4852 Form

What is the 4852 Form

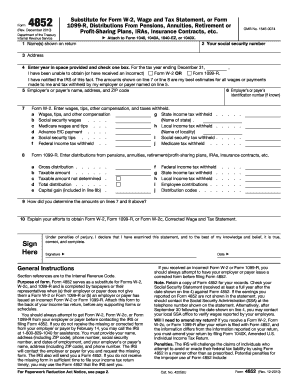

The 4852 form, officially known as IRS Form 4852, is a substitute for Form W-2 or Form 1099-R. It is used by taxpayers who have not received their expected wage or pension statements from their employers or payers. This form allows individuals to report their income and withholding amounts to the IRS when the original documents are unavailable. The 4852 form is particularly useful for ensuring that taxpayers can still file their tax returns accurately and on time, even without the standard documentation.

How to use the 4852 Form

Using the 4852 form involves several key steps. First, gather any information regarding your income, including pay stubs or other documentation that reflects your earnings. Next, complete the form by providing your personal information, the details of your employer or payer, and the estimated amounts of wages and withholdings. Once completed, the form should be submitted with your tax return to the IRS. It is important to keep copies of all documents for your records and to ensure that the information reported is as accurate as possible.

Steps to complete the 4852 Form

Completing the 4852 form requires careful attention to detail. Follow these steps:

- Gather all relevant income information, including pay stubs and previous tax documents.

- Fill in your personal details, such as name, address, and Social Security number.

- Provide information about your employer or payer, including their name and address.

- Estimate your total wages and any federal income tax withheld based on your records.

- Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

Legal use of the 4852 Form

The 4852 form is legally recognized by the IRS as a valid substitute for Form W-2 or Form 1099-R, provided that it is completed accurately and submitted in a timely manner. It is essential to ensure that the information reported on the form is truthful and reflects your actual earnings and withholdings. Misreporting can lead to penalties or delays in processing your tax return. Therefore, using the 4852 form correctly is crucial for compliance with tax laws.

Filing Deadlines / Important Dates

When using the 4852 form, it is important to be aware of key filing deadlines. Generally, tax returns are due on April 15 of each year. If you are using the 4852 form, it should be submitted along with your tax return by this deadline. If you anticipate needing more time, you may file for an extension, but the 4852 form must still be completed and submitted with your return by the extended deadline. Keeping track of these dates helps ensure that you remain compliant with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The 4852 form can be submitted in various ways, depending on your preference and circumstances. You can file your tax return electronically using tax software that supports the 4852 form, which is often the quickest method. Alternatively, you can print the completed form and mail it to the IRS along with your tax return. In-person submission is generally not applicable for the 4852 form, as it is primarily handled through electronic or postal methods. Ensure that you choose the submission method that best fits your needs and allows for timely processing.

Quick guide on how to complete 4852 form

Accomplish 4852 Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as a fantastic eco-conscious alternative to conventional printed and signed paperwork, as you can access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without any holdups. Handle 4852 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign 4852 Form with ease

- Find 4852 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your revisions.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign 4852 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4852 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4852 and why do I need it?

Form 4852 is a tax form used by taxpayers who did not receive a W-2 or 1099 form from an employer. You may need to file form 4852 to report your income and calculate your tax liabilities accurately. airSlate SignNow makes the preparation and electronic submission of form 4852 simple and efficient, ensuring you meet tax deadlines.

-

How does airSlate SignNow simplify the completion of form 4852?

airSlate SignNow provides an intuitive interface that guides users through the process of filling out form 4852. With features like templates and easy editing tools, you can efficiently complete all required fields. Additionally, our platform allows for secure e-signing, ensuring your form 4852 is ready for submission quickly.

-

Is there a cost associated with using airSlate SignNow for form 4852?

Yes, airSlate SignNow offers several pricing plans tailored to meet different needs. The cost varies based on the features you choose, but it is generally considered a cost-effective solution for managing documents like form 4852. You can review the available plans on our pricing page to find the one that suits you best.

-

Can I integrate airSlate SignNow with other software to manage form 4852?

Absolutely! airSlate SignNow offers seamless integrations with a wide range of software applications, including accounting and tax preparation tools. This makes it easy to incorporate form 4852 into your existing workflows and streamline the overall document management process.

-

What benefits does e-signing provide for form 4852?

E-signing form 4852 through airSlate SignNow offers numerous benefits, including faster processing times and improved document security. By eliminating the need for physical signatures, you can complete your form 4852 from anywhere at any time. This convenience not only saves time but also reduces the risk of lost or misplaced forms.

-

How can I ensure my form 4852 is filed correctly?

To ensure that your form 4852 is filed correctly, airSlate SignNow offers helpful tips and guidelines during the completion process. Additionally, you can review your entries before finalizing the e-sign process. Our customer support team is also available to assist you with any questions you may have about specific requirements.

-

What security measures are in place for my form 4852 on airSlate SignNow?

AirSlate SignNow prioritizes your document security with industry-standard encryption and secure data storage. Your form 4852 and all personal information are safeguarded to prevent unauthorized access. We adhere to rigorous compliance protocols that ensure your sensitive tax documents remain protected throughout the signing process.

Get more for 4852 Form

- Dmv from for vision form

- Bizfile sos ca gov form

- Handicap form for dmv az

- Copy of kansas tax exemption certificate form

- Application for life time fishing linces for over 65 form

- 51a260 form

- The state of oregon follows the social security administration ssa guidelines for the filing of w 2 wage and form

- Or form or tm instructions 2019 fill out tax template

Find out other 4852 Form

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word