Cisp Form

What is the CISP?

The Cooperative Insurance System of the Philippines (CISP) is a unique insurance model designed to provide coverage through a cooperative framework. This system allows members to pool their resources to share risks and benefits. Unlike traditional insurance, CISP emphasizes community involvement and mutual support among its members, fostering a sense of belonging and collective responsibility. It is particularly beneficial for individuals and businesses seeking affordable insurance options while promoting local economic growth.

How to Use the CISP

Using the CISP involves a few essential steps to ensure that members can effectively access and benefit from the cooperative insurance model. First, individuals must join a cooperative that offers CISP coverage. After membership is established, members can submit applications for insurance coverage based on their specific needs. It is important to understand the terms and conditions associated with the coverage, including any exclusions or limitations. Regular participation in cooperative meetings and activities can also enhance the overall benefits received from the system.

Steps to Complete the CISP

Completing the CISP process requires careful attention to detail. Here are the basic steps:

- Join a cooperative that offers CISP coverage.

- Fill out the application form accurately, providing all necessary information.

- Submit required documentation, such as identification and proof of membership.

- Review the terms and conditions of the insurance policy.

- Pay any applicable premiums to activate the coverage.

Following these steps ensures that members can successfully obtain and utilize their CISP insurance effectively.

Legal Use of the CISP

The legal framework surrounding the CISP is vital for its operation and acceptance. CISP insurance is recognized under Philippine law, which provides guidelines on how cooperative insurance should be managed and regulated. Members must comply with the stipulations set forth by the cooperative and adhere to local regulations to ensure that their insurance coverage is valid and enforceable. Understanding these legal aspects helps protect members' rights and ensures that they receive the benefits promised by the cooperative.

Eligibility Criteria

To be eligible for CISP insurance, individuals must meet specific criteria established by the cooperative. Generally, eligibility includes:

- Membership in a recognized cooperative.

- Age requirements, often set between eighteen and sixty-five years.

- Submission of a completed application form with accurate information.

- Payment of initial premiums as outlined by the cooperative.

These criteria help ensure that members are adequately assessed for coverage and that the cooperative can manage risk effectively.

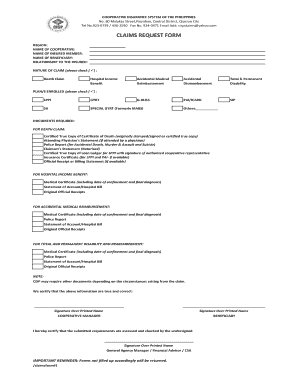

Required Documents

When applying for CISP insurance, members must prepare several key documents to facilitate the process. Commonly required documents include:

- A valid identification card to verify identity.

- Proof of membership in the cooperative.

- Completed application form with all necessary details.

- Any additional documents requested by the cooperative, such as medical records or financial statements.

Having these documents ready can streamline the application process and help ensure timely approval of coverage.

Quick guide on how to complete cisp

Prepare Cisp effortlessly on any device

Online document administration has become increasingly popular with businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents quickly without delays. Manage Cisp on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to alter and eSign Cisp effortlessly

- Locate Cisp and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Modify and eSign Cisp and ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cisp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cisp insurance and how does it relate to airSlate SignNow?

CISP insurance, or Commercial Insurance Service Policy, is designed to protect businesses from various risks. By using airSlate SignNow, companies can streamline their document signing processes while ensuring their contracts meet the legal standards required by CISP insurance companies.

-

How does airSlate SignNow ensure compliance with cisp insurance requirements?

airSlate SignNow provides features such as tamper-proof signatures and audit trails that help ensure compliance with cisp insurance standards. This means that all signed documents are legally binding and secure, which is crucial for businesses needing cisp insurance coverage.

-

Is airSlate SignNow affordable for companies needing cisp insurance?

Yes, airSlate SignNow offers cost-effective solutions tailored to various business sizes. This affordability is essential for companies seeking cisp insurance without breaking the bank on document management solutions.

-

What features does airSlate SignNow provide for businesses interested in cisp insurance?

airSlate SignNow includes features like template management, multi-party signing, and secure storage. These features cater specifically to businesses in need of cisp insurance by making document handling efficient and compliant.

-

Can airSlate SignNow integrate with other software for cisp insurance management?

Absolutely! airSlate SignNow easily integrates with various business software, including CRM and accounting systems, which is beneficial for managing cisp insurance processes. This capability allows companies to enhance productivity while maintaining compliance.

-

How does using airSlate SignNow improve the efficiency of handling cisp insurance documents?

Using airSlate SignNow improves efficiency through its user-friendly interface and automated workflows. This simplifies the process of signing and managing documents related to cisp insurance, which saves time and reduces the risk of errors.

-

Are electronic signatures on airSlate SignNow valid for cisp insurance purposes?

Yes, electronic signatures created with airSlate SignNow are legally valid and recognized across various jurisdictions. This validity is particularly important for documents related to cisp insurance, ensuring that agreements are enforceable.

Get more for Cisp

Find out other Cisp

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free