Credit Application Form

What is the credit application form?

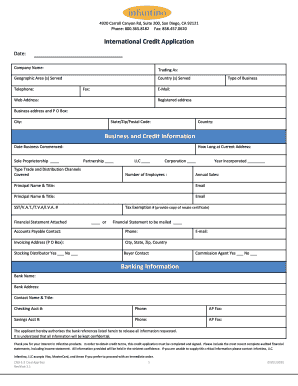

The credit application form is a document used by individuals or businesses to apply for credit from lenders or financial institutions. This form collects essential information about the applicant's financial history, income, and creditworthiness. By providing this information, lenders can assess the risk associated with granting credit. The credit application form is crucial for establishing a formal request for credit and is often the first step in the borrowing process.

How to use the credit application form

Using the credit application form involves several straightforward steps. First, gather all necessary financial documents, including proof of income, employment history, and any existing debts. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to provide honest and comprehensive information, as inaccuracies can lead to delays or denials. Once the form is completed, review it for any errors before submitting it to the lender, either online or in person.

Steps to complete the credit application form

Completing the credit application form effectively requires attention to detail. Follow these steps for a successful submission:

- Gather documentation: Collect necessary documents such as pay stubs, tax returns, and identification.

- Fill out personal information: Include your name, address, Social Security number, and contact details.

- Provide financial details: List your income sources, monthly expenses, and any outstanding debts.

- Review your application: Check for accuracy and completeness to avoid potential issues.

- Submit the form: Send your application to the lender through the preferred method, whether online or by mail.

Legal use of the credit application form

The legal use of the credit application form is governed by various regulations that protect both lenders and borrowers. When filling out the form, it is essential to comply with federal and state laws regarding consumer credit. This includes providing truthful information and understanding the implications of your application. Additionally, lenders must adhere to the Fair Credit Reporting Act (FCRA), which regulates how credit information is collected and used. Ensuring compliance with these legal requirements helps maintain the integrity of the credit application process.

Key elements of the credit application form

Several key elements are typically included in a credit application form. These elements help lenders evaluate the applicant's creditworthiness:

- Personal information: Name, address, Social Security number, and contact information.

- Employment details: Current employer, job title, and length of employment.

- Income information: Monthly income, additional income sources, and total annual income.

- Debt obligations: Existing loans, credit cards, and other financial commitments.

- Requested credit amount: The amount of credit the applicant is seeking.

Required documents

When submitting a credit application form, certain documents are typically required to support the application. These may include:

- Proof of identity: A government-issued ID, such as a driver's license or passport.

- Income verification: Recent pay stubs, tax returns, or bank statements.

- Credit history: Any existing credit reports or statements from previous lenders.

- Employment verification: A letter from the employer or a recent employment contract.

Quick guide on how to complete credit application form 335742

Complete Credit Application Form effortlessly on any device

Online document management has become trendy among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle Credit Application Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Credit Application Form with ease

- Obtain Credit Application Form and then click Get Form to commence.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Credit Application Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application form 335742

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit application form?

A credit application form is a document that businesses use to collect information from customers seeking credit. This form typically includes personal details, credit history, and financial information necessary for evaluating loan or credit requests. Using airSlate SignNow, you can streamline the process of filling out and submitting credit application forms electronically.

-

How does airSlate SignNow enhance the credit application form process?

airSlate SignNow optimizes the credit application form process by enabling users to electronically send, fill, and eSign documents securely. This eliminates the need for physical paperwork, speeds up the application review process, and improves overall efficiency. Additionally, our platform allows for real-time tracking of document status.

-

What features does airSlate SignNow offer for credit application forms?

Our platform provides features such as customizable credit application forms, automated reminders for signers, and advanced security measures to protect sensitive information. You can also integrate these forms seamlessly with various CRM systems, ensuring a smooth workflow from application to approval. These features make the credit application form process easier and more effective for users.

-

Is there a cost associated with using airSlate SignNow for credit application forms?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers to suit different business needs. Each plan offers essential features for creating and managing credit application forms, with competitive pricing designed to be cost-effective for businesses of all sizes. We also provide a free trial for new users to explore our features before committing.

-

Can I customize my credit application form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily customize your credit application form to fit your specific business requirements. You can add or remove fields, include company branding, and set up logic rules to guide users through the form. This level of customization ensures that you collect all necessary information for your credit evaluations.

-

What benefits does eSigning credit application forms provide?

Using airSlate SignNow to eSign credit application forms provides numerous benefits, including faster turnaround times and reduced paper waste. eSigning is legally binding and secure, ensuring that all parties can trust the integrity of the document. This not only enhances customer satisfaction but also speeds up the credit approval process.

-

Does airSlate SignNow integrate with other tools for managing credit application forms?

Yes, airSlate SignNow offers extensive integrations with popular CRM and financial software, making it easier to manage credit application forms alongside your other business processes. These integrations allow for automatic data transfer and better tracking of your customer information. Streamlining this workflow improves overall productivity and data accuracy.

Get more for Credit Application Form

Find out other Credit Application Form

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement