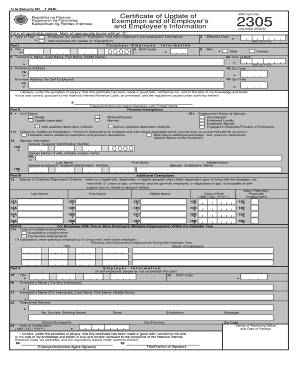

Bir Form 2305

What is the Bir Form 2305

The Bir Form 2305 is a tax form used in the United States, specifically designed for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with tax regulations and helps in the accurate assessment of tax liabilities. The Bir Form 2305 may be required for various purposes, including reporting income, claiming deductions, or providing information about tax withholding.

How to use the Bir Form 2305

Using the Bir Form 2305 involves several key steps. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to double-check the information for accuracy to avoid delays or issues with processing. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements and your preference.

Steps to complete the Bir Form 2305

Completing the Bir Form 2305 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the IRS website or your tax professional.

- Read the instructions carefully to understand what information is needed.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions accurately.

- Review the form for errors or omissions before submission.

Legal use of the Bir Form 2305

The Bir Form 2305 is legally binding when filled out correctly and submitted according to IRS regulations. To ensure its legal validity, it is crucial to comply with all relevant laws and guidelines governing tax reporting. This includes maintaining accurate records and ensuring that all submitted information is truthful and complete. Failure to comply with these regulations may result in penalties or legal repercussions.

Key elements of the Bir Form 2305

Several key elements make up the Bir Form 2305. These include:

- Identification Information: Personal details such as name, address, and taxpayer identification number.

- Income Reporting: Sections dedicated to reporting various types of income, including wages, dividends, and interest.

- Deductions and Credits: Areas for claiming eligible deductions and tax credits that can reduce overall tax liability.

- Signature Section: A place for the taxpayer to sign and date the form, affirming the accuracy of the information provided.

Form Submission Methods

The Bir Form 2305 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically using tax software, which simplifies the process and often includes built-in error checks.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address, ensuring that it is sent with sufficient time to meet deadlines.

- In-Person Submission: Taxpayers can also visit local IRS offices to submit the form directly, although appointments may be necessary.

Quick guide on how to complete bir form 2305

Effortlessly Prepare Bir Form 2305 on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to acquire the necessary format and safely store it in the cloud. airSlate SignNow offers all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Bir Form 2305 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related tasks today.

How to Modify and Electronically Sign Bir Form 2305 with Ease

- Obtain Bir Form 2305 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to secure your changes.

- Select your preferred method for sharing the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and electronically sign Bir Form 2305 to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 2305

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of bir 2305 in document signing?

The bir 2305 relates to specific tax documentation that may require electronic signatures. Using airSlate SignNow can simplify the process of signing these documents, making compliance easier for businesses. Ensuring that bir 2305 forms are signed electronically can accelerate processing times and improve efficiency.

-

How does airSlate SignNow support bir 2305 management?

airSlate SignNow provides features that facilitate the signing and management of bir 2305 documents seamlessly. With its intuitive interface, users can quickly send these forms for electronic signatures and track their status. This reduces the risk of errors and ensures timely submissions.

-

Is airSlate SignNow a cost-effective solution for handling bir 2305?

Yes, airSlate SignNow is known for its affordability, making it a great option for businesses dealing with bir 2305 forms. By eliminating unnecessary paper processes and streamlining workflows, companies can save signNow costs. Additionally, the various pricing tiers cater to businesses of all sizes, ensuring everyone can access essential features.

-

What features does airSlate SignNow offer for bir 2305 forms?

airSlate SignNow offers various features designed to enhance the signing and management of bir 2305 documents. These include customizable templates, automatic reminders, and comprehensive audit trails for tracking changes. Such features make it easier for users to manage their documents efficiently.

-

Can I integrate airSlate SignNow with other software for bir 2305 processing?

Absolutely! airSlate SignNow integrates seamlessly with a range of software solutions commonly used for managing bir 2305 forms. This includes CRMs, cloud storage services, and accounting software, allowing for streamlined workflows and improved collaboration across teams.

-

How secure is the electronic signing process for bir 2305 documents with airSlate SignNow?

The security of bir 2305 document signing is paramount, and airSlate SignNow employs advanced encryption and compliance standards. This ensures that all documents signed electronically are protected from unauthorized access. Businesses can trust that their sensitive information is secure when using airSlate SignNow.

-

What benefits can I expect when using airSlate SignNow for bir 2305 forms?

Using airSlate SignNow for bir 2305 forms brings numerous benefits, such as faster turnaround times and reduced manual errors. The ease of accessing documents from any device means that stakeholders can sign wherever they are. This not only improves efficiency but also enhances the overall experience for users.

Get more for Bir Form 2305

- Individual renewal mississippi department of environmental quality deq state ms form

- Ds120 form

- Ncaeop scholarship form

- Nc bond mecklenburg county form

- Https webapps7 doc state nc us dcccheckin offenderlogin htm form

- Review ncdpi form

- Request for job shadow application form nd

- Ride along request form sarpy county nebraska

Find out other Bir Form 2305

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter