Indiana Corn Checkoff Refund Application 2015

What is the Indiana Corn Checkoff Refund Application

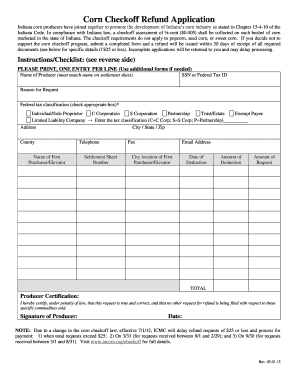

The Indiana Corn Checkoff Refund Application is a form used by corn producers in Indiana to request a refund of checkoff fees paid. These fees are typically collected to support various corn-related programs, including research, promotion, and education. Producers may be eligible for a refund if they meet specific criteria outlined by the Indiana Corn Marketing Council. Understanding this application is essential for those who wish to reclaim their contributions to the checkoff program.

Steps to complete the Indiana Corn Checkoff Refund Application

Completing the Indiana Corn Checkoff Refund Application involves several key steps:

- Gather necessary information, including your producer identification number and details about the checkoff fees paid.

- Access the refund application form, which can typically be found online or through the Indiana Corn Marketing Council.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information before submission.

- Submit the completed application via the designated method, whether online, by mail, or in-person.

Eligibility Criteria

To qualify for a refund through the Indiana Corn Checkoff Refund Application, producers must meet specific eligibility criteria. Generally, these include:

- Being a registered corn producer in Indiana.

- Having paid checkoff fees during the applicable period.

- Submitting the application within the designated timeframe set by the Indiana Corn Marketing Council.

It is important for producers to verify their eligibility before completing the application to ensure a smooth refund process.

Form Submission Methods

Producers can submit the Indiana Corn Checkoff Refund Application through various methods. These options may include:

- Online submission via the Indiana Corn Marketing Council's website, which often allows for quicker processing.

- Mailing the completed form to the appropriate address provided on the application.

- In-person submission at designated locations, if available.

Choosing the right submission method can impact the speed and efficiency of receiving a refund.

Legal use of the Indiana Corn Checkoff Refund Application

The Indiana Corn Checkoff Refund Application is legally binding when completed in accordance with state regulations. To ensure compliance, producers must:

- Provide accurate information as required by the application.

- Sign the application, either digitally or physically, depending on the submission method.

- Adhere to any deadlines for submission to avoid penalties or disqualification from receiving a refund.

Understanding the legal implications of the application can help producers navigate the refund process effectively.

Required Documents

When filling out the Indiana Corn Checkoff Refund Application, producers may need to provide supporting documents. These documents can include:

- Proof of payment for checkoff fees, such as receipts or invoices.

- Identification information, including a producer identification number.

- Any additional documentation requested by the Indiana Corn Marketing Council to verify eligibility.

Having these documents ready can streamline the application process and help ensure a successful refund request.

Quick guide on how to complete indiana corn checkoff refund application

Finalize Indiana Corn Checkoff Refund Application effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed files, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without holdups. Manage Indiana Corn Checkoff Refund Application on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient method to edit and electronically sign Indiana Corn Checkoff Refund Application with ease

- Locate Indiana Corn Checkoff Refund Application and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your desktop.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Indiana Corn Checkoff Refund Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana corn checkoff refund application

Create this form in 5 minutes!

How to create an eSignature for the indiana corn checkoff refund application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana corn checkoff refund form?

The Indiana corn checkoff refund form is a document that allows eligible corn farmers in Indiana to request a refund of their corn checkoff fees. This form helps in initiating the refund process, ensuring that farmers can reclaim their contributions toward corn promotion and research.

-

How do I fill out the Indiana corn checkoff refund form?

To fill out the Indiana corn checkoff refund form, you will need to provide personal information, including your farm details and the amount you are requesting as a refund. Ensure that all required fields are completed accurately to prevent delays in the processing of your request.

-

Where can I obtain the Indiana corn checkoff refund form?

You can obtain the Indiana corn checkoff refund form from the official Indiana Corn Marketing Council website or directly through your local agricultural extension office. Once you have the form, you can easily fill it out and submit it for processing.

-

What is the deadline for submitting the Indiana corn checkoff refund form?

The deadline for submitting the Indiana corn checkoff refund form typically falls within six months after the checkoff fees were collected. Be sure to check the specific deadlines on the Indiana Corn Marketing Council's website to ensure your submission is timely and eligible for processing.

-

Is there a fee associated with the Indiana corn checkoff refund form?

There is no fee to submit the Indiana corn checkoff refund form. It is a free process for eligible corn farmers who wish to request a refund of their checkoff contributions. Make sure to follow the correct submission procedures for a smooth experience.

-

What information do I need to provide for the Indiana corn checkoff refund form?

For the Indiana corn checkoff refund form, you will need to provide your name, address, farm identification number, and the amount you are requesting as a refund. Accurate information is crucial to ensure your application is processed without delays.

-

Can I track the status of my Indiana corn checkoff refund form?

Yes, you can track the status of your Indiana corn checkoff refund form by contacting the Indiana Corn Marketing Council. They provide updates on the processing of refund requests, allowing you to stay informed about your application.

Get more for Indiana Corn Checkoff Refund Application

- The delphi and nominal group technique in health service form

- Disc injury in hernando call morton chiropractic clinic form

- Client emergency contact form

- 2013 2019 form cg 20 15 fill online printable fillable blank

- Editable pdf patient intake form

- Accident claim form housatonic valley regional high school

- Dear patient to facilitate your first visit we ask that you kindly form

- Taxonomy crosswalk form

Find out other Indiana Corn Checkoff Refund Application

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter