Massdot Nonresident Driver Statement 2011-2026

What is the Massdot Nonresident Driver Statement

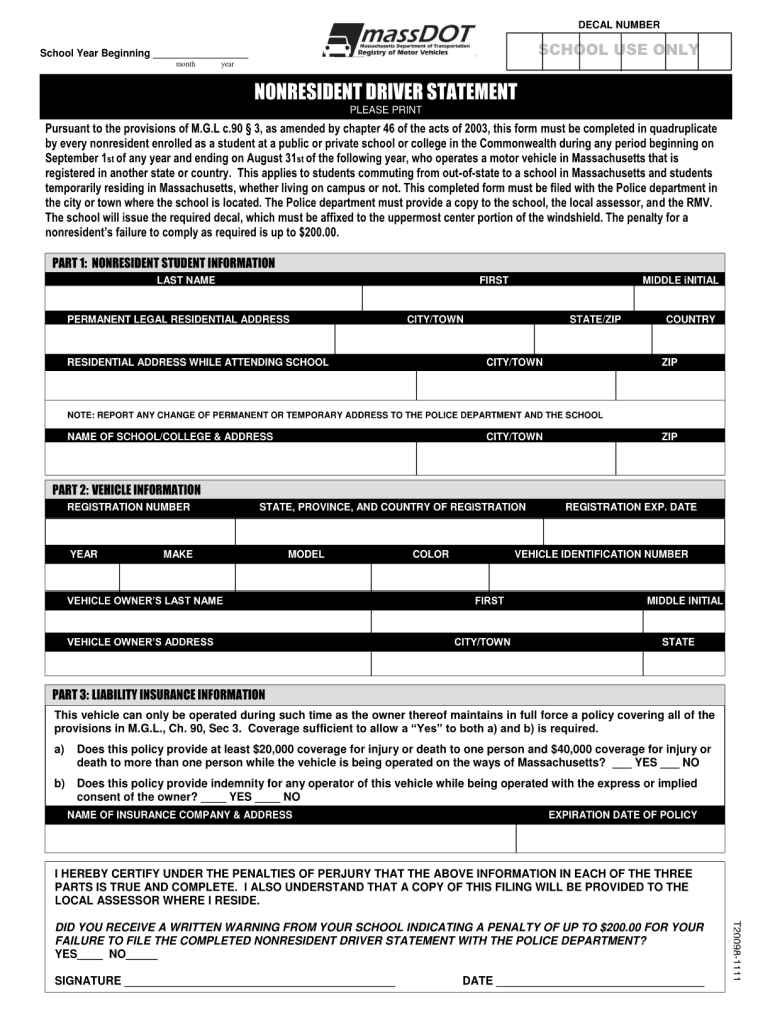

The Massdot Nonresident Driver Statement is a legal document required for individuals who are not residents of Massachusetts but need to operate a vehicle within the state. This form serves to validate the driver's eligibility and intent to comply with Massachusetts driving laws. It is particularly relevant for nonresident students, temporary workers, or individuals who have recently relocated to Massachusetts but have not yet established residency.

Steps to complete the Massdot Nonresident Driver Statement

Completing the Massdot Nonresident Driver Statement involves several key steps:

- Gather all necessary personal information, including your full name, address, and contact details.

- Provide details about the vehicle you intend to drive, such as the make, model, year, and vehicle identification number (VIN).

- Fill in the statement section, affirming your understanding of Massachusetts driving regulations and your intention to comply.

- Sign and date the form to validate your submission.

- If completing the form online, ensure you use a secure platform that complies with eSignature regulations.

How to obtain the Massdot Nonresident Driver Statement

The Massdot Nonresident Driver Statement can be obtained through the Massachusetts Department of Transportation (Massdot) website or at local Massdot offices. It is advisable to check for any specific requirements or updates that may affect the form's availability. In some cases, you may also find the form on related state government websites or through authorized service providers.

Legal use of the Massdot Nonresident Driver Statement

To ensure the legal validity of the Massdot Nonresident Driver Statement, it must be filled out accurately and completely. The statement acts as a formal declaration of your nonresident status and your commitment to adhere to Massachusetts driving laws. When signed, it provides legal protection should any questions arise regarding your driving eligibility in the state.

Required Documents

When completing the Massdot Nonresident Driver Statement, you may need to provide additional documentation to support your application. Commonly required documents include:

- A valid driver's license from your home state or country.

- Proof of insurance for the vehicle you will be operating.

- Any relevant identification documents, such as a passport or student ID, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Massdot Nonresident Driver Statement can be submitted through various methods, including:

- Online submission via the Massdot website, where you can fill out and eSign the form securely.

- Mailing the completed form to the appropriate Massdot office, ensuring that it is sent to the correct address for processing.

- In-person submission at a local Massdot office, where you can receive assistance if needed.

Quick guide on how to complete massachusetts non resident driver statement form

Simplify your existence by signNowing Massdot Nonresident Driver Statement document with airSlate SignNow

Whether you need to register a new vehicle, apply for a driver’s permit, transfer ownership, or engage in any other tasks related to automobiles, handling such RMV paperwork as Massdot Nonresident Driver Statement is an unavoidable chore.

There are several methods available to access them: via postal mail, at the RMV service center, or by obtaining them online through your local RMV website and printing them. Each of these options consumes a considerable amount of time. If you seek a more efficient way to complete them and authenticate them with a legally-recognized eSignature, airSlate SignNow stands out as the optimum solution.

How to finish Massdot Nonresident Driver Statement swiftly

- Click on Show details to view a brief overview of the form you are interested in.

- Select Get form to initiate and access the form.

- Follow the green indicator highlighting the mandatory fields if applicable.

- Utilize the top toolbar and make use of our advanced feature set to modify, comment on, and enhance the appearance of your form.

- Add text, your initials, shapes, images, and other elements.

- Select Sign in from the same toolbar to create a legally-recognized eSignature.

- Review the form’s content to ensure it’s devoid of errors and inconsistencies.

- Click on Done to complete the form submission.

Using our platform to complete your Massdot Nonresident Driver Statement and other related paperwork will save you a signNow amount of time and hassle. Enhance your RMV form submission process from the very beginning!

Create this form in 5 minutes or less

FAQs

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

As an international student (F1 visa) studying in Massachusetts (from Aug 2013), who was in California from May - Aug, do I have to fill tax forms as a resident or non-resident for Massachusetts?

Massachusetts does not define residency for tax purposes based on your US visa status. Under Massachusetts law, you are considered a resident of Massachusetts if you are either domiciled there, or if you maintain a permanent place of abode there and you spent at least 183 days there during the tax year.As a student on an F-1 visa, the first of these does not apply. As to the second, if you are living in university-supplied housing that is available only to university students, then the second wouldn't apply either. If you are living in a private apartment or other non-university housing that is available to the general public as well as to university students, on the other hand, that would be considered a permanent place of abode, since you have been in Massachusetts for a predetermined period of time in excess of one year. If that is the case and you spent 183 days in Massachusetts in 2014, you are a resident for Massachusetts state tax purposes and you file a resident tax return.The income you earned working in the library would be considered to be Massachusetts source income, and would be your only taxable income in Massachusetts if you are not a Massachusetts resident. If you are a Massachusetts resident, you declare all of your income, including that which you earned in California, and you can take a credit for the taxes you pay California.You absolutely should consult with a local tax professional in Massachusetts who has worked with international students. Your university international student center can usually recommend someone. I recommend against trying to do this yourself.

-

Can a non-resident of UP fill out the form of UPCATET?

Yes , there are always certain amount of seats for the candidates of other states. But if you belong to any reserved category you won't get the benefits of reservation, otherwise you can fill the form as general candidate.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

Create this form in 5 minutes!

How to create an eSignature for the massachusetts non resident driver statement form

How to create an electronic signature for the Massachusetts Non Resident Driver Statement Form in the online mode

How to make an eSignature for the Massachusetts Non Resident Driver Statement Form in Chrome

How to make an electronic signature for signing the Massachusetts Non Resident Driver Statement Form in Gmail

How to make an eSignature for the Massachusetts Non Resident Driver Statement Form right from your smartphone

How to make an electronic signature for the Massachusetts Non Resident Driver Statement Form on iOS devices

How to make an electronic signature for the Massachusetts Non Resident Driver Statement Form on Android

People also ask

-

What is the Massdot Nonresident Driver Statement?

The Massdot Nonresident Driver Statement is a document required for individuals who are not Massachusetts residents but need to drive in the state. This statement verifies your driving eligibility and is essential for obtaining a Massachusetts driver's license or permit. With airSlate SignNow, you can easily complete and eSign your Massdot Nonresident Driver Statement online.

-

How do I complete the Massdot Nonresident Driver Statement using airSlate SignNow?

To complete the Massdot Nonresident Driver Statement with airSlate SignNow, simply upload the form to our platform. You can fill in the necessary information, add your eSignature, and send it securely. Our user-friendly interface makes it easy to manage your documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the Massdot Nonresident Driver Statement?

Yes, airSlate SignNow offers a cost-effective solution for eSigning documents, including the Massdot Nonresident Driver Statement. We provide various pricing plans suited for individual users and businesses, ensuring that you have access to the features you need at an affordable price.

-

What features does airSlate SignNow offer for the Massdot Nonresident Driver Statement?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for the Massdot Nonresident Driver Statement. Additionally, you can easily collaborate with others, ensuring that all necessary parties can review and sign the document seamlessly.

-

Can I integrate airSlate SignNow with other applications for managing the Massdot Nonresident Driver Statement?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Microsoft Office. This allows you to streamline your document management process, making it simpler to access and complete your Massdot Nonresident Driver Statement alongside other essential documents.

-

What are the benefits of using airSlate SignNow for the Massdot Nonresident Driver Statement?

Using airSlate SignNow for your Massdot Nonresident Driver Statement offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The ability to eSign documents online saves time and ensures that your sensitive information is handled securely and confidentially.

-

Is airSlate SignNow compliant with legal standards for the Massdot Nonresident Driver Statement?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring that your Massdot Nonresident Driver Statement is valid and legally binding. Our platform adheres to industry regulations, providing peace of mind that your electronic documents are secure and compliant.

Get more for Massdot Nonresident Driver Statement

Find out other Massdot Nonresident Driver Statement

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF