Irs Form Non Filers

What is the IRS Form Non Filers?

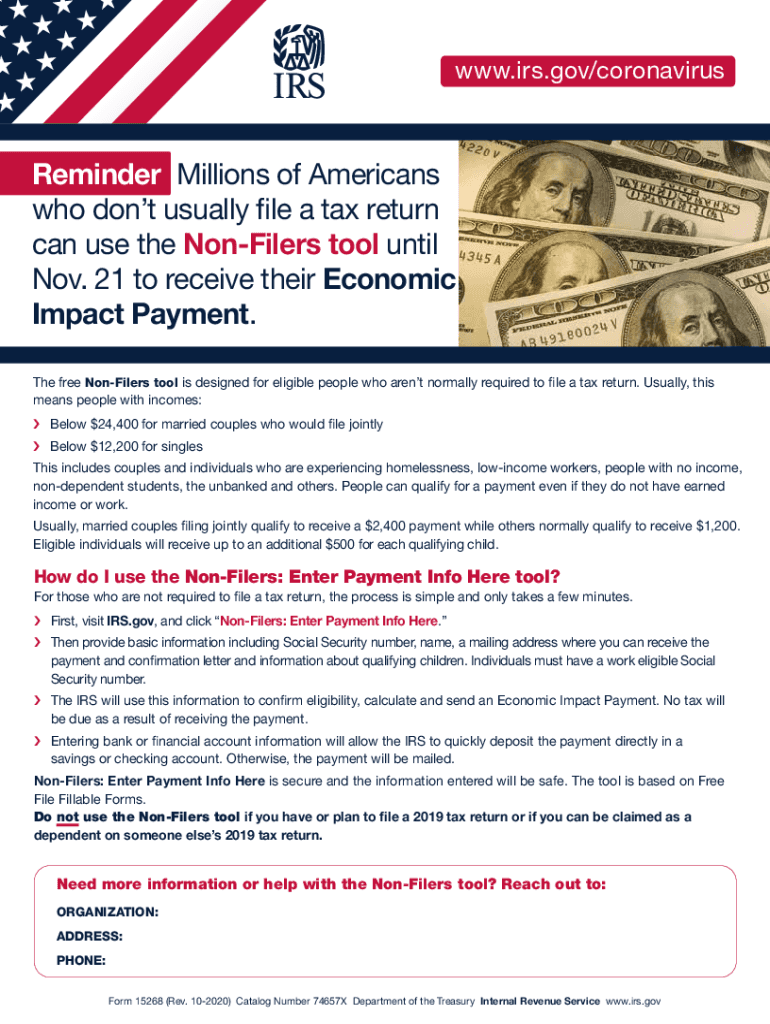

The IRS Form Non Filers is a specific tax form designed for individuals who do not typically file tax returns but are eligible for certain benefits, such as the Economic Impact Payments. This form allows non-filers to provide their information to the Internal Revenue Service (IRS) to ensure they receive any stimulus payments or tax credits they may qualify for. It is particularly relevant for low-income individuals, students, and others who may not have a filing requirement.

How to Obtain the IRS Form Non Filers

Obtaining the IRS Form Non Filers is straightforward. The form is available on the official IRS website as a downloadable PDF. Individuals can also access the form through various tax preparation software that supports non-filer submissions. It is important to ensure that you are using the correct version for the tax year you are addressing, such as the 2020 IRS Form Non Filers for the relevant fiscal year.

Steps to Complete the IRS Form Non Filers

Completing the IRS Form Non Filers involves several key steps:

- Gather necessary personal information, including your Social Security number, income details, and bank account information for direct deposit.

- Download and open the form, ensuring you have the correct version for the tax year.

- Fill out the form accurately, providing all required information in the designated fields.

- Review the completed form for any errors or omissions.

- Sign the form electronically if submitting online, or print and sign if mailing it.

Legal Use of the IRS Form Non Filers

The IRS Form Non Filers is legally binding, provided it is completed correctly and submitted according to IRS guidelines. When using this form, it is essential to comply with the legal requirements for electronic signatures, which may include using a certified eSignature solution. This ensures that the form is accepted by the IRS and fulfills its intended purpose of securing benefits for eligible individuals.

Key Elements of the IRS Form Non Filers

Key elements of the IRS Form Non Filers include:

- Personal Information: Full name, Social Security number, and address.

- Income Details: Information regarding any income received, even if below the filing threshold.

- Banking Information: For direct deposit of any payments, including Economic Impact Payments.

- Signature: Required to validate the form, whether electronically or physically.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Non Filers can vary based on specific circumstances, such as the type of relief being sought. Generally, it is advisable to submit the form as soon as possible to ensure timely processing of any benefits. For the 2020 tax year, the deadline for submitting the non-filer form to receive Economic Impact Payments was set by the IRS, and individuals should stay informed about any updates or changes in deadlines for subsequent tax years.

Quick guide on how to complete 2020 irs form non filers

Complete Irs Form Non Filers effortlessly on any gadget

Digital document management has gained traction with companies and private users alike. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without complications. Manage Irs Form Non Filers across any platform using airSlate SignNow mobile apps for Android or iOS and simplify your document-related tasks today.

How to modify and electronically sign Irs Form Non Filers with ease

- Locate Irs Form Non Filers and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or mislaid documents, tiring form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in a few clicks from the device of your choice. Modify and electronically sign Irs Form Non Filers to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 irs form non filers

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 2020 IRS form for non-filers?

The 2020 IRS form for non-filers is a simplified tax form designed for individuals who did not earn enough income to require filing a tax return. This form allows eligible individuals to receive applicable tax credits and economic stimulus payments. If you need assistance with filling out this form, our solutions can streamline the document process.

-

How can airSlate SignNow help with the 2020 IRS form non-filers?

airSlate SignNow simplifies the process of completing and submitting the 2020 IRS form non-filers by providing an intuitive eSignature platform. You can securely send and eSign documents without needing extensive technical knowledge. This ensures that your paperwork is processed efficiently and accurately.

-

Is there a cost to use airSlate SignNow for 2020 IRS form non-filers?

Yes, airSlate SignNow offers various pricing plans suitable for individual and business needs. The costs are competitive and designed to provide value, especially for those handling the 2020 IRS form non-filers, as our platform reduces the need for expensive notary services or excessive paperwork.

-

What features does airSlate SignNow offer for managing the 2020 IRS form non-filers?

Our platform provides features such as customizable templates, secure eSignatures, and real-time tracking. These tools are essential for managing the 2020 IRS form non-filers as they speed up signature collection and document management. It’s designed for ease of use so you can focus on what matters most.

-

Can I integrate airSlate SignNow with other software for filing the 2020 IRS form non-filers?

Absolutely! airSlate SignNow offers easy integrations with popular software applications, including cloud storage and CRM systems. This means you can seamlessly incorporate your workflows with other programs when managing your 2020 IRS form non-filers, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the 2020 IRS form non-filers?

Using airSlate SignNow benefits users by ensuring compliance, enhancing security, and saving time. Our platform helps you quickly complete the 2020 IRS form non-filers, allowing you to concentrate on your financial priorities. Plus, our customer support is always available if you need assistance.

-

How can small businesses leverage airSlate SignNow for the 2020 IRS form non-filers?

Small businesses can use airSlate SignNow to efficiently handle the 2020 IRS form non-filers for themselves and their employees. This cost-effective solution simplifies tax filing and helps in maintaining organized records. Streamlined processes lead to less administrative burden and more focus on core business activities.

Get more for Irs Form Non Filers

- It 2104 spanish form

- Lausd tb test form

- Ui28 form

- 8100 professional level exam form

- Ct fdrm form

- New york member enrollment form ohi

- Deductions and creditsdepartment of revenue form

- Instructions for form 706 rev october instructions for form 706 united states estate and generation skipping transfer tax return

Find out other Irs Form Non Filers

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF