Kdororgtaxclearanceselfdefaultaspx Form

What is the Kdororgtaxclearanceselfdefaultaspx Form

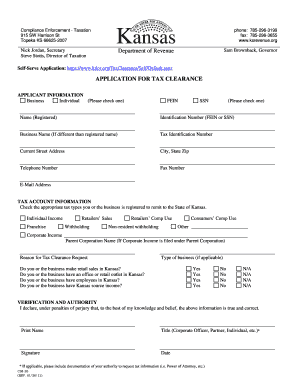

The Kdororgtaxclearanceselfdefaultaspx form is a document used primarily for tax clearance purposes in the United States. This form serves as a request for a tax clearance certificate, which verifies that an individual or business has met all tax obligations. It is essential for various transactions, including business licenses, permits, and other legal requirements. Understanding the purpose and implications of this form is crucial for compliance with state tax regulations.

How to use the Kdororgtaxclearanceselfdefaultaspx Form

Using the Kdororgtaxclearanceselfdefaultaspx form involves a straightforward process. First, gather all necessary information, including your tax identification number and details of your tax filings. Next, access the form through the appropriate state tax authority's website. Fill out the required fields accurately, ensuring that all information matches your tax records. Once completed, submit the form electronically or as instructed by the state guidelines. It is important to keep a copy for your records.

Steps to complete the Kdororgtaxclearanceselfdefaultaspx Form

Completing the Kdororgtaxclearanceselfdefaultaspx form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including previous tax returns and identification.

- Access the form through the official state tax website.

- Fill in your personal or business information, ensuring accuracy.

- Provide any additional information requested, such as tax year details.

- Review the completed form for errors or omissions.

- Submit the form electronically or as directed, and retain a copy for your records.

Legal use of the Kdororgtaxclearanceselfdefaultaspx Form

The Kdororgtaxclearanceselfdefaultaspx form is legally binding when completed and submitted according to state regulations. It is essential to understand that providing false information can lead to penalties, including fines or legal action. To ensure legal compliance, utilize a reliable electronic signature solution that adheres to the ESIGN and UETA acts. This guarantees that your submission is recognized as valid and enforceable in a legal context.

Required Documents

When preparing to complete the Kdororgtaxclearanceselfdefaultaspx form, certain documents are typically required. These may include:

- Tax identification number (TIN) or Social Security number (SSN).

- Recent tax returns for verification of tax obligations.

- Any correspondence from the tax authority regarding outstanding taxes.

- Proof of identity, such as a driver's license or state ID.

Form Submission Methods

The Kdororgtaxclearanceselfdefaultaspx form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's website.

- Mailing a printed version of the form to the appropriate tax office.

- In-person submission at designated tax office locations.

Quick guide on how to complete kdororgtaxclearanceselfdefaultaspx form

Ready Kdororgtaxclearanceselfdefaultaspx Form seamlessly on any device

Web-based document administration has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, as you can locate the necessary form and safely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly without interruptions. Manage Kdororgtaxclearanceselfdefaultaspx Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Kdororgtaxclearanceselfdefaultaspx Form effortlessly

- Obtain Kdororgtaxclearanceselfdefaultaspx Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choosing. Adjust and eSign Kdororgtaxclearanceselfdefaultaspx Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kdororgtaxclearanceselfdefaultaspx form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kdororgtaxclearanceselfdefaultaspx Form?

The Kdororgtaxclearanceselfdefaultaspx Form is a crucial document used for tax clearance purposes. With airSlate SignNow, you can easily fill out and eSign this form, streamlining the process of obtaining your tax clearance.

-

How can airSlate SignNow help me with the Kdororgtaxclearanceselfdefaultaspx Form?

airSlate SignNow provides an intuitive platform for completing and electronically signing the Kdororgtaxclearanceselfdefaultaspx Form. Our solution ensures that you can manage your documents seamlessly, enhancing efficiency in your tax-related processes.

-

What are the pricing options for using airSlate SignNow for the Kdororgtaxclearanceselfdefaultaspx Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose the plan that best suits your requirements for managing the Kdororgtaxclearanceselfdefaultaspx Form and other documents, providing cost-effective solutions for eSigning.

-

Is the Kdororgtaxclearanceselfdefaultaspx Form legally binding when signed through airSlate SignNow?

Yes, signatures made on the Kdororgtaxclearanceselfdefaultaspx Form through airSlate SignNow are legally binding. Our platform complies with electronic signature laws, ensuring that your signed documents hold the same legal weight as traditional paper signatures.

-

Can I integrate airSlate SignNow with other applications to manage the Kdororgtaxclearanceselfdefaultaspx Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for the Kdororgtaxclearanceselfdefaultaspx Form. Connect with popular tools like Google Drive, Dropbox, and more to enhance document management.

-

What features does airSlate SignNow offer for handling the Kdororgtaxclearanceselfdefaultaspx Form?

AirSlate SignNow provides features like templates, automated workflows, and real-time tracking to simplify managing the Kdororgtaxclearanceselfdefaultaspx Form. These tools help reduce errors and improve the efficiency of document handling.

-

How secure is the electronic signing process for the Kdororgtaxclearanceselfdefaultaspx Form?

The security of your documents is our top priority. When you use airSlate SignNow to eSign the Kdororgtaxclearanceselfdefaultaspx Form, your data is protected with bank-level encryption, ensuring complete confidentiality and security.

Get more for Kdororgtaxclearanceselfdefaultaspx Form

Find out other Kdororgtaxclearanceselfdefaultaspx Form

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF