Roundpoint Mortgage Payoff Form

What is the Roundpoint Mortgage Payoff

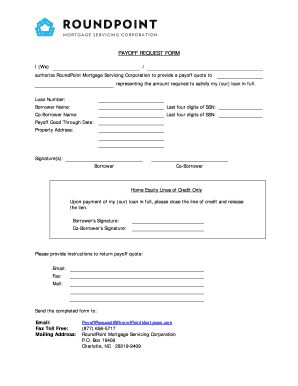

The Roundpoint mortgage payoff refers to the process of settling the remaining balance on a mortgage held with Roundpoint Mortgage Servicing Corporation. This process involves obtaining a payoff statement, which details the total amount required to fully pay off the mortgage, including any accrued interest, fees, and other charges. Understanding this payoff amount is crucial for homeowners looking to refinance, sell their property, or simply eliminate their debt. It is essential to ensure that the payoff request is accurate and submitted in a timely manner to avoid any complications.

How to obtain the Roundpoint Mortgage Payoff

To obtain the Roundpoint mortgage payoff, homeowners typically need to submit a formal payoff request. This can often be done online through the Roundpoint mortgage servicing website or by contacting their customer service. Homeowners should provide necessary details, such as the mortgage account number and personal identification information, to facilitate the request. It is advisable to check for any specific requirements or forms needed for the request, as these may vary based on individual circumstances.

Steps to complete the Roundpoint Mortgage Payoff

Completing the Roundpoint mortgage payoff involves several key steps:

- Gather necessary information, including your mortgage account number and personal identification.

- Visit the Roundpoint mortgage servicing website or contact customer service to access the payoff request form.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form electronically or via mail, depending on the options provided by Roundpoint.

- Await confirmation of your request and the subsequent payoff statement, which will outline the total amount due.

Legal use of the Roundpoint Mortgage Payoff

The legal validity of the Roundpoint mortgage payoff is supported by compliance with various eSignature laws, such as the ESIGN Act and UETA. These laws ensure that electronic signatures and documents are recognized as legally binding. When submitting a payoff request online, it is important to use a secure platform that provides an electronic certificate, confirming the authenticity of the transaction. This legal backing protects both the borrower and the lender during the payoff process.

Key elements of the Roundpoint Mortgage Payoff

Several key elements are essential when dealing with a Roundpoint mortgage payoff:

- Payoff Statement: This document outlines the total amount required to pay off the mortgage, including principal, interest, and any applicable fees.

- Request Method: Homeowners can typically request the payoff statement online, by phone, or through mail.

- Time Sensitivity: Payoff amounts can change daily due to accruing interest, making it important to act quickly once the statement is received.

- Verification: Ensuring that the information provided in the payoff request is accurate to prevent delays or complications.

Form Submission Methods (Online / Mail / In-Person)

Homeowners have multiple options for submitting their Roundpoint mortgage payoff request. The most common methods include:

- Online Submission: Many homeowners prefer to submit their requests through the Roundpoint mortgage servicing website for convenience and speed.

- Mail: For those who prefer traditional methods, sending the request via postal mail is also an option, though it may take longer to process.

- In-Person: Some homeowners may choose to visit a Roundpoint office to submit their request directly, allowing for immediate confirmation and assistance.

Quick guide on how to complete roundpoint mortgage payoff 62591838

Effortlessly Prepare Roundpoint Mortgage Payoff on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Roundpoint Mortgage Payoff on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Roundpoint Mortgage Payoff with Ease

- Locate Roundpoint Mortgage Payoff and click Get Form to commence.

- Use the tools we provide to complete your form.

- Emphasize relevant portions of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements within a few clicks from your preferred device. Modify and electronically sign Roundpoint Mortgage Payoff to ensure excellent communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the roundpoint mortgage payoff 62591838

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a RoundPoint mortgage payoff request?

A RoundPoint mortgage payoff request is a formal request for the total amount owed on your mortgage, including any applicable fees. This request can help you understand your payoff balance and plan for the next steps in your mortgage journey. Using airSlate SignNow simplifies the process of submitting a RoundPoint mortgage payoff request.

-

How can I submit a RoundPoint mortgage payoff request using airSlate SignNow?

To submit a RoundPoint mortgage payoff request using airSlate SignNow, simply create a digital document and include your request details. You can easily eSign and send the document online. Our platform streamlines this process, saving you time and effort.

-

Are there any fees associated with submitting a RoundPoint mortgage payoff request through airSlate SignNow?

While airSlate SignNow does have affordable pricing plans, there are usually no additional fees specifically for submitting a RoundPoint mortgage payoff request. Our cost-effective solution ensures that you can manage your documents efficiently without unexpected charges.

-

What features does airSlate SignNow offer for managing RoundPoint mortgage payoff requests?

AirSlate SignNow provides several features for managing RoundPoint mortgage payoff requests, including eSigning, document templates, and secure storage. Our user-friendly interface makes it easy for you to create, send, and track your requests. These features ensure that you can handle your documents professionally and efficiently.

-

Can I track the status of my RoundPoint mortgage payoff request submitted through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your RoundPoint mortgage payoff request. You can see when the document is viewed, signed, and completed. This tracking capability provides peace of mind as you await your payoff information.

-

What benefits does eSigning my RoundPoint mortgage payoff request offer?

eSigning your RoundPoint mortgage payoff request offers several benefits including faster processing and reduced paperwork. It eliminates the need for printing, signing, and scanning documents, allowing for a more efficient workflow. This approach saves time and helps you get your payoff information more quickly.

-

Is airSlate SignNow compatible with other integrations for RoundPoint mortgage payoff requests?

Yes, airSlate SignNow is compatible with various integrations that can enhance your RoundPoint mortgage payoff request process. You can connect with popular applications like CRM systems and cloud storage services for streamlined operations. This flexibility allows you to work seamlessly across multiple platforms.

Get more for Roundpoint Mortgage Payoff

- I name accept appointment to and agree to perform the duties and

- Office forms kentucky court of appeals 18 legal approval for

- The juvenile justice national criminal justice reference service form

- 2013 2019 form va dc 469 fill online printable fillable blank

- North carolina immunization law religious exemption form

- Self help forms money cases foreign colorado judicial branch

- Sss e6 form

- Laboratory address number and street form

Find out other Roundpoint Mortgage Payoff

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement