Form 5695

What is the Form 5695

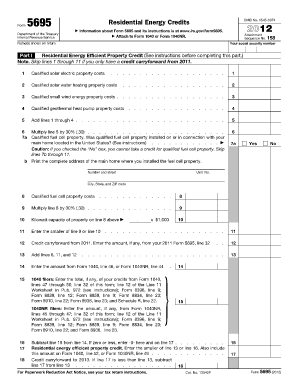

The Department of Treasury Form 5695, also known as the Residential Energy Credits form, is used by taxpayers in the United States to claim tax credits for specific energy-efficient home improvements. This form allows individuals to report eligible expenditures related to solar energy systems, energy-efficient windows, doors, and other qualifying improvements. The credits can provide significant financial benefits, helping to offset the costs of making homes more energy-efficient.

How to obtain the Form 5695

To obtain the Department of Treasury Form 5695, taxpayers can visit the official IRS website, where the form is available for download in PDF format. It is also possible to request a physical copy by contacting the IRS directly or visiting a local IRS office. Additionally, many tax preparation software programs include the form as part of their offerings, allowing users to fill it out digitally.

Steps to complete the Form 5695

Completing the Form 5695 involves several key steps:

- Gather necessary documentation, including receipts for eligible energy-efficient improvements.

- Fill out Part I to calculate the residential energy efficient property credit, detailing the costs associated with solar energy systems.

- Complete Part II to report other energy-efficient improvements, such as windows and doors, and calculate the corresponding credit.

- Transfer the total credits calculated on the form to your tax return, ensuring all information is accurate.

Legal use of the Form 5695

The Form 5695 must be completed accurately to ensure compliance with IRS regulations. Taxpayers should only claim credits for improvements that meet the IRS criteria for energy efficiency. Proper documentation and adherence to eligibility requirements are essential to avoid penalties or audits. It is advisable to consult IRS guidelines or a tax professional if there are uncertainties regarding the form's legal use.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with Form 5695. Typically, the form must be submitted along with the annual tax return by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but it is crucial to ensure that all forms, including Form 5695, are submitted by the extended deadline to avoid penalties.

Eligibility Criteria

To qualify for the credits claimed on Form 5695, taxpayers must meet specific eligibility criteria. These include:

- The improvements must be made to a primary residence located in the United States.

- Only certain types of energy-efficient improvements are eligible, as defined by the IRS.

- Taxpayers must have proper documentation, including receipts and manufacturer certifications, to substantiate their claims.

Form Submission Methods (Online / Mail / In-Person)

Form 5695 can be submitted in various ways, depending on how taxpayers file their taxes. For those using tax preparation software, the form can often be submitted electronically along with the tax return. Alternatively, taxpayers can print the completed form and mail it to the IRS. In-person submission is also possible at local IRS offices, although this method may require an appointment.

Quick guide on how to complete form 5695 100098126

Complete Form 5695 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the valid form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hold-ups. Manage Form 5695 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Form 5695 with ease

- Obtain Form 5695 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your adjustments.

- Select how you would like to deliver your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Revise and eSign Form 5695 to ensure smooth communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5695 100098126

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the department of treasury form 5695 and why is it important?

The department of treasury form 5695, also known as the Residential Energy Credits form, is used to claim tax credits for energy-efficient improvements made to your home. Understanding how to accurately complete this form can help you maximize your potential savings on your tax return, making it a valuable resource for homeowners.

-

How can I easily eSign the department of treasury form 5695 using airSlate SignNow?

With airSlate SignNow, you can effortlessly eSign the department of treasury form 5695 by uploading the document to our platform. Our user-friendly interface allows you to add your signature, initials, and any required information in just a few clicks, streamlining the signing process.

-

What features does airSlate SignNow offer for completing the department of treasury form 5695?

airSlate SignNow offers robust features for completing the department of treasury form 5695, including customizable templates, secure storage, and easy sharing options. These tools ensure that your document is not only correctly filled out but also securely accessible whenever you need it.

-

Is airSlate SignNow a cost-effective solution for managing department of treasury form 5695?

Yes, airSlate SignNow provides a cost-effective solution for managing the department of treasury form 5695. With competitive pricing and various subscription plans, businesses can save time and resources while efficiently handling their eSigning needs.

-

Can I integrate airSlate SignNow with other software to manage department of treasury form 5695?

Absolutely! airSlate SignNow offers integrations with numerous software applications, allowing you to streamline your workflow when managing the department of treasury form 5695. Whether it’s CRM systems or cloud storage, you can easily connect and automate processes.

-

What are the benefits of using airSlate SignNow for the department of treasury form 5695?

Using airSlate SignNow for the department of treasury form 5695 provides numerous benefits, such as faster turnaround times for document signing and improved tracking for tax preparation. Our platform enhances overall productivity, ensuring you stay organized and compliant.

-

How does airSlate SignNow ensure the security of my department of treasury form 5695?

airSlate SignNow prioritizes security by implementing encrypted storage and secure access protocols for your department of treasury form 5695. This ensures that your sensitive information remains protected while being available for authorized users.

Get more for Form 5695

- School records release form date requested as the parent stowe k12 vt

- Washington state patrol background check form solid ground solid ground

- Wcdjfs form

- Well being index form

- Guest ride along policy amp application city of mountlake terrace form

- Field trip form for rehearsal highline public schools highlineschools

- Vipassana igatpuri form

- Donation form for a team

Find out other Form 5695

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast