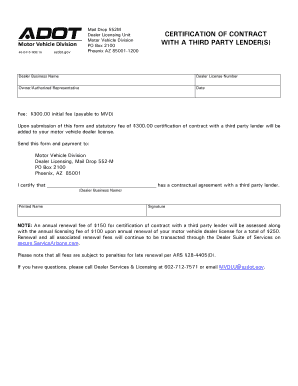

Arizona Lender Form

What is the Arizona Lender Form

The Arizona lender form is a crucial document used in the state of Arizona for various lending transactions. This form serves as a legal agreement between the lender and the borrower, outlining the terms and conditions of the loan. It is essential for ensuring that both parties are aware of their rights and obligations. The Arizona lender form is particularly relevant in real estate transactions, personal loans, and business financing. Understanding its components is vital for both lenders and borrowers to avoid potential disputes.

How to use the Arizona Lender Form

Using the Arizona lender form involves several steps to ensure compliance and legal validity. Initially, both parties must review the terms of the loan, including interest rates, repayment schedules, and any collateral involved. Once all terms are agreed upon, the form can be filled out electronically or in print. It is important to provide accurate information to avoid any issues during the loan process. After completing the form, both parties must sign it, preferably using a secure electronic signature solution to enhance the legality and security of the document.

Steps to complete the Arizona Lender Form

Completing the Arizona lender form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including borrower and lender details.

- Clearly state the loan amount, interest rate, and repayment terms.

- Include any fees or additional costs associated with the loan.

- Specify the collateral, if applicable, to secure the loan.

- Review the form for accuracy and completeness.

- Sign the form using a reliable electronic signature platform for added security.

Legal use of the Arizona Lender Form

The legal use of the Arizona lender form is governed by state laws and regulations. To be considered legally binding, the form must meet specific criteria, including proper signatures and adherence to the Arizona Revised Statutes. It is essential for both parties to understand their rights under the law, including the implications of defaulting on the loan. Utilizing a trusted electronic signature solution can help ensure that the form complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Key elements of the Arizona Lender Form

Several key elements must be included in the Arizona lender form to ensure its effectiveness and legality:

- Borrower and Lender Information: Full names, addresses, and contact details of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan, clearly stated.

- Repayment Schedule: Details on how and when payments will be made.

- Collateral: Any assets pledged to secure the loan.

- Signatures: Both parties must sign the form to validate the agreement.

Who Issues the Form

The Arizona lender form is typically issued by financial institutions, private lenders, or can be created by legal professionals specializing in lending agreements. It is important for the form to be tailored to the specific transaction and comply with Arizona laws. Many lenders provide their own versions of the form that include all necessary legal language and requirements, ensuring that both parties are protected throughout the lending process.

Quick guide on how to complete arizona lender form

Prepare Arizona Lender Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an optimal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the features necessary to generate, modify, and electronically sign your documents promptly. Manage Arizona Lender Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to adjust and electronically sign Arizona Lender Form without hassle

- Obtain Arizona Lender Form and select Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Arizona Lender Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona lender form

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are the benefits of using an Arizona lender for e-signature services?

Using an Arizona lender for e-signature services like airSlate SignNow provides you with a reliable solution that streamlines document management. Arizona lenders understand local regulations and can ensure compliance, saving you time and headaches. Additionally, these lenders typically offer personalized customer support tailored to your needs.

-

How does airSlate SignNow integrate with Arizona lenders?

airSlate SignNow seamlessly integrates with various Arizona lenders to enhance your document workflows. These integrations allow you to send and eSign critical documents directly from your lender's platform. This functionality helps you improve efficiency and maintain all your processes in one place.

-

What pricing plans are available for Arizona lenders using airSlate SignNow?

airSlate SignNow offers competitive pricing plans specifically designed for Arizona lenders. Whether you need basic functionalities or advanced features, there are plans to fit every budget. The transparent pricing structure makes it easy to choose the right option, ensuring you get the best value for your investment.

-

Is airSlate SignNow secure for interactions with an Arizona lender?

Yes, airSlate SignNow prioritizes security, making it an excellent choice for interactions with an Arizona lender. Documents are encrypted, and the platform complies with industry-leading security standards. This ensures that your sensitive information remains safe during transactions.

-

Can Arizona lenders customize document templates in airSlate SignNow?

Absolutely! Arizona lenders can customize document templates in airSlate SignNow to suit their specific needs. This feature allows you to create branded, professional documents quickly, ensuring that they meet compliance standards while also reflecting your brand's identity.

-

What industries can benefit from using an Arizona lender in conjunction with airSlate SignNow?

Various industries, including real estate, finance, and legal services, can benefit from using an Arizona lender with airSlate SignNow. The platform's flexibility allows it to cater specifically to the unique needs within these sectors, enhancing communication and speeding up transaction times.

-

How can airSlate SignNow help streamline processes for Arizona lenders?

airSlate SignNow can signNowly streamline processes for Arizona lenders by automating document workflows and reducing manual tasks. This efficiency leads to quicker turnaround times on loans and transactions, ultimately improving customer satisfaction and retention. By going digital, lenders can also reduce paper waste and associated costs.

Get more for Arizona Lender Form

Find out other Arizona Lender Form

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe