Bank Alfalah Credit Card Form

What is the Bank Alfalah Credit Card

The Bank Alfalah Credit Card is a financial product that allows cardholders to make purchases on credit, enabling them to manage their expenses more flexibly. This card comes with various features, including reward points, cashback offers, and access to exclusive deals. Users can choose from different types of credit cards, such as the standard credit card, gold credit card, or premium options, each tailored to meet different financial needs and spending habits.

Eligibility Criteria

To qualify for a Bank Alfalah Credit Card, applicants typically need to meet certain eligibility requirements. These may include being at least eighteen years old, having a stable source of income, and possessing a good credit history. Additionally, the bank may require proof of identity and residence, along with any other documents that support the application. Meeting these criteria is essential for a smooth application process.

Application Process & Approval Time

The application process for a Bank Alfalah Credit Card can be completed online or in person at a bank branch. Applicants need to fill out a credit card application form, providing necessary personal and financial information. After submission, the bank reviews the application, which may take anywhere from a few days to a couple of weeks, depending on the volume of applications and the completeness of the submitted documents. Approval is communicated through email or SMS, and once approved, the card is usually mailed to the applicant's registered address.

Steps to Complete the Bank Alfalah Credit Card Limit Enhancement

Enhancing the credit limit on a Bank Alfalah Credit Card involves several steps. First, the cardholder should assess their current financial situation to determine the desired limit increase. Next, they can fill out the bank alfalah credit card limit increase form, providing details such as income, employment status, and any other relevant financial information. After submitting the form, the bank will review the request, and if approved, the new limit will be communicated to the cardholder. It is advisable to maintain a good payment history to improve the chances of approval for the limit enhancement.

Required Documents

When applying for a Bank Alfalah Credit Card or requesting a limit enhancement, certain documents are typically required. These may include:

- Proof of identity (such as a government-issued ID)

- Proof of income (such as recent pay stubs or tax returns)

- Proof of residence (such as a utility bill)

- Completed application form

Providing accurate and complete documentation can expedite the approval process and increase the likelihood of a successful application.

Legal Use of the Bank Alfalah Credit Card

The Bank Alfalah Credit Card must be used in accordance with the terms and conditions set by the bank. Cardholders are responsible for making timely payments to avoid penalties and maintain a good credit score. Additionally, understanding the legal implications of credit card use, such as interest rates, fees, and the impact of late payments, is crucial for responsible financial management. Compliance with these regulations ensures a positive experience with the credit card.

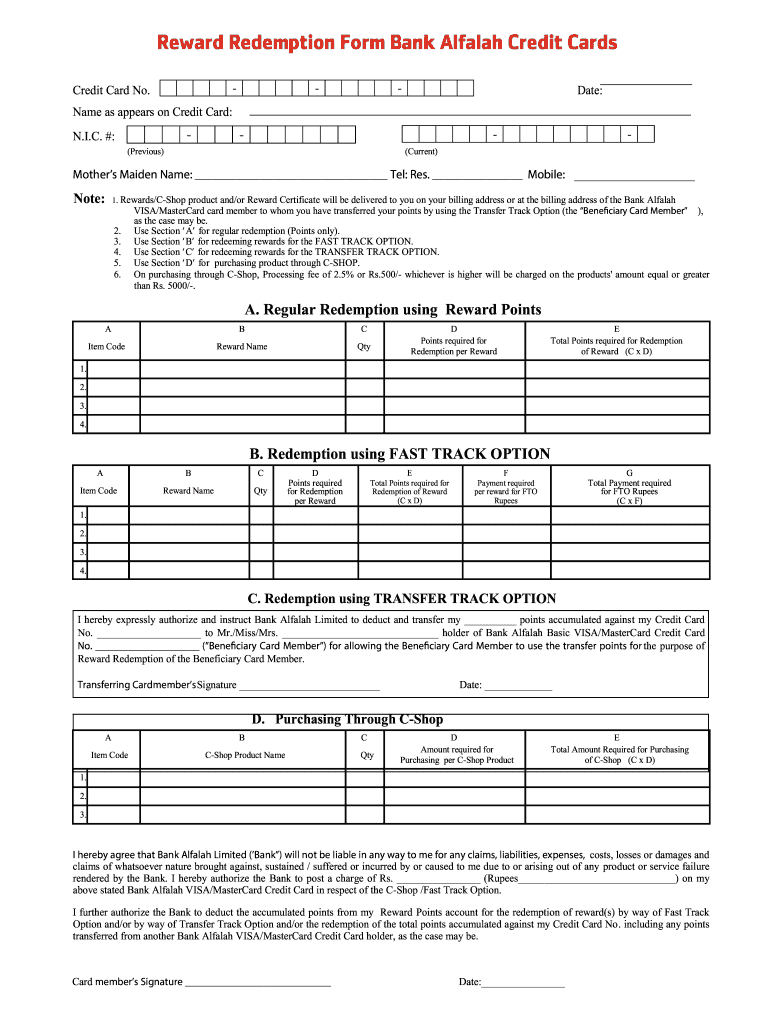

Quick guide on how to complete reward redemption form bank alfalah credit cards

Prepare Bank Alfalah Credit Card effortlessly on any device

Online document management has become increasingly popular with companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Bank Alfalah Credit Card on any device with airSlate SignNow's applications for Android or iOS and enhance any document-centered operation today.

The simplest way to alter and eSign Bank Alfalah Credit Card easily

- Locate Bank Alfalah Credit Card and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your amendments.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Bank Alfalah Credit Card and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can banks afford to offer credit card rewards?

Credit card offers are mixture of offers from:MerchantsBanks having agreements for offering special discounts for using their credit cards as it increases purchasing power of consumers.Bank’s discretion to part with part of Merchant fee charged for online transaction from Merchants.All the above make it possible for banks to offer credit cards rewards.

-

How can I convert my debit card/credit card reward points and send it back to my bank account?

Which card are you asking specifically? Debit card rewards point should be redeemed as cashback. But Credit card rewards point cannot be sent to bank account directly. You can redeem it as voucher for specific brands. For Amex, you can convert rewards points as credit balance which will be deducted in next purchase amount or statement.

-

How do banks make money even after offering reward points to credit card customers?

Banks give reward points, loyalty points to attract customers to their fold. They generally allow reward points for products with whom they have tie up arrangement and earn interest and commission from them for business dealings. Out of that part is given to retail customers by way of reward points. Not only banks but also medicine companies and e-commerce agents supply products below retail price. Now-a-days, banks allow loyalty points for ATM cash withdrawn from the same bank. This is due to the fact that cash is a costly item and it is expensive to replenish it. Other banks take service charge for rendering such service to customers of another bank.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

Create this form in 5 minutes!

How to create an eSignature for the reward redemption form bank alfalah credit cards

How to make an electronic signature for your Reward Redemption Form Bank Alfalah Credit Cards online

How to create an eSignature for your Reward Redemption Form Bank Alfalah Credit Cards in Chrome

How to generate an electronic signature for signing the Reward Redemption Form Bank Alfalah Credit Cards in Gmail

How to create an eSignature for the Reward Redemption Form Bank Alfalah Credit Cards from your smart phone

How to generate an eSignature for the Reward Redemption Form Bank Alfalah Credit Cards on iOS devices

How to make an eSignature for the Reward Redemption Form Bank Alfalah Credit Cards on Android devices

People also ask

-

What is the process for bank Alfalah credit card limit enhancement?

The process for bank Alfalah credit card limit enhancement begins with reviewing your current credit card usage and payment history. Customers can apply for a limit increase online or by visiting a bank branch. Approval depends on factors like income and creditworthiness, making it essential to maintain healthy financial behavior for the best chances of enhancement.

-

How can I check my eligibility for bank Alfalah credit card limit enhancement?

To check your eligibility for bank Alfalah credit card limit enhancement, you can contact customer service or log into your online banking account. Maintain a good credit score and consistent payment history, as these factors signNowly influence your eligibility. Additionally, regular spending and responsible credit use contribute to the chances of receiving a limit enhancement.

-

What are the benefits of bank Alfalah credit card limit enhancement?

The bank Alfalah credit card limit enhancement offers several benefits, including increased purchasing power, better cash flow management, and the ability to make larger purchases without exceeding the limit. This enhancement can also positively impact your credit score, as it lowers your credit utilization ratio. Ultimately, a higher limit provides financial flexibility for unexpected expenses.

-

Are there any fees associated with bank Alfalah credit card limit enhancement?

Typically, there are no explicit fees associated with bank Alfalah credit card limit enhancement. However, it's essential to review your credit card agreement for any potential fees related to annual charges or late payments that could impact your credit limit. Conducting this enhancement responsibly helps avoid unnecessary fees while improving your financial position.

-

How long does it take to get a decision on my bank Alfalah credit card limit enhancement request?

The decision process for a bank Alfalah credit card limit enhancement typically takes a few business days. Once your application is submitted, the bank will review your credit profile and financial history. You will be notified via email or SMS regarding the outcome of your request, ensuring prompt communication on important financial decisions.

-

Can I request a bank Alfalah credit card limit enhancement if I have a low credit score?

While it is possible to request a bank Alfalah credit card limit enhancement with a low credit score, approval may be challenging. Most banks prefer applicants with a healthy credit history and strong income level. It may be advisable to improve your credit score first before requesting a limit enhancement to increase your chances of approval.

-

What factors are considered for bank Alfalah credit card limit enhancement?

Factors considered for bank Alfalah credit card limit enhancement include your credit score, payment history, current credit utilization, and income level. The bank evaluates your overall financial behavior to assess risk. Demonstrating responsible spending and timely payments signNowly boosts your chances for a successful enhancement.

Get more for Bank Alfalah Credit Card

- Tabc 60 day sign form

- Punjabi university patiala degree certificate download form

- Bakerripley rental assistance application 2022 form

- College fee receipt format in excel

- Dbt worksheets form

- City of frankfort business license application frankfort ky gov form

- A state by state guide to medicaid do i qualify form

- Ohio it 10 do not staple or paper clip zero form

Find out other Bank Alfalah Credit Card

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF