CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov on

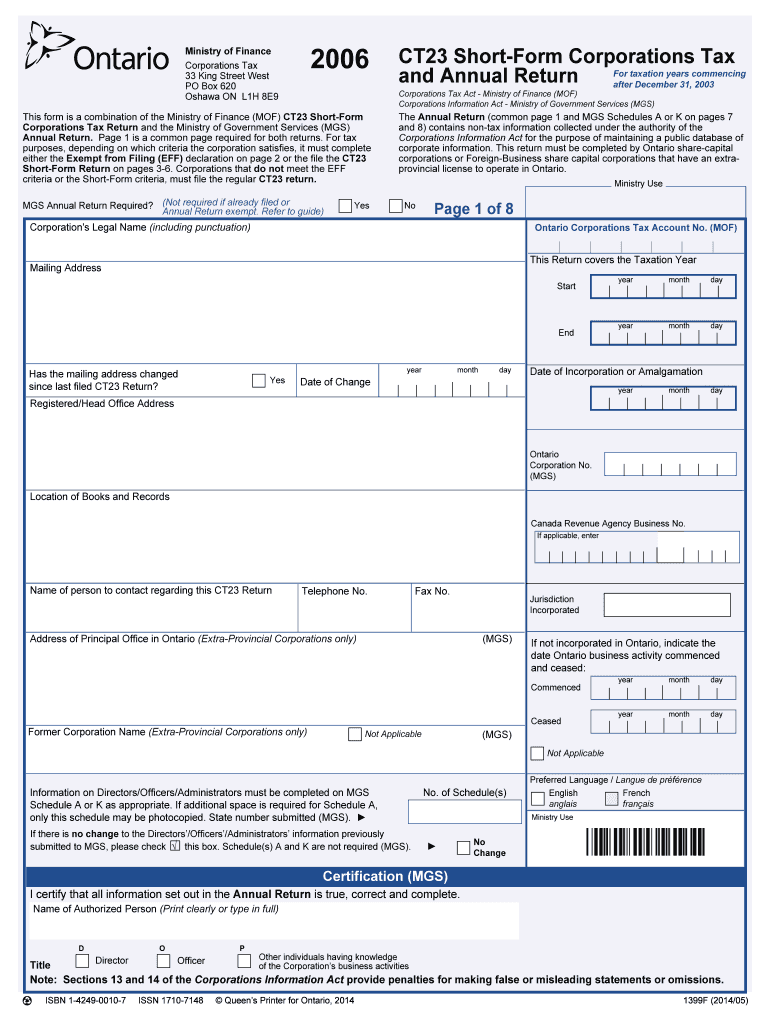

What is the CT23 Short Form Corporations Tax?

The CT23 short form is a tax document used by corporations in the United States to report their income and calculate their tax liability. This form is specifically designed for corporations that meet certain criteria, allowing them to file a simplified version of the standard corporate tax return. The CT23 short form streamlines the filing process, making it easier for eligible businesses to comply with tax regulations while ensuring they accurately report their financial activities.

Steps to Complete the CT23 Short Form

Completing the CT23 short form requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section with the corporation's name, address, and tax identification number.

- Report total income and allowable deductions in the respective sections of the form.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable tax rate.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Legal Use of the CT23 Short Form

The CT23 short form is legally binding when completed and submitted according to IRS regulations. To ensure its validity, corporations must adhere to specific guidelines, including accurate reporting of financial data and compliance with federal and state tax laws. Using a reliable eSignature solution, such as airSlate SignNow, can enhance the legal standing of the form by providing a secure digital signature and maintaining compliance with eSignature regulations.

Form Submission Methods

Corporations can submit the CT23 short form through various methods, ensuring flexibility and convenience. The available submission options include:

- Online submission through the official tax portal, which allows for immediate processing.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, providing an opportunity for direct assistance if needed.

Filing Deadlines / Important Dates

Timely submission of the CT23 short form is crucial to avoid penalties. The filing deadline typically aligns with the corporation's tax year end. Corporations should be aware of the following important dates:

- Initial filing deadline: usually within a few months after the end of the tax year.

- Extension request deadline: if additional time is needed, a formal extension request must be submitted before the initial deadline.

- Final submission deadline after an extension: typically six months after the initial due date.

Key Elements of the CT23 Short Form

The CT23 short form includes several key elements that corporations must complete accurately. These elements typically encompass:

- Identification information for the corporation, including name and tax ID.

- Sections for reporting income, deductions, and credits.

- Calculations for determining taxable income and tax liability.

- Signature section to confirm the accuracy of the information provided.

Quick guide on how to complete 2006 ct23 short form corporations tax 2006 ct23 short form corporations tax forms ssb gov on

Effortlessly Complete CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On across any platform with airSlate SignNow's Android or iOS applications and simplify your document-centric processes today.

The Simplest Way to Modify and Electronically Sign CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On Effortlessly

- Find CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On and click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Complete button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

No more lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On and ensure exceptional communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I declare a short term capital gain tax in the ITR in India? I want to know about the ITR form number and where and what to fill in the details. This is my first time to pay a short term capital gain tax on an equity sale.

The selection of ITR form will depend upon the type of one's income.For Income from salary, house property, capital gains for ITR2 is suggestedHowever for income from above heads and business/profession ITR4 is suggestedIn both the forms under head CG, revenue from sale of equity shares are required to be mentioned along with purchase amount and expenses incurred on sale are also required to be mentioned.For short term and long term separate rows are there.Just fill up and it will take the net capital gain to respective cell in computation if income.

Create this form in 5 minutes!

How to create an eSignature for the 2006 ct23 short form corporations tax 2006 ct23 short form corporations tax forms ssb gov on

How to create an eSignature for your 2006 Ct23 Short Form Corporations Tax 2006 Ct23 Short Form Corporations Tax Forms Ssb Gov On in the online mode

How to generate an eSignature for your 2006 Ct23 Short Form Corporations Tax 2006 Ct23 Short Form Corporations Tax Forms Ssb Gov On in Chrome

How to make an eSignature for putting it on the 2006 Ct23 Short Form Corporations Tax 2006 Ct23 Short Form Corporations Tax Forms Ssb Gov On in Gmail

How to generate an eSignature for the 2006 Ct23 Short Form Corporations Tax 2006 Ct23 Short Form Corporations Tax Forms Ssb Gov On straight from your smart phone

How to create an eSignature for the 2006 Ct23 Short Form Corporations Tax 2006 Ct23 Short Form Corporations Tax Forms Ssb Gov On on iOS devices

How to generate an eSignature for the 2006 Ct23 Short Form Corporations Tax 2006 Ct23 Short Form Corporations Tax Forms Ssb Gov On on Android

People also ask

-

What is airSlate SignNow and how does it relate to ct23?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents seamlessly. The ct23 feature enhances this functionality, providing efficient document management tools tailored for user convenience. With ct23, you can streamline your workflows and improve document turnaround time.

-

How much does airSlate SignNow cost, including the ct23 feature?

airSlate SignNow offers several pricing plans to fit different business needs, including options that feature the ct23 capability. Our plans are designed to be cost-effective, ensuring you get the most value for your investment. For detailed pricing, you can visit our website or contact our sales team.

-

What key features does ct23 offer within airSlate SignNow?

The ct23 feature within airSlate SignNow provides advanced document routing and tracking capabilities. Users can take advantage of customizable templates, automated reminders, and real-time notifications, which facilitate a smoother signing process. These features help improve efficiency and reduce the time spent on document management.

-

How does airSlate SignNow ensure the security of documents signed using the ct23 feature?

Security is a top priority at airSlate SignNow. The ct23 feature utilizes advanced encryption technology and secure cloud storage to safeguard your documents and signatures. Additionally, we comply with industry standards and regulations to ensure complete privacy and protection of sensitive information.

-

Can I integrate airSlate SignNow with other tools while using the ct23 feature?

Yes, airSlate SignNow easily integrates with various third-party applications such as CRM systems, cloud storage services, and project management tools. The ct23 functionality supports these integrations, allowing for a more streamlined experience across platforms. This flexibility enhances productivity and helps to centralize your workflow.

-

What are the benefits of using the ct23 feature with airSlate SignNow?

Using the ct23 feature with airSlate SignNow brings numerous advantages, including faster document processing and increased team collaboration. It allows businesses to customize their workflows, ensuring that document handling meets their specific needs. Moreover, these benefits contribute to improved satisfaction and reduced operational costs.

-

Is technical support available for issues related to the ct23 feature?

Absolutely! airSlate SignNow provides robust technical support for users, including assistance for any issues with the ct23 feature. Our dedicated support team is available to help you troubleshoot problems and ensure you maximize the potential of our platform. You can signNow out through multiple channels for quick guidance.

Get more for CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On

Find out other CT23 Short Form Corporations Tax CT23 Short Form Corporations Tax Forms Ssb Gov On

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure