Vat 61a Form

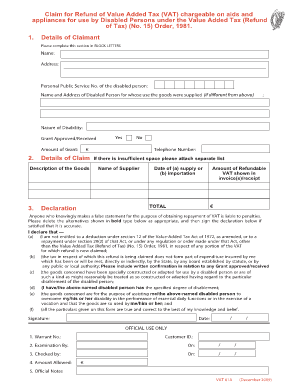

What is the Vat 61a Form

The Vat 61a form is a document used primarily for tax purposes, specifically related to value-added tax (VAT) in the United States. This form is essential for businesses and individuals who need to report VAT-related transactions to the relevant tax authorities. It helps in ensuring compliance with tax regulations and provides a clear record of VAT collected and paid. Understanding the purpose and requirements of the Vat 61a form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Vat 61a Form

Using the Vat 61a form involves several steps to ensure proper completion and submission. First, gather all necessary financial records related to VAT transactions, including sales invoices and receipts. Next, accurately fill out the form with the required information, such as the total VAT collected and any VAT paid on purchases. After completing the form, review it for accuracy to prevent errors that could lead to complications with tax authorities. Finally, submit the form according to the specified filing method, whether online or via mail.

Steps to complete the Vat 61a Form

Completing the Vat 61a form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, including invoices and receipts.

- Access the Vat 61a form through the appropriate tax authority website or office.

- Fill in the required fields, ensuring all figures are accurate and reflect your records.

- Double-check the calculations for VAT collected and paid.

- Sign and date the form as required.

- Submit the completed form by the deadline set by the tax authority.

Legal use of the Vat 61a Form

The legal use of the Vat 61a form is governed by tax regulations that require accurate reporting of VAT transactions. This form must be completed truthfully and submitted in accordance with the law to avoid penalties. Failure to comply with the legal requirements can result in fines or audits by tax authorities. Therefore, it is essential to understand the legal implications of using the Vat 61a form and ensure that all information provided is correct and verifiable.

Key elements of the Vat 61a Form

Several key elements must be included when completing the Vat 61a form. These include:

- Name and address of the taxpayer or business.

- Tax identification number (TIN).

- Total sales subject to VAT.

- Total VAT collected during the reporting period.

- Any VAT paid on purchases.

- Signature of the individual completing the form.

Form Submission Methods

The Vat 61a form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's electronic filing system.

- Mailing a printed version of the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete vat 61a form

Effortlessly Prepare Vat 61a Form on Any Gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Vat 61a Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Vat 61a Form effortlessly

- Obtain Vat 61a Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Edit and eSign Vat 61a Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 61a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vat61a form and how can airSlate SignNow help with it?

The vat61a form is an essential document for businesses in the UK to report and account for VAT. airSlate SignNow simplifies the process of sending and eSigning the vat61a form, ensuring that your documents are completed accurately and securely.

-

Is airSlate SignNow suitable for handling the vat61a form?

Yes, airSlate SignNow is designed to handle various forms, including the vat61a form. Our platform provides an intuitive interface that allows users to easily create, send, and sign this document without any hassle.

-

What are the pricing options for using airSlate SignNow for the vat61a form?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Each plan provides the tools necessary for efficient management of documents, including the vat61a form, ensuring you get the best value for your investment.

-

Can airSlate SignNow integrate with other software to manage the vat61a form?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications, allowing you to manage the vat61a form alongside your existing workflows. This integration helps streamline your processes and improve overall efficiency.

-

What features does airSlate SignNow provide for the vat61a form?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure eSignature capabilities specifically for the vat61a form. These tools help ensure that your documents are processed swiftly and securely.

-

How does using airSlate SignNow benefit my business when handling the vat61a form?

Using airSlate SignNow for the vat61a form enhances your business's efficiency by saving time and reducing paper usage. Additionally, our secure eSignature process reduces the risk of errors, helping you stay compliant with VAT regulations.

-

Is it easy to get started with airSlate SignNow for the vat61a form?

Yes, getting started with airSlate SignNow is quick and user-friendly. You can easily create your first vat61a form in minutes and begin benefiting from our intuitive platform designed for businesses of all sizes.

Get more for Vat 61a Form

Find out other Vat 61a Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe