Form 1116 Filla

What is the Form 1116 Filla

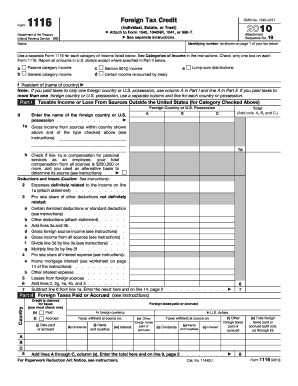

The Form 1116 is a tax form used by U.S. taxpayers to claim the foreign tax credit. This credit allows individuals to reduce their U.S. tax liability based on taxes paid to foreign governments. By using this form, taxpayers can avoid double taxation on income earned abroad. The form is particularly relevant for those who have foreign income or have paid foreign taxes, providing a mechanism to offset U.S. taxes owed.

Steps to complete the Form 1116 Filla

Completing the Form 1116 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documentation, including details of foreign income and taxes paid. Next, fill out the form by providing personal information, including your name, Social Security number, and details about your foreign income. Be sure to accurately report the amount of foreign taxes paid and calculate the allowable credit. Finally, review the completed form for any errors before submission.

Legal use of the Form 1116 Filla

To ensure that the Form 1116 is legally valid, it must be completed accurately and submitted according to IRS guidelines. The form serves as a formal request for the foreign tax credit, and any inaccuracies can lead to penalties or disallowance of the credit. It is essential to maintain records of all foreign income and taxes paid, as these may be requested by the IRS for verification purposes. Using reliable e-signature solutions can enhance the legal standing of the submitted form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1116. Taxpayers should refer to the IRS instructions for the form, which detail eligibility criteria, required information, and filing procedures. It is important to stay updated on any changes to tax laws that may affect the completion of this form. Following the IRS guidelines helps ensure that the form is processed efficiently and accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1116 typically align with the annual tax return due date. For most taxpayers, this means the form must be submitted by April 15 of the following year. However, extensions may be available, allowing additional time to file. It is crucial to be aware of these deadlines to avoid penalties and ensure that the foreign tax credit is claimed in a timely manner.

Required Documents

When completing the Form 1116, certain documents are necessary to support the claims made. Taxpayers should gather documentation such as proof of foreign income, records of foreign taxes paid, and any relevant financial statements. These documents not only assist in accurately filling out the form but also serve as evidence in case of an audit by the IRS.

Software Compatibility (TurboTax, QuickBooks, etc.)

Many tax preparation software programs, including TurboTax, offer features for completing the Form 1116. These platforms provide guided assistance and can help automate calculations, making the process more efficient. Users should ensure that their chosen software is compatible with the Form 1116 to facilitate a smooth filing experience. Utilizing such software can also help in maintaining compliance with IRS requirements.

Quick guide on how to complete form 1116 filla

Complete Form 1116 Filla seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form 1116 Filla across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign Form 1116 Filla effortlessly

- Locate Form 1116 Filla and then click Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to store your modifications.

- Select how you wish to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form 1116 Filla to ensure optimal communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1116 filla

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1116 in TurboTax?

Form 1116 in TurboTax is used to claim the foreign tax credit, which allows U.S. taxpayers to reduce their tax liability on income earned abroad. By utilizing TurboTax, you can seamlessly complete this form and potentially maximize your tax savings. It's essential for individuals who have paid foreign taxes to use Form 1116 in TurboTax.

-

How does airSlate SignNow integrate with TurboTax?

AirSlate SignNow integrates with TurboTax to streamline the eSigning and document management process, especially when dealing with tax forms like Form 1116. This integration allows users to easily send, sign, and manage their tax documents from one comprehensive platform. By utilizing airSlate SignNow, you can enhance your TurboTax experience signNowly.

-

What features does airSlate SignNow offer for signing Form 1116?

AirSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for signing Form 1116. These functionalities ensure that you can sign documents efficiently and keep track of their status, which is vital during tax season. Streamlining your document signing process makes handling your tax obligations much easier.

-

Is there a cost associated with using airSlate SignNow for Form 1116?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs while providing a cost-effective solution for managing forms like Form 1116. With its competitive pricing, you can choose a plan that fits your budget and ensures that all your eSigning requirements are met efficiently. It's a valuable investment for businesses handling tax documents.

-

Can I track the status of my Form 1116 documents in airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking features that allow users to monitor the status of their Form 1116 documents. You will receive notifications on when documents are viewed and signed, ensuring you stay updated on your tax filings. This feature is particularly beneficial during the busy tax season.

-

How does airSlate SignNow ensure the security of my Form 1116?

AirSlate SignNow prioritizes the security of your documents, including Form 1116, by employing advanced encryption and secure cloud storage solutions. This ensures that sensitive tax information is protected while in transit and at rest. Additionally, compliance with industry standards helps to give you peace of mind regarding your data.

-

Can I customize my eSignature for Form 1116 using airSlate SignNow?

Yes, airSlate SignNow allows you to create a customized eSignature for signing Form 1116. This feature enables users to choose from various signature styles or upload their own, adding a personal touch to your documents. Customizing your eSignature enhances your brand identity while providing a professional appearance.

Get more for Form 1116 Filla

- California school immunization record hope technology school form

- Ri w 4 form fillable form 2018 2019

- Account identification number form

- Ak 6000 form 2017 2019

- Form 6390 orders and limits federal based credits on an

- Name and ein of alaska taxpayer generating attributes if different from taxpayers filing this return attach additional forms if

- Instructions for form 6395

- Tax forms texas comptroller texasgov

Find out other Form 1116 Filla

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors