Form 8554 Renewal

What is the Form 8554 Renewal

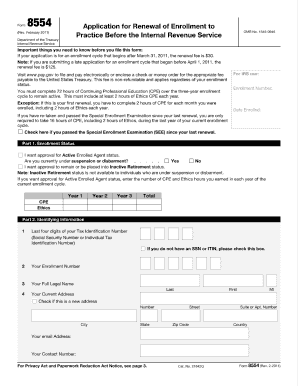

The Form 8554 is a document used by tax professionals to renew their status as an enrolled agent with the Internal Revenue Service (IRS). This form is essential for those who wish to continue representing clients before the IRS and maintaining their credentials. The renewal process ensures that enrolled agents stay updated on tax laws and regulations, which is crucial for providing accurate and effective representation.

How to complete the Form 8554 Renewal

Completing the Form 8554 requires attention to detail. Start by gathering necessary information, including your personal details, Social Security number, and any relevant tax identification numbers. Follow these steps:

- Enter your personal information accurately in the designated fields.

- Provide details about your continuing education credits, as proof of compliance with IRS requirements.

- Include your signature and date to certify the information provided is correct.

Once completed, ensure that all information is clear and legible to avoid delays in processing.

IRS Guidelines for Form 8554 Renewal

The IRS has specific guidelines regarding the Form 8554 renewal process. It is important to review these guidelines to ensure compliance. Key points include:

- Submit the form before the expiration of your current enrollment status.

- Maintain a record of your continuing education credits, as these may be requested for verification.

- Ensure that the form is signed and dated to validate the submission.

Following these guidelines helps prevent any issues with your renewal status and maintains your eligibility to represent clients before the IRS.

Filing Deadlines for Form 8554 Renewal

Timely submission of the Form 8554 renewal is crucial to avoid lapses in your enrolled agent status. The IRS sets specific deadlines for filing:

- The renewal form should be submitted at least 60 days before your current enrollment status expires.

- Late submissions may result in penalties or a delay in processing, which could affect your ability to represent clients.

Being aware of these deadlines can help ensure a smooth renewal process.

Legal use of the Form 8554 Renewal

The legal validity of the Form 8554 renewal is supported by compliance with IRS regulations. When completed correctly, the form serves as an official request to maintain your status as an enrolled agent. It is important to ensure that:

- All information provided is accurate and truthful.

- The form is submitted within the required timeframe to avoid any legal complications.

Using a reliable electronic signature tool can further enhance the legal standing of your submission, ensuring that it meets all necessary requirements.

Key elements of the Form 8554 Renewal

Understanding the key elements of the Form 8554 renewal can streamline the completion process. Important components include:

- Personal identification information, including your name and Social Security number.

- Details regarding your continuing education credits, which demonstrate your commitment to professional development.

- Your signature and date, which affirm the accuracy of the information provided.

Focusing on these elements helps ensure that your renewal application is complete and compliant with IRS standards.

Quick guide on how to complete form 8554 renewal

Easily prepare Form 8554 Renewal on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8554 Renewal on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to amend and electronically sign Form 8554 Renewal effortlessly

- Obtain Form 8554 Renewal and then click Get Form to begin.

- Utilize our tools to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign function, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 8554 Renewal and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8554 renewal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8554 and how is it used?

Form 8554 is a document used by businesses to apply for tax-exempt status with the IRS. By submitting form 8554, organizations can ensure compliance with federal regulations while simplifying their tax management processes. Understanding how to properly complete form 8554 is crucial for qualifying for tax benefits.

-

How can airSlate SignNow help with form 8554 submissions?

airSlate SignNow offers an intuitive platform that allows businesses to electronically sign and send form 8554 securely. With robust features for document management, users can streamline the submission process, ensuring that all necessary signatures are collected efficiently. This accelerates compliance and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for form 8554?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers, making it accessible for different business sizes. The pricing includes features specifically designed for handling forms like 8554, ensuring that users get great value for their investment. You can choose a plan that fits your organization's needs.

-

What features are available for managing form 8554 with airSlate SignNow?

airSlate SignNow provides a variety of features including templates, workflow automation, and analytics to help manage form 8554. These tools allow users to customize their document processes, track progress, and evaluate performance metrics, making eSignature management more efficient and effective.

-

Can I integrate airSlate SignNow with other software to manage form 8554?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. This allows businesses to easily import and export form 8554 documents, streamlining your workflow and enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for form 8554 submissions?

One of the main benefits of using airSlate SignNow for form 8554 is the increased efficiency it brings to document handling. With eSigning, there's no need for printing, faxing, or mailing, which saves time and reduces hassle. Additionally, the secure platform ensures that sensitive information in form 8554 is protected.

-

Is airSlate SignNow secure for handling sensitive information in form 8554?

Yes, airSlate SignNow prioritizes security and utilizes industry-standard encryption to safeguard documents, including form 8554. The platform complies with legal requirements and best practices for data protection, giving users peace of mind when managing their sensitive tax documents.

Get more for Form 8554 Renewal

Find out other Form 8554 Renewal

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now