Retail Motor Vehicle Credit Application DealerCenter Support Form

What is the Retail Motor Vehicle Credit Application DealerCenter Support

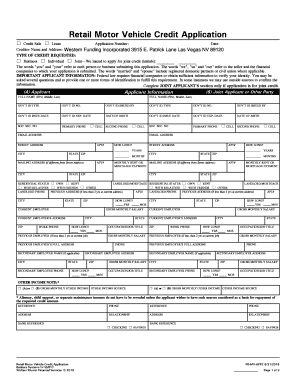

The Retail Motor Vehicle Credit Application DealerCenter Support is a specialized form used by dealerships to assess a customer's creditworthiness when purchasing a vehicle. This application collects essential financial information, allowing dealerships to make informed lending decisions. It is crucial for both the dealership and the customer, as it establishes the terms of financing and helps facilitate the vehicle purchase process.

Steps to complete the Retail Motor Vehicle Credit Application DealerCenter Support

Completing the Retail Motor Vehicle Credit Application DealerCenter Support involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal information, including your name, address, Social Security number, and employment details. Next, provide financial information such as income, monthly expenses, and existing debts. After filling out the application, review all entries for accuracy. Finally, sign the document electronically using a secure eSignature platform to ensure it is legally binding.

Legal use of the Retail Motor Vehicle Credit Application DealerCenter Support

The legal use of the Retail Motor Vehicle Credit Application DealerCenter Support is governed by regulations that ensure electronic signatures are valid and enforceable. To be legally binding, the application must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures carry the same weight as handwritten ones, provided certain conditions are met, such as consent to use electronic records and proper authentication of the signer's identity.

Key elements of the Retail Motor Vehicle Credit Application DealerCenter Support

Key elements of the Retail Motor Vehicle Credit Application DealerCenter Support include personal identification information, financial history, and consent for credit checks. The form typically requires details such as the applicant's full name, contact information, Social Security number, and income sources. Additionally, it may ask for information on current debts and assets to assess the applicant's financial stability. Consent for a credit check is also a critical component, allowing lenders to evaluate the applicant's creditworthiness.

Eligibility Criteria

Eligibility criteria for the Retail Motor Vehicle Credit Application DealerCenter Support vary by dealership but generally include age, residency, and credit history requirements. Applicants must typically be at least eighteen years old and a legal resident of the United States. A satisfactory credit history is often necessary to qualify for financing, although some dealerships may offer options for individuals with less-than-perfect credit. Understanding these criteria can help applicants prepare their information accordingly.

Form Submission Methods

The Retail Motor Vehicle Credit Application DealerCenter Support can be submitted through various methods, including online, by mail, or in-person at the dealership. Submitting the form online is often the most efficient option, allowing for quick processing and immediate feedback. Mail submissions may take longer due to postal delays, while in-person submissions provide an opportunity for immediate assistance from dealership staff. Each method has its advantages, depending on the applicant's preference and urgency.

Quick guide on how to complete retail motor vehicle credit application dealercenter support

Complete Retail Motor Vehicle Credit Application DealerCenter Support effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly and without delays. Manage Retail Motor Vehicle Credit Application DealerCenter Support on any platform using the airSlate SignNow Android or iOS apps and simplify any document-related task today.

How to edit and eSign Retail Motor Vehicle Credit Application DealerCenter Support with ease

- Obtain Retail Motor Vehicle Credit Application DealerCenter Support and click on Get Form to commence.

- Use the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Forge your signature using the Sign feature, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether it’s via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Retail Motor Vehicle Credit Application DealerCenter Support and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retail motor vehicle credit application dealercenter support

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Retail Motor Vehicle Credit Application DealerCenter Support?

The Retail Motor Vehicle Credit Application DealerCenter Support is a streamlined solution that allows dealerships to easily manage credit applications for vehicle purchases. This product integrates seamlessly with DealerCenter, providing a smooth experience for both dealers and customers. With airSlate SignNow, you can simplify the process and reduce paperwork hassles.

-

How does the Retail Motor Vehicle Credit Application DealerCenter Support benefit my dealership?

Using the Retail Motor Vehicle Credit Application DealerCenter Support enhances efficiency by enabling electronic signatures and quick processing. This means your sales team can focus on closing deals rather than managing paperwork. Additionally, it improves customer satisfaction by making the application process faster and more convenient.

-

Is there a cost associated with the Retail Motor Vehicle Credit Application DealerCenter Support?

Yes, there is a cost for using the Retail Motor Vehicle Credit Application DealerCenter Support, but it is designed to be a cost-effective solution for dealerships. Pricing can vary based on the features and volume of documents processed. For detailed information, you can contact our sales team for a personalized quote.

-

What features are included in the Retail Motor Vehicle Credit Application DealerCenter Support?

The Retail Motor Vehicle Credit Application DealerCenter Support includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features ensure that your dealership can maintain compliance while improving efficiency. You can also track the status of applications in real time to stay informed.

-

Can the Retail Motor Vehicle Credit Application DealerCenter Support integrate with my existing systems?

Absolutely! The Retail Motor Vehicle Credit Application DealerCenter Support is designed to integrate seamlessly with various systems, including DealerCenter. This integration helps reduce redundancy, allowing you to maintain a smooth workflow and accurate data management across your dealership operations.

-

How secure is the Retail Motor Vehicle Credit Application DealerCenter Support?

Security is a top priority with the Retail Motor Vehicle Credit Application DealerCenter Support. All documents and data are encrypted, ensuring that sensitive information is protected. Additionally, the platform complies with industry standards to provide peace of mind for dealerships and their customers.

-

What type of support is available for the Retail Motor Vehicle Credit Application DealerCenter Support users?

Users of the Retail Motor Vehicle Credit Application DealerCenter Support have access to a dedicated support team that is ready to assist with any questions or issues. Support options include live chat, email, and phone assistance, ensuring you receive timely help when needed. Our team is committed to helping you get the most out of the platform.

Get more for Retail Motor Vehicle Credit Application DealerCenter Support

Find out other Retail Motor Vehicle Credit Application DealerCenter Support

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple