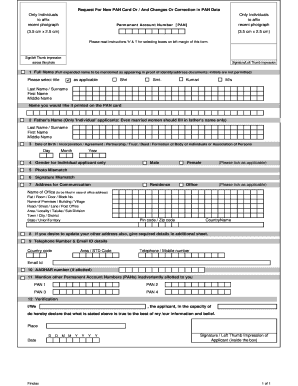

Request for New PAN Card or and Changes or Correction in PAN Data Taxlawassociates Form

Understanding the PAN Card Correction Form

The PAN card correction form is essential for individuals seeking to update or rectify details on their Permanent Account Number (PAN) card. This form is particularly important for ensuring that personal information, such as name, address, and date of birth, is accurate and up to date. An accurate PAN is crucial for tax purposes and financial transactions in the United States.

Steps to Complete the PAN Card Correction Form

Filling out the PAN card correction form involves several straightforward steps:

- Gather necessary documents, including proof of identity and address.

- Access the PAN card correction form from an authorized source.

- Fill in the required fields, ensuring all information is accurate.

- Attach the supporting documents as specified in the form.

- Submit the completed form either online or through the designated mailing address.

Required Documents for PAN Card Correction

To successfully process a PAN card correction, specific documents are necessary. These typically include:

- Proof of identity, such as a government-issued ID.

- Proof of address, which can be a utility bill or lease agreement.

- Any documents supporting the correction, like a marriage certificate for name changes.

Form Submission Methods

The PAN card correction form can be submitted through various methods, catering to different preferences:

- Online Submission: Fill out and submit the form electronically through authorized government websites.

- Mail Submission: Print the completed form and send it to the designated address.

- In-Person Submission: Visit a local tax office or designated center to submit the form directly.

Legal Use of the PAN Card Correction Form

The PAN card correction form serves a legal purpose, ensuring that the information associated with an individual's tax identification is accurate. This accuracy is vital for compliance with tax regulations and for avoiding potential penalties related to incorrect information. Submitting the form correctly helps maintain the integrity of the tax system.

Key Elements of the PAN Card Correction Form

When completing the PAN card correction form, it is important to pay attention to several key elements:

- Personal information: Ensure all details are filled in accurately.

- Signature: A valid signature is required to authenticate the form.

- Document verification: Attach all necessary documents to support the corrections.

Quick guide on how to complete request for new pan card or and changes or correction in pan data taxlawassociates

Complete Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can obtain the correct format and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates effortlessly

- Locate Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Modify and eSign Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for new pan card or and changes or correction in pan data taxlawassociates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the pan card correction form?

The pan card correction form is designed to help individuals update or rectify any inaccuracies in their PAN card information. This form streamlines the process, allowing users to submit necessary corrections quickly and efficiently, ensuring that their details are accurate for tax purposes.

-

How do I fill out the pan card correction form?

Filling out the pan card correction form is straightforward. You just need to provide the required personal information accurately, specify the corrections needed, and submit any supporting documents. Once completed, you can easily send the form using airSlate SignNow for a seamless experience.

-

Is there a fee associated with the pan card correction form?

The fee for submitting the pan card correction form generally depends on the service provider used. With airSlate SignNow, you can expect affordable pricing for sending and signing documents electronically, which includes handling your pan card correction efficiently.

-

Can I track the status of my pan card correction form submission?

Yes, you can track the status of your pan card correction form submission when using airSlate SignNow. Our platform provides real-time updates, ensuring you are informed each step of the way until your corrections are processed.

-

What benefits does airSlate SignNow offer for the pan card correction form?

Using airSlate SignNow for your pan card correction form allows for enhanced efficiency and security. You can easily eSign your documents, reduce paper usage, and enjoy a streamlined workflow that saves time and minimizes errors.

-

Does airSlate SignNow integrate with other tools for submitting the pan card correction form?

Yes, airSlate SignNow offers integrations with various applications, making it easier to manage your documents, including the pan card correction form. You can connect with tools such as Google Drive and Dropbox for a smoother document management experience.

-

What features does airSlate SignNow include for managing the pan card correction process?

AirSlate SignNow includes features such as customizable templates, document sharing, and secure electronic signatures specifically designed to enhance the management of your pan card correction form. This ensures that the entire process is user-friendly and efficient.

Get more for Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates

Find out other Request For New PAN Card Or And Changes Or Correction In PAN Data Taxlawassociates

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template