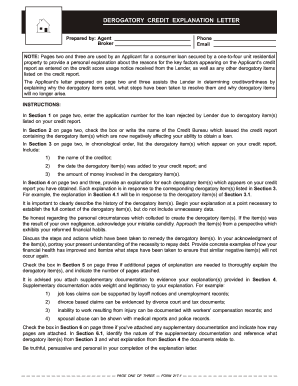

Sample Delinquent Credit Explanation Letter Form

What is the Sample Delinquent Credit Explanation Letter

A sample delinquent credit explanation letter is a formal document used to clarify the reasons behind late payments or derogatory marks on a credit report. This letter serves to provide context to creditors or lenders regarding past financial difficulties, such as unexpected medical expenses, job loss, or other significant life events. By explaining these circumstances, individuals can potentially mitigate the negative impact on their credit scores and improve their chances of obtaining credit in the future.

Key Elements of the Sample Delinquent Credit Explanation Letter

When drafting a delinquent credit explanation letter, several key elements should be included to ensure clarity and effectiveness:

- Sender's Information: Include your full name, address, phone number, and email at the top of the letter.

- Date: Add the date on which the letter is written.

- Recipient's Information: Provide the name and address of the creditor or lender you are addressing.

- Subject Line: Clearly state the purpose of the letter, such as "Explanation of Delinquent Credit."

- Detailed Explanation: Offer a concise yet comprehensive explanation of the circumstances that led to the delinquency.

- Supporting Documentation: Mention any attached documents that support your explanation, such as medical bills or termination letters.

- Closing Statement: Express gratitude for their understanding and consideration, and include your signature.

Steps to Complete the Sample Delinquent Credit Explanation Letter

Completing a delinquent credit explanation letter involves several straightforward steps:

- Gather Information: Collect all necessary details, including your credit report, payment history, and any relevant documents.

- Draft the Letter: Use a clear and professional tone, ensuring that all key elements are included.

- Review for Accuracy: Proofread the letter for any grammatical errors or inaccuracies in the information provided.

- Attach Supporting Documents: Include any documentation that supports your explanation, making sure to reference them in the letter.

- Send the Letter: Choose a method of delivery, whether by mail or electronically, ensuring it reaches the intended recipient.

Legal Use of the Sample Delinquent Credit Explanation Letter

The delinquent credit explanation letter is a legally recognized document that can be used to communicate with creditors and lenders. For it to be considered valid, the letter must be truthful and provide accurate information regarding your financial situation. Misrepresentation or false statements can lead to legal repercussions. It is essential to ensure that the letter complies with applicable laws, including the Fair Credit Reporting Act (FCRA), which governs how credit information is reported and used.

How to Use the Sample Delinquent Credit Explanation Letter

Using a delinquent credit explanation letter effectively can help improve your creditworthiness. Here are some practical ways to utilize it:

- Credit Applications: Include the letter when applying for loans or credit cards to provide context for any negative marks on your credit report.

- Negotiations: Use the letter during negotiations with creditors to discuss payment plans or settlements.

- Credit Report Disputes: Submit the letter when disputing inaccuracies on your credit report to help clarify your position.

Examples of Using the Sample Delinquent Credit Explanation Letter

Examples of scenarios where a delinquent credit explanation letter may be beneficial include:

- A borrower who missed payments due to unexpected medical expenses.

- A recent graduate who struggled to find employment after college, resulting in late payments.

- A homeowner facing temporary financial hardship due to job loss and needing to explain missed mortgage payments.

Quick guide on how to complete sample delinquent credit explanation letter

Complete Sample Delinquent Credit Explanation Letter effortlessly on any device

Online document administration has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Sample Delinquent Credit Explanation Letter on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Sample Delinquent Credit Explanation Letter without effort

- Find Sample Delinquent Credit Explanation Letter and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Sample Delinquent Credit Explanation Letter and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample delinquent credit explanation letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample delinquent credit explanation letter?

A sample delinquent credit explanation letter is a template that helps individuals communicate with creditors regarding their late payments or negative credit marks. This letter serves to clarify the circumstances surrounding the delinquency and can be tailored to fit personal situations. Using a sample delinquent credit explanation letter can improve your chances of persuading creditors or lenders to reconsider their decisions.

-

How can airSlate SignNow help me create a sample delinquent credit explanation letter?

airSlate SignNow allows users to create personalized documents, including a sample delinquent credit explanation letter. With its intuitive interface, you can easily input your information and customize the content as needed. Plus, you can eSign and send the letter directly through the platform, streamlining the communication process with creditors.

-

Is there a cost associated with using airSlate SignNow for a sample delinquent credit explanation letter?

airSlate SignNow offers a cost-effective solution for creating and sending documents. Pricing varies based on the subscription plan, but you can take advantage of free trials or basic features that allow you to create a sample delinquent credit explanation letter without upfront costs. For comprehensive features, consider exploring the premium plans.

-

What features does airSlate SignNow offer for creating legal documents like a sample delinquent credit explanation letter?

airSlate SignNow provides professional templates, eSignature capabilities, and document sharing options. You can easily modify a sample delinquent credit explanation letter to suit your needs and even collaborate with others in real time. These features enhance your document's accessibility and ensure it meets legal requirements.

-

Can I integrate airSlate SignNow with other tools while working on a sample delinquent credit explanation letter?

Yes, airSlate SignNow seamlessly integrates with various third-party applications. You can connect it with CRMs, email services, and cloud storage platforms to enhance your workflow. This means you can manage your sample delinquent credit explanation letter alongside other important documents and data without any hassle.

-

What are the benefits of using airSlate SignNow for my sample delinquent credit explanation letter?

Using airSlate SignNow offers numerous benefits for your sample delinquent credit explanation letter, including ease of use and legal compliance. You can create, edit, and sign your letter quickly, reducing the time spent on administrative tasks. Additionally, the secure platform ensures that your sensitive information is protected.

-

How secure is the information I input for my sample delinquent credit explanation letter on airSlate SignNow?

airSlate SignNow prioritizes the security of your information. The platform employs advanced encryption methods to protect your data, ensuring that your sample delinquent credit explanation letter and associated documents are safe from unauthorized access. You can have confidence in using the platform for sensitive financial communications.

Get more for Sample Delinquent Credit Explanation Letter

- Gsa order gsagov form

- Retention incentive service agreement usaid form

- Title of document heading 1calibri bold 18pt cdc form

- Other unusual circumstances name of requestor form

- Employee requesting evacuation assistance form

- Shop safety manual university of californiaoffice of the form

- Congressional relations government publishing office form

- Mv3644 47728554 form

Find out other Sample Delinquent Credit Explanation Letter

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile