St 8 Form Ga

What is the St 8 Form Ga

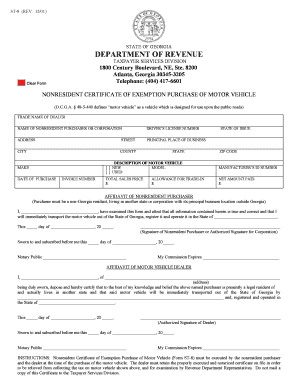

The St 8 Form Ga, also known as the Georgia tax exemption form, is a crucial document used by businesses and individuals in Georgia to claim tax-exempt status for certain purchases. This form is particularly relevant for organizations that qualify under specific criteria, such as non-profit entities, government agencies, and certain educational institutions. By submitting the St 8 Form Ga, eligible parties can avoid paying sales tax on qualifying items, thereby reducing overall operational costs.

How to use the St 8 Form Ga

Using the St 8 Form Ga involves several straightforward steps. First, ensure that your organization qualifies for tax exemption based on the criteria outlined by the Georgia Department of Revenue. Next, complete the form accurately, providing all required information, including the name of the organization, address, and the reason for the exemption. Once completed, present the form to the vendor at the time of purchase to avoid sales tax charges. It is important to retain a copy of the form for your records, as it may be required for future reference or audits.

Steps to complete the St 8 Form Ga

Completing the St 8 Form Ga requires attention to detail. Follow these steps to ensure accuracy:

- Obtain the St 8 Form Ga from the Georgia Department of Revenue's website or a trusted source.

- Fill in the organization’s name and address in the designated fields.

- Indicate the type of exemption being claimed and provide a valid reason for the tax exemption.

- Include any necessary identification numbers, such as the federal employer identification number (EIN).

- Sign and date the form to certify that the information provided is true and accurate.

Legal use of the St 8 Form Ga

The legal use of the St 8 Form Ga is governed by Georgia state law. It is essential to understand that misuse of the form can lead to penalties. Only eligible organizations should use this form to claim tax exemption. The form must be presented to vendors at the time of purchase, and it is advisable to keep thorough records of all transactions involving the form. In case of an audit, the Georgia Department of Revenue may request documentation to support the tax-exempt status claimed.

Required Documents

To successfully complete the St 8 Form Ga, certain documents may be required. These typically include:

- Proof of the organization’s tax-exempt status, such as a letter from the IRS or the Georgia Department of Revenue.

- Identification numbers, including the federal EIN.

- Any additional documentation that supports the reason for the exemption, such as organizational bylaws or mission statements.

Eligibility Criteria

Eligibility for using the St 8 Form Ga depends on specific criteria set by the Georgia Department of Revenue. Generally, qualifying entities include:

- Non-profit organizations that are recognized as tax-exempt under IRS regulations.

- Government entities at the federal, state, or local level.

- Certain educational institutions that meet the criteria for tax exemption.

It is important to review the detailed eligibility guidelines provided by the Georgia Department of Revenue to ensure compliance.

Quick guide on how to complete st 8 form ga

Complete St 8 Form Ga easily on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents promptly without any delays. Handle St 8 Form Ga on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest method to modify and eSign St 8 Form Ga effortlessly

- Find St 8 Form Ga and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight essential sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign St 8 Form Ga to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 8 form ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Georgia tax exempt form?

A Georgia tax exempt form is a document used by organizations and individuals to claim exemption from state sales tax in Georgia. This form allows tax-exempt entities, such as non-profits and government agencies, to make purchases without being charged sales tax. Utilizing a Georgia tax exempt form is essential for eligible entities to maximize their financial resources.

-

How can I obtain a Georgia tax exempt form?

You can obtain a Georgia tax exempt form through the Georgia Department of Revenue's website or by contacting their office directly. Additionally, many businesses will provide their own version of the form for you to fill out at the time of purchase. It is important to ensure you have the correct form for your specific tax exempt status.

-

How does airSlate SignNow facilitate the use of Georgia tax exempt forms?

airSlate SignNow simplifies the process of sending and eSigning Georgia tax exempt forms by providing an easy-to-use platform for document management. You can quickly upload, send, and receive signed forms securely without hassle. This streamlines your workflow, ensuring that you maintain compliance with Georgia tax regulations.

-

Are there any costs associated with using airSlate SignNow for Georgia tax exempt forms?

airSlate SignNow offers a cost-effective solution for managing Georgia tax exempt forms, with various pricing plans to suit different business needs. While there may be subscription fees, the savings on time and resources can far outweigh the initial costs. Evaluate the plans to find the one that fits your organization's budget.

-

What features does airSlate SignNow offer for Georgia tax exempt forms?

airSlate SignNow includes features such as customizable templates, secure signing, and robust tracking for your Georgia tax exempt forms. You can easily create a custom template for your forms, ensuring they meet your organization's needs. Plus, real-time tracking allows you to monitor the status of each document effortlessly.

-

Can I integrate airSlate SignNow with other software for managing Georgia tax exempt forms?

Yes, airSlate SignNow offers seamless integrations with various software systems to enhance the management of Georgia tax exempt forms. Whether you use CRMs, project management tools, or cloud storage services, you can connect them to streamline your document workflow. This enhances efficiency and reduces manual input errors.

-

What are the benefits of using airSlate SignNow for Georgia tax exempt forms?

Using airSlate SignNow for Georgia tax exempt forms provides numerous benefits, such as improved compliance, enhanced security, and faster processing. You'll find that electronically signing and managing your forms can signNowly reduce turnaround time, allowing for more efficient financial operations. This can lead to better resource management for your organization.

Get more for St 8 Form Ga

Find out other St 8 Form Ga

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free