Ssa 766 Form

What makes the ssa 766 form legally valid?

Because the world takes a step away from in-office working conditions, the completion of paperwork more and more happens electronically. The ssa 766 form isn’t an any different. Handling it utilizing digital means differs from doing so in the physical world.

An eDocument can be viewed as legally binding provided that specific requirements are met. They are especially vital when it comes to signatures and stipulations associated with them. Entering your initials or full name alone will not guarantee that the organization requesting the form or a court would consider it performed. You need a trustworthy solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your ssa 766 form when completing it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make form execution legitimate and safe. Furthermore, it gives a lot of possibilities for smooth completion security wise. Let's quickly go through them so that you can stay assured that your ssa 766 form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of protection and validates other parties identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Completing the ssa 766 form with airSlate SignNow will give better confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete ssa 766

Easily Prepare Ssa 766 on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Ssa 766 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Simple Steps to Edit and eSign Ssa 766

- Find Ssa 766 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all information thoroughly and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Ssa 766 to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ssa 766

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I report self-employment income?

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

-

Is it better to be self-employed or employed?

In general, you will earn more per hour working for yourself than you will as an employee. Where you may lose out is in the dependability of that income.

-

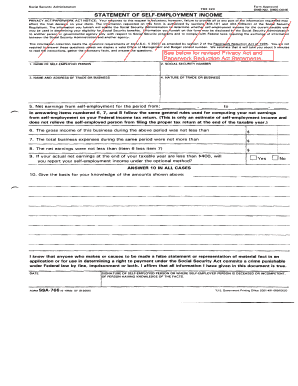

What is SSA 766?

Form SSA-766 Statement of Self-Employment Income.

-

Do I have to pay Social Security tax on 1099 income?

In addition to paying federal and state income taxes, independent contractors, the self-employed, freelancers, and anyone who receives a 1099 are also responsible for paying self-employment income taxes, i.e, Social Security and Medicare taxes.

Get more for Ssa 766

- 2020 instructions 2290 form

- Les droits et les obligations des parties de grandpr chait form

- Pdf publication 5399 zh t internal revenue service form

- No nc hng ng pht trin mnh m hn na ngy php lu t vit nam n form

- 2020 irs form non filers

- Pdf publication 5412 q rev 10 2020 internal revenue service form

- Publication 5427 sp 6 2020 internal revenue service form

- Ffi list user guide pdf irs form

Find out other Ssa 766

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy