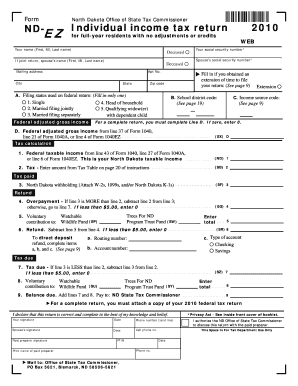

North Dakota Office of the State Tax Commissioner Form

Understanding the North Dakota Office of the State Tax Commissioner

The North Dakota Office of the State Tax Commissioner is the primary agency responsible for administering state tax laws. This office oversees the collection of various taxes, including income tax, sales tax, and property tax. It also provides guidance and support to taxpayers, ensuring compliance with state tax regulations. The office plays a crucial role in maintaining the integrity of the state's tax system, offering resources to help individuals and businesses navigate their tax obligations.

Steps to Complete the North Dakota Income Tax Form

Completing the North Dakota income tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other relevant financial records. Next, determine your filing status, which can affect your tax rate and deductions. After that, fill out the form carefully, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submitting it to the North Dakota Office of the State Tax Commissioner.

Required Documents for Filing North Dakota Income Tax

When filing your North Dakota income tax, it is essential to have the right documents on hand. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Proof of any tax credits you may be claiming

Having these documents ready will streamline the filing process and help ensure that your tax return is accurate.

Filing Deadlines for North Dakota Income Tax

Filing deadlines for North Dakota income tax are crucial for compliance. Typically, individual income tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines, as they can affect your tax obligations. Filing on time helps avoid penalties and interest charges on any taxes owed.

Digital vs. Paper Version of the North Dakota Income Tax Form

Taxpayers in North Dakota have the option to file their income tax returns either digitally or via paper forms. The digital version offers several advantages, such as faster processing times and immediate confirmation of receipt. Additionally, e-filing can reduce the chance of errors, as many software programs provide prompts and checks. On the other hand, some individuals may prefer the traditional paper method for its simplicity. Regardless of the chosen method, ensuring that the form is completed accurately is essential for compliance.

Penalties for Non-Compliance with North Dakota Income Tax Regulations

Failure to comply with North Dakota income tax regulations can result in various penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action. The state takes tax compliance seriously, and taxpayers are encouraged to file on time and pay any taxes owed to avoid these consequences. Understanding the implications of non-compliance can help individuals and businesses maintain good standing with the North Dakota Office of the State Tax Commissioner.

Quick guide on how to complete north dakota office of the state tax commissioner

Effortlessly prepare North Dakota Office Of The State Tax Commissioner on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely preserve it online. airSlate SignNow equips you with all the necessary tools to quickly create, alter, and eSign your documents without any setbacks. Handle North Dakota Office Of The State Tax Commissioner on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

The simplest way to edit and eSign North Dakota Office Of The State Tax Commissioner with ease

- Obtain North Dakota Office Of The State Tax Commissioner and click on Get Form to initiate the process.

- Utilize the features we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just a moment and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require you to print new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Revise and eSign North Dakota Office Of The State Tax Commissioner to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north dakota office of the state tax commissioner

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the north dakota income tax rate for individuals?

The north dakota income tax rate for individuals varies depending on the taxpayer's income bracket. Generally, the rates range from 1.1% to 2.9%, making it essential to understand your income level. Ensuring compliance with north dakota income tax regulations can save you signNow amounts during tax season.

-

How does airSlate SignNow help with north dakota income tax documentation?

airSlate SignNow streamlines the process of preparing and signing tax documents related to north dakota income tax. Our platform allows you to easily eSign documents and securely send them, enhancing your overall tax preparation experience. By utilizing our services, you can ensure that all necessary documentation regarding north dakota income tax is completed efficiently.

-

Are there any features specifically for north dakota income tax filers?

Yes, airSlate SignNow provides features tailored for north dakota income tax filers, such as customizable templates for tax forms and direct eSigning capabilities. These features help you manage the specific documentation needed for your tax filings in North Dakota. With airSlate SignNow, you can simplify the entire process while staying compliant with north dakota income tax requirements.

-

How much does airSlate SignNow cost for businesses handling north dakota income tax?

The pricing for airSlate SignNow is competitive and designed to suit businesses of all sizes managing north dakota income tax documents. We offer various subscription plans that provide options for different user requirements and budgets. Investing in our solution can optimize your tax documentation process while accommodating the north dakota income tax needs.

-

Can I integrate airSlate SignNow with accounting software for north dakota income tax?

Absolutely! airSlate SignNow offers integrations with popular accounting software that can further streamline your north dakota income tax processes. This allows you to manage your financial data efficiently while ensuring all necessary tax documents are signed and sent seamlessly. Our integrations can enhance your overall workflow for north dakota income tax preparation.

-

What benefits does airSlate SignNow provide for managing north dakota income tax?

airSlate SignNow offers numerous benefits for managing north dakota income tax, including improved accuracy and reduced processing time. Our eSigning features eliminate the need for paper-based signatures, reducing potential errors associated with manual entries. By adopting airSlate SignNow, businesses can enhance their tax filing experience, ensuring compliance with north dakota income tax regulations.

-

How secure is airSlate SignNow for north dakota income tax documents?

Security is a top priority for airSlate SignNow when handling north dakota income tax documents. We utilize robust encryption protocols and comply with leading industry standards to ensure your sensitive information remains safe. You can trust our platform to protect your north dakota income tax documents throughout the entire signing and submission process.

Get more for North Dakota Office Of The State Tax Commissioner

- Bureau of indian education riverside indian school 101 form

- Emergency plan for allergic reactionsdoc form

- Application for firearm control card form

- Av1 form wyco online

- C e u tracking form kansas department for children and families dcf ks

- Application for advance ballot by mail kansas secretary of form

- School use of emergency safety interventions incident report form

- Coelho middle school student council award attleboro public form

Find out other North Dakota Office Of The State Tax Commissioner

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement