the requirements set by the IRS.

Steps to complete the 941 Form Printable

Completing the IL 941 form requires attention to detail. Follow these steps:

- Download the IL 941 form for the relevant year.

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Report total wages paid to employees during the quarter.

- Calculate and enter the total federal income tax withheld.

- Include the amounts for Social Security and Medicare taxes.

- Make any necessary adjustments for overpayments or corrections.

- Sign and date the form to certify its accuracy.

Legal use of the 941 Form Printable

The IL 941 form is legally binding when completed and submitted correctly. It must be filed according to IRS guidelines to avoid penalties. Employers are required to keep accurate records of all payroll information and tax payments. Failure to file the form on time or inaccuracies in reporting can lead to fines and interest charges. Therefore, understanding the legal implications of this form is essential for compliance and financial responsibility.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the IL 941 form. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for 2017 were as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

It is important to mark these dates on your calendar to ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The IL 941 form can be submitted through various methods. Employers have the option to file electronically via the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be printed and mailed to the appropriate IRS address based on the business's location. In-person submissions are generally not available for this form. Choosing the right method depends on the employer's preference and the need for confirmation of receipt.

Quick guide on how to complete 941 form printable

Complete 941 Form Printable effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow furnishes you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 941 Form Printable on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 941 Form Printable with ease

- Locate 941 Form Printable and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with features specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign 941 Form Printable and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941 form printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 941 form 2017 printable?

The IL 941 form 2017 printable is a tax form used by employers in Illinois to report income tax withheld from employee wages. This form is essential for ensuring that your payroll taxes are submitted accurately and on time. You can easily find a printable version of the IL 941 form for the 2017 tax year through various online resources.

-

How can I access the IL 941 form 2017 printable?

You can access the IL 941 form 2017 printable by visiting the official Illinois Department of Revenue website or by using document management solutions like airSlate SignNow. Our platform offers easy access to essential forms, allowing you to print and fill out the IL 941 form conveniently from your device.

-

Is it free to download the IL 941 form 2017 printable?

Yes, downloading the IL 941 form 2017 printable is typically free from official sources. Additionally, using platforms like airSlate SignNow to manage your document signing and eSigning needs can offer cost-effective solutions for your overall business operations, including tax form management.

-

What are the benefits of using airSlate SignNow for the IL 941 form 2017 printable?

Using airSlate SignNow enhances the process of handling the IL 941 form 2017 printable by allowing you to eSign documents securely online. This not only saves time but also reduces paperwork signNowly. Furthermore, our platform ensures compliance and offers features that make organizing and storing your tax forms easier.

-

Can I edit the IL 941 form 2017 printable before signing?

Yes, with airSlate SignNow, you can easily edit the IL 941 form 2017 printable before signing. Our platform provides powerful document editing tools that allow you to customize the form as needed. This feature ensures you include all necessary information accurately before submission.

-

Does airSlate SignNow integrate with accounting software for the IL 941 form 2017 printable?

Yes, airSlate SignNow offers integration options with various accounting software programs, ensuring seamless management of the IL 941 form 2017 printable within your existing workflows. This integration helps streamline the process of filing taxes and managing payroll. Check our integration page for supported applications.

-

What should I do if I have trouble filling out the IL 941 form 2017 printable?

If you encounter any difficulties while filling out the IL 941 form 2017 printable, consider accessing the user-friendly resources available on the airSlate SignNow platform. We provide tutorials and support to guide you through the process. Additionally, consulting with a tax professional can help clarify any issues.

Get more for 941 Form Printable

Find out other 941 Form Printable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors