Global Blue Tax Form PDF

What is the Global Blue Tax Form Pdf

The Global Blue Tax Form Pdf is a document designed for travelers who wish to claim a tax refund on purchases made while visiting the United States. This form facilitates the process of reclaiming sales tax on eligible items purchased during a trip. It is particularly useful for international visitors who may not be familiar with the local tax regulations. The form must be filled out accurately to ensure compliance with tax laws and to facilitate a smooth refund process.

How to Obtain the Global Blue Tax Form Pdf

To obtain the Global Blue Tax Form Pdf, travelers can visit the official Global Blue website or contact their customer service for assistance. Many retailers participating in the Global Blue tax refund scheme also provide the form at the point of sale. It is essential to ensure that the form is the correct version and is filled out properly to avoid delays in processing the refund.

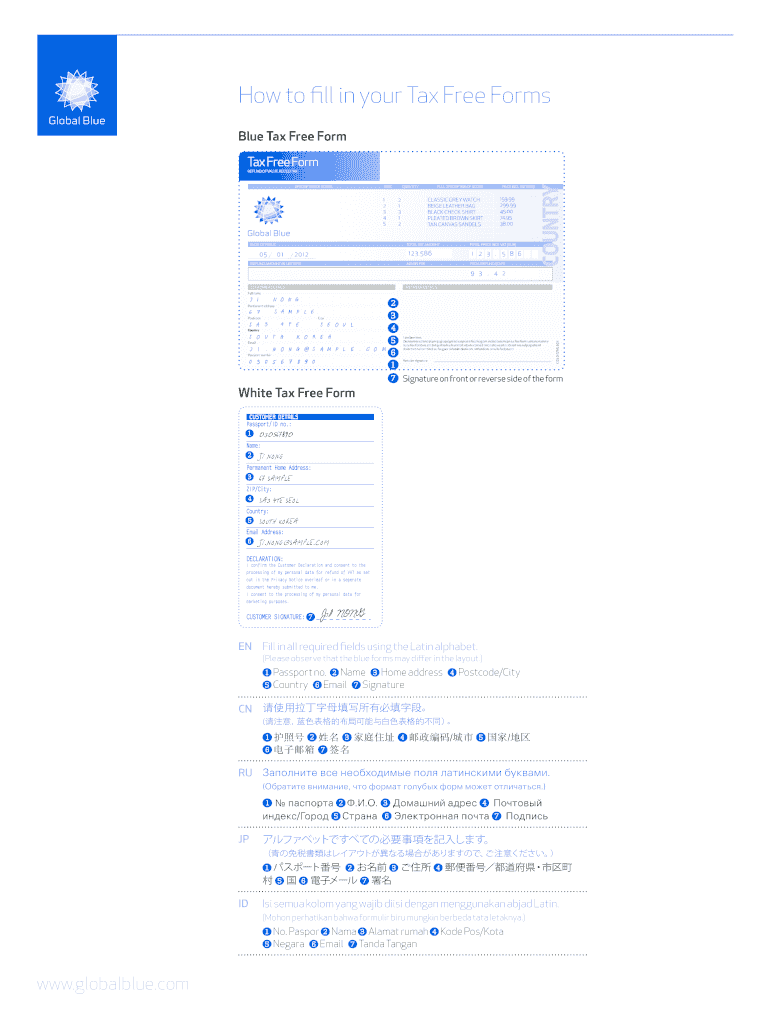

Steps to Complete the Global Blue Tax Form Pdf

Completing the Global Blue Tax Form Pdf involves several key steps:

- Gather all necessary receipts and documentation for the purchases made.

- Fill in personal details such as name, address, and passport number on the form.

- List the purchased items, including their prices and the corresponding tax amounts.

- Sign and date the form to validate the information provided.

- Submit the completed form along with the receipts to the designated refund office or retailer.

Legal Use of the Global Blue Tax Form Pdf

The Global Blue Tax Form Pdf is legally recognized as a valid document for claiming tax refunds. To ensure its legal standing, it must be filled out in accordance with U.S. tax laws and regulations. This includes providing accurate information and submitting the form within the required time frame. Compliance with these guidelines helps prevent issues with tax authorities and facilitates a smoother refund process.

Key Elements of the Global Blue Tax Form Pdf

Several key elements are essential for the Global Blue Tax Form Pdf to be valid:

- Personal Information: This includes the traveler’s name, address, and passport number.

- Purchase Details: A detailed list of items purchased, including prices and tax amounts.

- Signature: The traveler’s signature confirms the accuracy of the information provided.

- Date: The date of signature is crucial for compliance with submission deadlines.

Form Submission Methods

The Global Blue Tax Form Pdf can be submitted through various methods:

- Online Submission: Some retailers allow electronic submission of the form through their websites.

- Mail: The completed form can be mailed to the designated tax refund office.

- In-Person: Travelers can submit the form in person at participating retailers or refund offices.

Quick guide on how to complete global blue tax form pdf

Effortlessly Prepare Global Blue Tax Form Pdf on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Global Blue Tax Form Pdf on any device with the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The Easiest Way to Modify and eSign Global Blue Tax Form Pdf Seamlessly

- Find Global Blue Tax Form Pdf and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Alter and eSign Global Blue Tax Form Pdf and guarantee smooth communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the global blue tax form pdf

How to generate an eSignature for the Global Blue Tax Form Pdf online

How to make an electronic signature for the Global Blue Tax Form Pdf in Google Chrome

How to generate an electronic signature for signing the Global Blue Tax Form Pdf in Gmail

How to generate an electronic signature for the Global Blue Tax Form Pdf straight from your smartphone

How to create an eSignature for the Global Blue Tax Form Pdf on iOS

How to make an eSignature for the Global Blue Tax Form Pdf on Android OS

People also ask

-

What is the Global Blue Tax Form Pdf and how can I use it?

The Global Blue Tax Form Pdf is a document used for reclaiming VAT on eligible purchases made abroad. With airSlate SignNow, you can easily fill out, sign, and manage your Global Blue Tax Form Pdf, ensuring a smooth process for tax refunds.

-

How does airSlate SignNow help with the Global Blue Tax Form Pdf?

airSlate SignNow allows you to upload, complete, and eSign your Global Blue Tax Form Pdf quickly and securely. Our platform streamlines the process, making it easier to manage your tax refund requests without the hassle of printing and mailing documents.

-

Is there a cost associated with using airSlate SignNow for the Global Blue Tax Form Pdf?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs. You can use our services for the Global Blue Tax Form Pdf at a competitive price, with options for businesses and individuals, ensuring you get the best value for your document signing needs.

-

Can I integrate airSlate SignNow with other tools for my Global Blue Tax Form Pdf?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This means you can easily manage your Global Blue Tax Form Pdf alongside your other business documents.

-

What features does airSlate SignNow offer for the Global Blue Tax Form Pdf?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for your Global Blue Tax Form Pdf. These tools enhance your productivity and keep your documents organized.

-

Is it safe to use airSlate SignNow for the Global Blue Tax Form Pdf?

Yes, airSlate SignNow prioritizes security and compliance, ensuring your Global Blue Tax Form Pdf is protected. Our platform uses advanced encryption and follows strict data protection regulations to keep your information safe.

-

Can I access the Global Blue Tax Form Pdf from my mobile device?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to access and manage your Global Blue Tax Form Pdf on the go. Whether you’re using a smartphone or tablet, you can eSign documents anytime, anywhere.

Get more for Global Blue Tax Form Pdf

- Ca garageyardrummage sale application city of carson form

- Co grand mesa baptist family camp registration form

- Fl high school athletic association at11 form

- Mn addendum to the community support plan ramsey county form

- Pba director nomination form

- Tx eviction diversion program form

- Tx lakeside allergy ent patient registration form

- Tx txsg form 2807 1

Find out other Global Blue Tax Form Pdf

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free