Application to Join the Flat Rate Scheme HM Revenue & Customs Hmrc Gov Form

What is the Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov

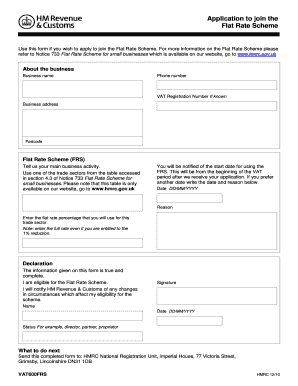

The Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov is a formal request for businesses to participate in a simplified tax scheme designed for small businesses. This scheme allows eligible businesses to pay a fixed percentage of their turnover as Value Added Tax (VAT), rather than calculating VAT on every individual sale and purchase. This can simplify accounting and reduce administrative burdens, making it an appealing option for many small business owners.

Steps to Complete the Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov

Completing the Application To Join The Flat Rate Scheme involves several key steps:

- Gather necessary information about your business, including turnover and VAT registration details.

- Ensure you meet the eligibility criteria, such as being a small business with a turnover below the specified threshold.

- Fill out the application form accurately, providing all required details to avoid delays.

- Review the completed application for accuracy before submission.

- Submit the application through the appropriate channel, either online or by mail.

Legal Use of the Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov

The legal use of the Application To Join The Flat Rate Scheme is governed by tax regulations set forth by HMRC. It is essential for businesses to ensure compliance with these regulations when submitting their application. This includes providing truthful information and adhering to the guidelines for the flat rate scheme. Failure to comply with these requirements can result in penalties or rejection of the application.

Eligibility Criteria for the Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov

To be eligible for the Application To Join The Flat Rate Scheme, businesses must meet specific criteria:

- Your business must be VAT registered.

- Your taxable turnover must be below the prescribed threshold, which is typically set at a certain amount annually.

- You must not be excluded due to certain business types, such as those involved in financial services or property management.

Form Submission Methods for the Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov

The Application To Join The Flat Rate Scheme can be submitted through various methods, ensuring convenience for business owners:

- Online submission via the HMRC website, which is often the quickest method.

- Mailing a printed version of the application to the appropriate HMRC address.

- In-person submission at designated HMRC offices, if available.

Required Documents for the Application To Join The Flat Rate Scheme HM Revenue & Customs HMRC Gov

When completing the Application To Join The Flat Rate Scheme, certain documents may be required to support your application:

- Proof of VAT registration.

- Financial records demonstrating turnover.

- Any additional documentation requested by HMRC to verify eligibility.

Quick guide on how to complete application to join the flat rate scheme hm revenue amp customs hmrc gov

Prepare Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov with ease

- Obtain Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your preferred device. Modify and eSign Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application to join the flat rate scheme hm revenue amp customs hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov?

The Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov is a form that allows eligible businesses to apply for a simplified VAT accounting method. This scheme is beneficial for small businesses, helping them save time and money on VAT administration.

-

How does signing the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov work?

Using airSlate SignNow, you can easily upload and eSign the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov online. Our platform ensures that your application is securely signed, sent, and stored without the hassle of physical paperwork.

-

What are the benefits of using airSlate SignNow for the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov?

With airSlate SignNow, you can streamline the process of submitting your Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov. Our solution is user-friendly, cost-effective, and helps ensure that your documents are signed and managed efficiently.

-

Is there a cost associated with submitting the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov?

While there may not be a fee specifically for the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov, you should review HMRC's guidelines. However, using airSlate SignNow can save you money by reducing your document management costs.

-

What features does airSlate SignNow offer for managing the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov?

airSlate SignNow provides features like eSigning, document templates, and real-time tracking for the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov. These tools simplify the submission process and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other tools for the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov?

Yes, airSlate SignNow offers integrations with various third-party applications. This allows you to seamlessly manage your Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov alongside your existing business tools for enhanced efficiency.

-

What types of businesses can benefit from the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov?

Small businesses with a turnover under the VAT threshold can benefit from the Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov. This scheme is designed to simplify VAT for smaller enterprises, which can signNowly reduce their administrative burdens.

Get more for Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov

- Govform941ss for

- Section c notes form

- Standing order form december 2019

- The director workforce opportunities amp residency cayman p form

- Get the specifications for substitute forms p60 p60

- Applications for subscriptions to be allowed as a tax govuk form

- Trust and estate tax return 2020 use form sa9002020 to file a tax return for a trust or estate for the tax year ended 5 april

- Tax return 2020 use form sa1002020 to file a tax return report your income and to claim tax reliefs and any repayment due youll

Find out other Application To Join The Flat Rate Scheme HM Revenue & Customs Hmrc Gov

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament