Michigan Form 2599

What is the Michigan Form 2599

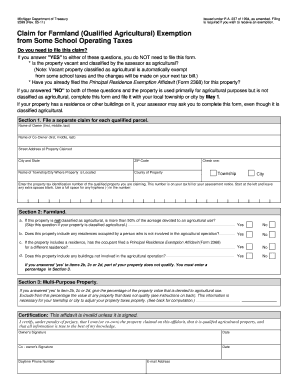

The Michigan Form 2599, also known as the Michigan claim farmland qualified, is a crucial document used by landowners to claim property as qualified farmland under state regulations. This form is issued by the Michigan Department of Treasury and is essential for individuals seeking to take advantage of specific agricultural tax benefits. Understanding the purpose and implications of this form is vital for those involved in farming or agricultural activities in Michigan.

How to use the Michigan Form 2599

To effectively use the Michigan Form 2599, landowners must first ensure they meet the eligibility criteria for claiming farmland. The form requires detailed information about the property, including its size, location, and the nature of its agricultural use. Once completed, the form must be submitted to the appropriate local tax authority to initiate the claim process. It is important to keep copies of all submitted documents for personal records.

Steps to complete the Michigan Form 2599

Completing the Michigan Form 2599 involves several key steps:

- Gather necessary information about the property, including legal descriptions and agricultural use details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the local tax authority by the specified deadline.

Following these steps will help ensure that the claim is processed smoothly and efficiently.

Eligibility Criteria

To qualify for the benefits associated with the Michigan Form 2599, applicants must meet specific eligibility criteria. This includes owning or leasing land that is primarily used for agricultural purposes. The property must meet the minimum acreage requirements set by state regulations, and the landowner must demonstrate that the land has been actively farmed or is intended for agricultural use. Understanding these criteria is essential for a successful claim.

Legal use of the Michigan Form 2599

The Michigan Form 2599 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it is important to provide accurate information and adhere to the guidelines set forth by the Michigan Department of Treasury. The form must be signed by the landowner or an authorized representative, and any false information can result in penalties or denial of the claim.

Form Submission Methods

The Michigan Form 2599 can be submitted through various methods, including:

- Online submission via the Michigan Department of Treasury's official website.

- Mailing the completed form to the designated local tax authority.

- In-person submission at local government offices.

Choosing the appropriate submission method can help expedite the processing of the claim.

Quick guide on how to complete michigan form 2599

Prepare Michigan Form 2599 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Michigan Form 2599 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Michigan Form 2599 without difficulty

- Obtain Michigan Form 2599 and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to apply your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Michigan Form 2599 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form 2599

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Michigan claim for farmland qualified?

The process for filing a Michigan claim for farmland qualified involves gathering necessary documentation and submitting your claim through the appropriate state agency. Utilizing airSlate SignNow can streamline this process by allowing you to eSign and manage all documents securely. This ensures your claim is submitted efficiently and effectively.

-

How can airSlate SignNow assist in managing Michigan claim farmland qualified documents?

AirSlate SignNow offers an easy-to-use platform that allows you to create, send, and eSign all documents related to your Michigan claim farmland qualified. The solution simplifies the document management process, helping you stay organized and compliant while focusing on your farming business.

-

What are the benefits of using airSlate SignNow for my farmland claim in Michigan?

Using airSlate SignNow for your Michigan claim farmland qualified offers numerous benefits, such as improved efficiency and reduced paperwork hassles. With electronic signatures, you can quickly finalize documents and keep them secure, which helps in meeting key deadlines and requirements associated with your claim.

-

Are there any costs associated with using airSlate SignNow for farmland claims?

Yes, airSlate SignNow offers various pricing plans tailored to fit your business needs, including options for users focused on Michigan claim farmland qualified. Consider trying our free trial to explore features before committing to a subscription, ensuring you get the best value for your investment.

-

Can airSlate SignNow be integrated with other tools for my farmland business?

Absolutely! AirSlate SignNow integrates seamlessly with various tools such as CRM systems, cloud storage services, and productivity software. This allows you to manage your Michigan claim farmland qualified documents alongside your existing workflows without interruption.

-

Is airSlate SignNow secure for my Michigan farmland documentation?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform complies with industry standards for data protection, ensuring that your Michigan claim farmland qualified information is stored and transmitted securely. You can trust us to protect your sensitive data.

-

What features does airSlate SignNow offer for eSigning documents related to farmland claims?

AirSlate SignNow provides robust features including customizable templates, real-time tracking, and automated reminders, all specifically geared towards your Michigan claim farmland qualified. These features enhance your document management process and help ensure timely submissions.

Get more for Michigan Form 2599

Find out other Michigan Form 2599

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form