Form 01 339

What is the Form 01 339

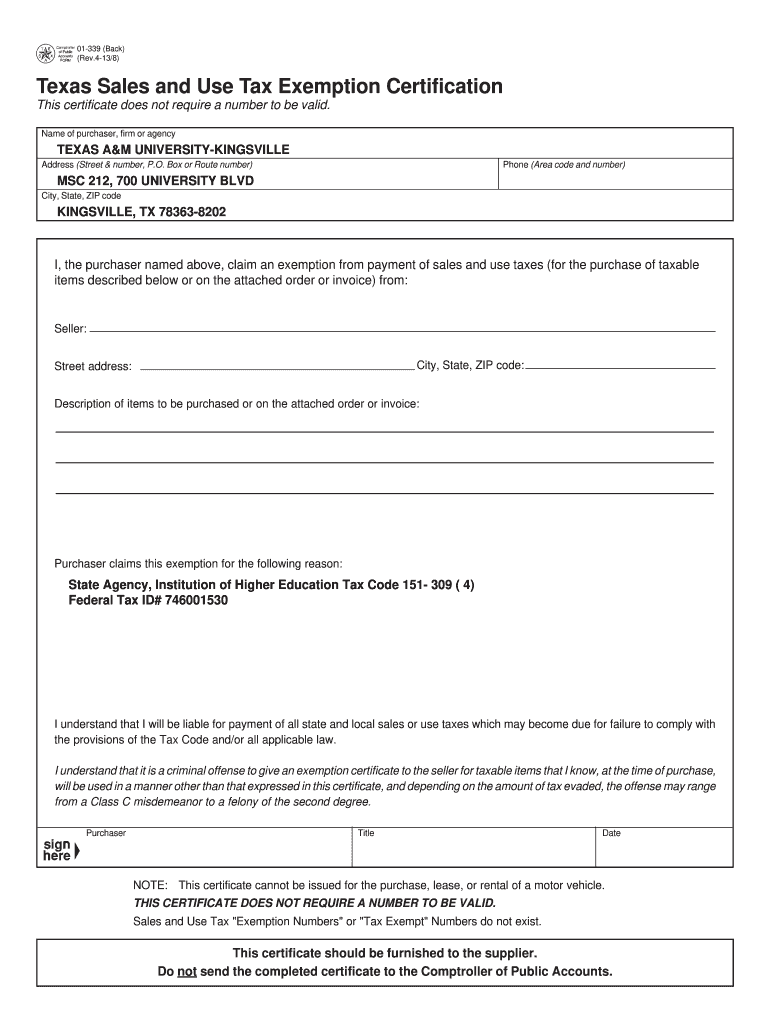

The Texas Sales and Use Tax Exemption Certification Form 01 339 is a legal document used by businesses to claim exemption from sales tax on purchases of tangible personal property or taxable services. This form is primarily utilized by organizations that are purchasing items for resale or for specific exempt purposes, such as non-profit entities. By completing this form, a buyer certifies that the items purchased will not be subject to sales tax, provided they meet the criteria outlined by the Texas Comptroller of Public Accounts.

How to use the Form 01 339

To effectively use the Texas form 01 339, individuals or businesses must first determine their eligibility for tax exemption. This involves understanding the specific categories that qualify for exemption, such as resale or certain non-profit activities. Once eligibility is established, the form should be filled out accurately, including the buyer's information, the seller's details, and a description of the items being purchased. The completed form must then be presented to the seller at the time of purchase to ensure that sales tax is not applied.

Steps to complete the Form 01 339

Completing the Texas sales tax exemption certificate form 01 339 involves several key steps:

- Gather necessary information, including your business name, address, and sales tax permit number.

- Identify the seller's information, including their name and address.

- Provide a detailed description of the items being purchased and their intended use.

- Sign and date the form to certify the information provided is accurate and truthful.

- Submit the completed form to the seller to validate your tax-exempt status during the transaction.

Legal use of the Form 01 339

The legal use of the Texas sales and use tax exemption certification form 01 339 is governed by state tax laws. The form must be filled out correctly to be considered valid. Misuse or fraudulent claims can lead to penalties, including fines and back taxes owed. It is essential for users to understand the legal implications of the form, ensuring that the items purchased truly qualify for exemption under Texas law.

Key elements of the Form 01 339

Key elements of the Texas form 01 339 include:

- Buyer Information: Name, address, and sales tax permit number of the entity claiming the exemption.

- Seller Information: Name and address of the seller providing the goods or services.

- Description of Items: Clear details about the items being purchased and their intended use.

- Signature: A declaration by the buyer affirming the accuracy of the information provided.

Eligibility Criteria

To qualify for using the Texas sales tax exemption certificate form 01 339, buyers must meet specific eligibility criteria. Generally, this includes being a registered business with a valid Texas sales tax permit. Additionally, the purchases must be for resale or for use in exempt activities, such as purchases made by non-profit organizations. It is important to review the Texas Comptroller's guidelines to ensure compliance with all requirements.

Quick guide on how to complete form 01 339 13374572

Effortlessly prepare Form 01 339 on any device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 01 339 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to adjust and eSign Form 01 339 with ease

- Obtain Form 01 339 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Adjust and eSign Form 01 339 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 01 339 13374572

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas sales and use tax exemption certification form 01 339?

The Texas sales and use tax exemption certification form 01 339 is a document that allows businesses to claim tax-exempt purchases in the state of Texas. This form is essential for entities that qualify for exemptions, helping to simplify the tax processes for eligible purchases. Proper use of this form can assist in reducing tax liabilities and ensuring compliance with Texas tax laws.

-

How can airSlate SignNow help with the Texas sales and use tax exemption certification form 01 339?

airSlate SignNow streamlines the process of filling out and submitting the Texas sales and use tax exemption certification form 01 339. Our platform provides an intuitive interface that allows users to easily eSign and manage tax exemption documents. This can save your business time and increase efficiency when dealing with sales tax compliance.

-

Is there a cost associated with using airSlate SignNow for the Texas sales and use tax exemption certification form 01 339?

AirSlate SignNow offers a range of pricing plans that accommodate different business needs, including plans tailored for those needing to handle the Texas sales and use tax exemption certification form 01 339. While pricing varies, our solution is designed to be cost-effective, providing great value with comprehensive features. Be sure to check our website for the latest pricing options.

-

What features does airSlate SignNow offer for managing the Texas sales and use tax exemption certification form 01 339?

airSlate SignNow offers features like customizable templates, cloud storage, and eSigning capabilities specifically for the Texas sales and use tax exemption certification form 01 339. These tools facilitate efficient document management and ensure that your exemption forms are easily accessible and secure. Additionally, automatic notifications and reminders help keep track of submission deadlines.

-

Can airSlate SignNow integrate with other tools for managing the Texas sales and use tax exemption certification form 01 339?

Yes, airSlate SignNow integrates seamlessly with a variety of business tools to enhance your workflow when dealing with the Texas sales and use tax exemption certification form 01 339. These integrations include CRM systems, accounting software, and other documentation platforms. By connecting your tools, you can streamline the process of managing tax documents more effectively.

-

Who is eligible to use the Texas sales and use tax exemption certification form 01 339?

Eligibility for the Texas sales and use tax exemption certification form 01 339 typically includes nonprofits, governmental entities, and certain businesses that make qualifying purchases for resale. It is crucial to review the specific guidelines provided by the Texas Comptroller to ensure compliance. By utilizing this form, eligible entities can signNowly reduce their tax expenses.

-

What are the benefits of using airSlate SignNow for the Texas sales and use tax exemption certification form 01 339?

Using airSlate SignNow for the Texas sales and use tax exemption certification form 01 339 offers several benefits, including reduced processing time and improved accuracy in document handling. The platform enables easy eSigning which expedites approvals and increases efficiency. Additionally, our online access allows you to manage documents from anywhere, enhancing flexibility for your team.

Get more for Form 01 339

- Student medical information form chicago public schools cps

- Unlv financial aid repeal form

- Baruch college transcript form

- Reentry plan form

- Substitute teacher reference forms rockdale county georgia 2019

- Msu diploma form

- Nearing aggregate federal stafford loan limits worksheet uaa alaska form

- Student entry form

Find out other Form 01 339

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now