Affidavit Cherokee County 2013-2026

What is the Affidavit Cherokee County

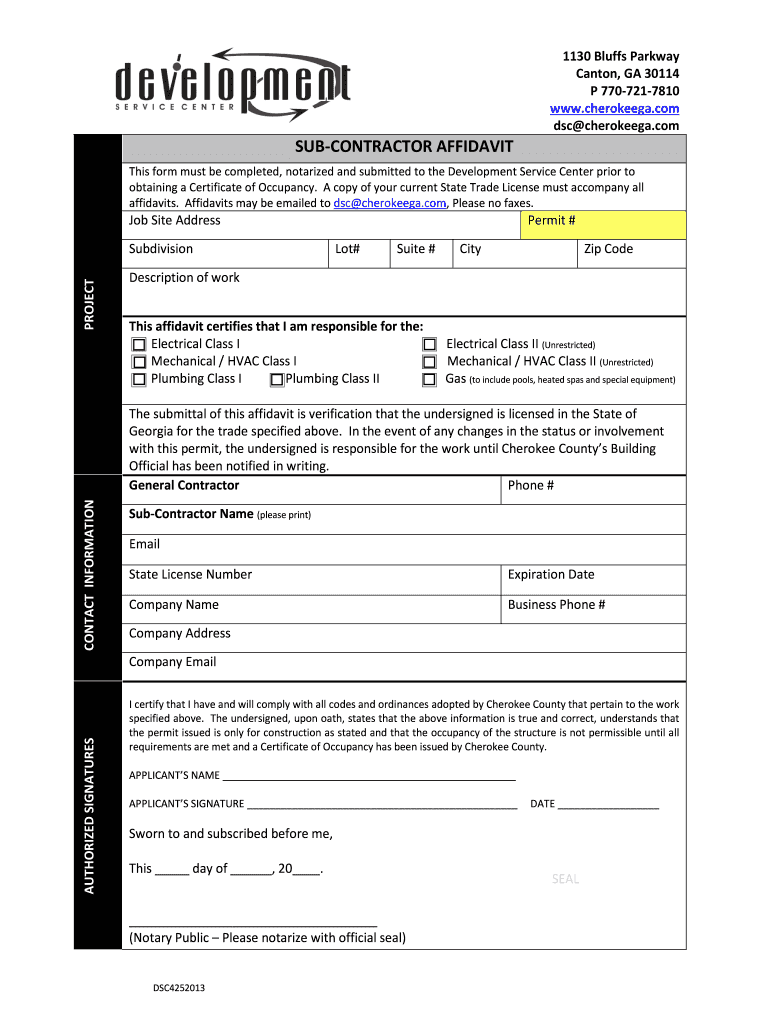

The Affidavit Cherokee County is a legal document used to affirm the truthfulness of certain statements or claims within Cherokee County, Georgia. This affidavit serves various purposes, including verifying the identity of individuals, confirming business operations, or attesting to specific facts required by local government or legal entities. It is crucial for individuals and businesses to understand the significance of this document, as it can impact legal proceedings and compliance with local regulations.

How to obtain the Affidavit Cherokee County

Obtaining the Affidavit Cherokee County involves a straightforward process. Individuals can typically acquire the form from the Cherokee County government office or their official website. It is important to ensure that the form is the most current version, as outdated forms may not be accepted. Additionally, applicants may need to provide identification or supporting documents to complete the process successfully.

Steps to complete the Affidavit Cherokee County

Completing the Affidavit Cherokee County requires careful attention to detail. Here are the essential steps:

- Download or obtain the affidavit form from the appropriate source.

- Read the instructions thoroughly to understand the requirements.

- Fill in all required fields with accurate information.

- Sign the affidavit in the presence of a notary public, if required.

- Submit the completed affidavit to the relevant authority or retain it for your records.

Legal use of the Affidavit Cherokee County

The legal use of the Affidavit Cherokee County is governed by state laws and local regulations. It is essential that the affidavit is filled out correctly and submitted to the appropriate authorities to avoid legal complications. This document may be used in various legal contexts, such as court cases, business transactions, or when applying for permits. Understanding the legal implications of the affidavit ensures compliance and protects the rights of the individual or business involved.

Key elements of the Affidavit Cherokee County

Several key elements must be included in the Affidavit Cherokee County to ensure its validity. These elements typically include:

- The full name and address of the affiant (the person signing the affidavit).

- A clear statement of the facts being affirmed.

- The date of signing.

- The signature of the affiant.

- Notary acknowledgment, if required.

Required Documents

When completing the Affidavit Cherokee County, certain documents may be required to support the claims made within the affidavit. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Supporting documents that validate the statements made in the affidavit.

- Any previous affidavits or legal documents relevant to the current affidavit.

Quick guide on how to complete sub contractor affidavit cherokee county government

Handle Affidavit Cherokee County from anywhere, at any moment

Your daily organizational tasks may require additional attention when managing state-specific business documents. Reclaim your work hours and minimize the costs related to paperwork by utilizing airSlate SignNow. airSlate SignNow provides a variety of pre-loaded business documents, including Affidavit Cherokee County, which can be utilized and shared with your business associates. Easily manage your Affidavit Cherokee County with robust editing and electronic signature tools, and send it straight to your recipients.

How to obtain Affidavit Cherokee County in a few clicks:

- Choose a form pertaining to your state.

- Click on Learn More to view the document and verify its accuracy.

- Select Get Form to begin working on it.

- Affidavit Cherokee County will promptly appear in the editor. No further steps are needed.

- Utilize airSlate SignNow’s advanced editing features to complete or amend the document.

- Click the Sign option to create your personal signature and eSign your document.

- When ready, simply click Done, save the changes, and access your document.

- Send the document via email or text, or use a link-to-fill feature with your colleagues or allow them to download the files.

airSlate SignNow greatly reduces the time spent managing Affidavit Cherokee County and enables you to locate necessary documents in one location. A comprehensive library of forms is organized and designed to address essential business functions required for your organization. The sophisticated editor minimizes the likelihood of mistakes, allowing you to easily rectify issues and review your documents on any device before sending them out. Start your free trial today to discover all the advantages of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

FAQs

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

If I am living in UK with T2 General visa and work as a contractor for a US company with W-8BEN form filled out, do I still need to pay income tax to the UK government?

Yes.Every country in the world taxes people who live there. The US (which claims global jurisdiction over its citizens) taxes you because you are a citizen, the UK (which accepts that its jurisdiction stops at its own border, like every other country except the US) taxes you because you are present and earning money.But you don’t pay tax twice.The UK gets the first bite of the cherry - you’re living there, so you should pay towards public services. If you’re resident, you are taxed like the British taxpayers alongside whom you work, except if you have US investment or rental income that you don’t transfer or remit to the UK, special rules for ‘non-domiciled’ visitors may mean there’s no UK tax on this non-UK income (this is a complex area - take proper advice).You then report all your income to Uncle Sam too. The IRS lets you exclude a certain amount of foreign earned income for US tax purposes (up to $103,900 for 2018). If, even with the exclusion, you still owe US income taxes on your UK compensation, you should be able to claim a credit for UK taxes paid that reduces your US tax liability.Again, this is a complex area - take proper advice.It’s actually even more complex, because social security taxes operate under different rules. You should pay in only the UK or the US, but which country’s rules apply depends on the exact circumstances and how they fit with the US-UK bilateral social security treaty.Take advice (I hope that is clear by now!).

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

Create this form in 5 minutes!

How to create an eSignature for the sub contractor affidavit cherokee county government

How to generate an electronic signature for your Sub Contractor Affidavit Cherokee County Government online

How to make an electronic signature for your Sub Contractor Affidavit Cherokee County Government in Chrome

How to make an electronic signature for signing the Sub Contractor Affidavit Cherokee County Government in Gmail

How to create an electronic signature for the Sub Contractor Affidavit Cherokee County Government from your mobile device

How to create an electronic signature for the Sub Contractor Affidavit Cherokee County Government on iOS

How to generate an electronic signature for the Sub Contractor Affidavit Cherokee County Government on Android devices

People also ask

-

What is the affidavit Cherokee County form?

The affidavit Cherokee County form is a legal document used to declare facts that are true to the best of your knowledge. This form is often required for various legal proceedings in Cherokee County, ensuring that the information provided is sworn to be accurate. Utilizing airSlate SignNow, you can easily fill out and eSign this document online.

-

How can I access the affidavit Cherokee County form using airSlate SignNow?

You can access the affidavit Cherokee County form by visiting the airSlate SignNow platform. Simply create an account, and you will have access to a wide range of templates, including the affidavit forms specifically for Cherokee County. The user-friendly interface allows for quick navigation and document retrieval.

-

Is there a cost associated with using the affidavit Cherokee County form on airSlate SignNow?

While airSlate SignNow offers both free and paid plans, accessing the affidavit Cherokee County form may require a subscription based on your needs. Each plan encompasses various features that can enhance your document signing experience. It's advisable to review the pricing options to find the best fit for your requirements.

-

What features does airSlate SignNow offer for the affidavit Cherokee County form?

airSlate SignNow provides a range of features for the affidavit Cherokee County form, including easy document creation, eSigning capability, and real-time collaboration. You can also track the status of your documents and receive automated reminders for signing. These features enhance efficiency and ensure compliance throughout the process.

-

Can I integrate airSlate SignNow with other applications when using the affidavit Cherokee County form?

Yes, airSlate SignNow allows integration with various applications, enhancing your workflow when using the affidavit Cherokee County form. You can connect with tools like Google Drive, Dropbox, and CRM platforms, helping you streamline document management and reducing the need for switching between apps.

-

What are the benefits of using airSlate SignNow for the affidavit Cherokee County form?

Using airSlate SignNow for the affidavit Cherokee County form offers signNow benefits, including a streamlined workflow and improved document security. You can quickly send and receive signed documents, leading to faster processing times. Additionally, the platform's compliance features ensure that your documents meet all legal standards.

-

How secure is the affidavit Cherokee County form on airSlate SignNow?

The affidavit Cherokee County form processed through airSlate SignNow is highly secure, as the platform employs top-notch encryption and secure data storage. With features like two-factor authentication, you can rest assured that your sensitive information is protected. airSlate SignNow prioritizes data privacy and regulatory compliance.

Get more for Affidavit Cherokee County

Find out other Affidavit Cherokee County

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document