Airbnb Spreadsheet Template Form

What is the Airbnb Spreadsheet Template

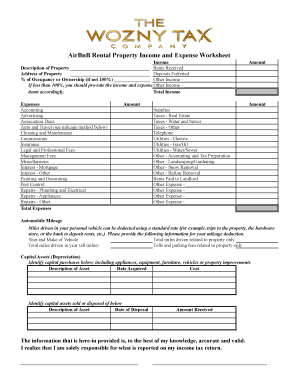

The Airbnb spreadsheet template is a specialized tool designed to help hosts manage their rental properties efficiently. This template typically includes sections for tracking income, expenses, occupancy rates, and guest information. It serves as a comprehensive overview of the financial performance of an Airbnb rental, allowing hosts to make informed decisions regarding pricing and marketing strategies. By organizing data in a clear format, the template simplifies the process of monitoring the profitability of the rental property.

How to Use the Airbnb Spreadsheet Template

Using the Airbnb spreadsheet template involves several straightforward steps. First, download the template in a compatible format, such as Excel or Google Sheets. Next, input your property details, including address and listing information. As you receive bookings, record guest names, check-in and check-out dates, and payment amounts. Regularly update the expenses section with costs related to cleaning, maintenance, and utilities. This ongoing tracking enables you to assess your rental's financial health and identify areas for improvement.

Steps to Complete the Airbnb Spreadsheet Template

Completing the Airbnb spreadsheet template requires careful attention to detail. Start by filling in the basic information about your property in the designated fields. Next, input your income data, including nightly rates and any additional fees. For expenses, categorize them into sections such as cleaning, repairs, and supplies. Ensure that all entries are accurate and up-to-date to maintain the integrity of your financial records. Finally, review the completed spreadsheet regularly to analyze trends in income and expenses, aiding in future planning.

Legal Use of the Airbnb Spreadsheet Template

When utilizing the Airbnb spreadsheet template, it is essential to ensure compliance with local regulations and tax laws. This includes accurately reporting rental income and expenses for tax purposes. The template can assist in organizing this information, making it easier to prepare for tax filing. Additionally, maintaining records of guest transactions can help protect against disputes and provide documentation if needed. Familiarize yourself with the legal requirements in your area to ensure that your use of the template aligns with local guidelines.

Key Elements of the Airbnb Spreadsheet Template

The key elements of the Airbnb spreadsheet template include sections for income tracking, expense management, and guest information. The income section typically captures nightly rates, cleaning fees, and any additional charges. The expense section should detail costs associated with property maintenance, utilities, and supplies. Guest information fields may include names, contact details, and reservation dates. By incorporating these elements, the template provides a holistic view of the rental's financial performance, facilitating better decision-making.

Examples of Using the Airbnb Spreadsheet Template

There are various practical applications for the Airbnb spreadsheet template. For instance, a host can use it to calculate the total income generated over a specific period, such as a month or year. This information can help determine if adjustments to pricing are necessary. Additionally, by analyzing expenses, hosts can identify areas where costs can be reduced, such as switching cleaning services or optimizing utility usage. These examples illustrate how the template can enhance operational efficiency and profitability for Airbnb rentals.

Quick guide on how to complete airbnb spreadsheet template

Complete Airbnb Spreadsheet Template effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It offers a seamless eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Airbnb Spreadsheet Template on any device using the airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

How to modify and eSign Airbnb Spreadsheet Template effortlessly

- Find Airbnb Spreadsheet Template and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select how you prefer to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Airbnb Spreadsheet Template and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the airbnb spreadsheet template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Airbnb spreadsheet and how can it help my vacation rental business?

An Airbnb spreadsheet is a powerful tool designed to help vacation rental hosts manage bookings, finances, and guest communication. By organizing essential data in one place, it enables you to track income, expenses, and availability more effectively, ultimately leading to better business decisions.

-

How does airSlate SignNow integrate with my Airbnb spreadsheet?

airSlate SignNow integrates seamlessly with your Airbnb spreadsheet, allowing you to eSign rental agreements, contracts, and other documents directly from your spreadsheet. This integration streamlines your workflow and enhances your ability to manage documentation alongside your rental data.

-

What features does airSlate SignNow offer for managing Airbnb spreadsheets?

airSlate SignNow offers features like easy document management, eSignature capabilities, and template creation that are beneficial for Airbnb spreadsheet users. These tools help you efficiently handle guest agreements and streamline communication, keeping your rental operations organized.

-

Is there a cost associated with using airSlate SignNow for Airbnb spreadsheets?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for users working with Airbnb spreadsheets. Each package provides essential features that ensure you can manage your documents without compromising your budget.

-

Can I access my Airbnb spreadsheet from mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow provides mobile access, allowing you to manage your Airbnb spreadsheet on the go. This flexibility ensures that you can eSign documents and keep track of your rental activities anytime and anywhere.

-

How does airSlate SignNow enhance the benefits of using an Airbnb spreadsheet?

By incorporating airSlate SignNow into your Airbnb spreadsheet management, you gain the ability to automate document workflows and ensure secure eSignatures. This integration not only saves time but also improves accuracy in handling contracts and important rental documentation.

-

What types of documents can I eSign related to my Airbnb spreadsheet?

With airSlate SignNow, you can eSign various documents pertinent to your Airbnb spreadsheet, including lease agreements, rental contracts, and liability waivers. This capability simplifies the process of executing essential paperwork, making it faster and more efficient.

Get more for Airbnb Spreadsheet Template

- Login default form

- Commercial transaction affidavit ccim online portfolio form

- Lees sandwiches application form

- Minardi bakery inc revised 2 08 rcs louis minardi age fifty andrews form

- Download employment application here arnel form

- Fancy sushi job aplication pdf form

- Employment and support allowance medical report form

- Starbucks employemnt application fillable form

Find out other Airbnb Spreadsheet Template

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form