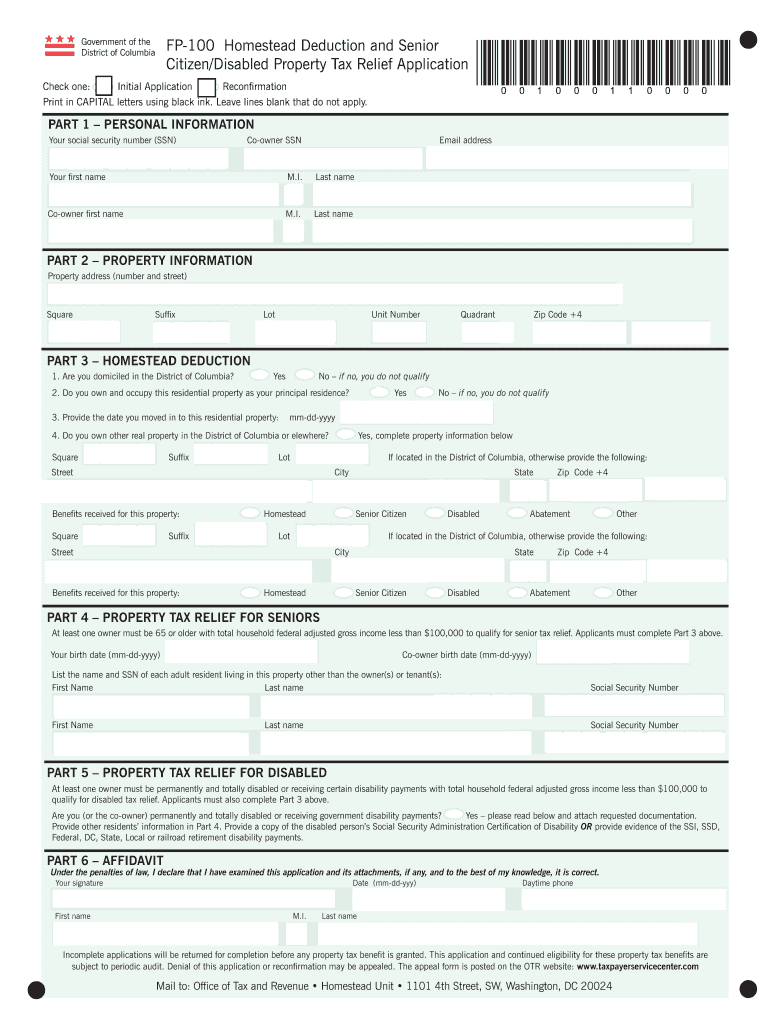

Dc Homestead Application Form

What is the DC Homestead Application?

The DC Homestead Application is a form that allows homeowners in Washington, D.C., to apply for a property tax deduction. This deduction is designed to reduce the property tax burden for eligible homeowners who occupy their properties as their primary residence. By completing this application, homeowners can benefit from significant savings on their annual property taxes, making homeownership more affordable.

Eligibility Criteria

To qualify for the DC homestead deduction, applicants must meet specific criteria, including:

- Ownership of the property, either through purchase or inheritance.

- Occupying the property as the primary residence.

- Meeting income limits set by the District of Columbia.

It is essential for applicants to review these criteria carefully to ensure they meet all requirements before submitting their application.

Steps to Complete the DC Homestead Application

Completing the DC Homestead Application involves several key steps:

- Obtain the application form, which can be found on the official DC government website.

- Fill out the form with accurate information, including property details and ownership status.

- Provide any required documentation, such as proof of residency and ownership.

- Submit the completed application by the specified deadline to the appropriate local agency.

Following these steps carefully can help ensure a smooth application process and increase the likelihood of approval.

Required Documents

When applying for the DC homestead deduction, applicants must provide specific documents to support their application. Commonly required documents include:

- Proof of property ownership, such as a deed or title.

- Identification documents, like a driver's license or state ID.

- Evidence of residency, such as utility bills or lease agreements.

Gathering these documents in advance can streamline the application process and prevent delays.

Form Submission Methods

Applicants can submit the DC Homestead Application through various methods, ensuring flexibility and convenience. The available submission methods include:

- Online submission through the DC government’s official portal.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Choosing the method that best suits your needs can help facilitate a timely application process.

Legal Use of the DC Homestead Application

The DC Homestead Application is legally recognized as a valid means for homeowners to claim a property tax deduction. To ensure compliance with local laws, applicants must adhere to the guidelines set forth by the District of Columbia. This includes providing truthful information and submitting the application within the designated time frame to avoid penalties.

Quick guide on how to complete dc homestead application

Complete Dc Homestead Application effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, since you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Dc Homestead Application on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Dc Homestead Application with ease

- Find Dc Homestead Application and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign Dc Homestead Application and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dc homestead application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DC homestead deduction?

The DC homestead deduction is a property tax reduction available to homeowners in Washington, D.C. It allows eligible property owners to reduce the taxable value of their primary residence, resulting in signNow savings on property taxes. To qualify, applicants must meet specific criteria set by the District of Columbia.

-

How do I apply for the DC homestead deduction?

To apply for the DC homestead deduction, homeowners must fill out an application form available on the DC government's website. You will need to provide information about your property and confirm that it is your primary residence. Once submitted, the application will be reviewed, and you will be notified of your eligibility.

-

What are the benefits of the DC homestead deduction?

The primary benefit of the DC homestead deduction is the reduction in your property tax bill, which can lead to substantial savings each year. Additionally, this deduction helps make homeownership more affordable for residents, especially first-time buyers. It is an essential financial incentive for those living in D.C.

-

Is there a deadline to apply for the DC homestead deduction?

Yes, there is a deadline to apply for the DC homestead deduction, typically set for March 31st each year. It's crucial to submit your application before this deadline to ensure you receive the deduction for the current tax year. Late applications may not be considered, so timely action is important.

-

Can I use airSlate SignNow to sign documents related to the DC homestead deduction?

Absolutely! airSlate SignNow allows you to easily eSign and send documents related to the DC homestead deduction. With our user-friendly platform, you can securely manage and track your application documents online, streamlining the process signNowly.

-

Are there any costs associated with the DC homestead deduction application?

Applying for the DC homestead deduction itself does not incur any fees; however, you may encounter some costs related to document preparation or legal advice if needed. Utilizing airSlate SignNow can save you time and resources by providing a cost-effective solution for managing your documents related to the homestead deduction.

-

Will my DC homestead deduction renew automatically?

In most cases, the DC homestead deduction will automatically renew as long as you continue to meet the eligibility criteria and your property remains your primary residence. However, it’s recommended to check your status periodically to ensure that you maintain the deduction without any interruptions.

Get more for Dc Homestead Application

Find out other Dc Homestead Application

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free